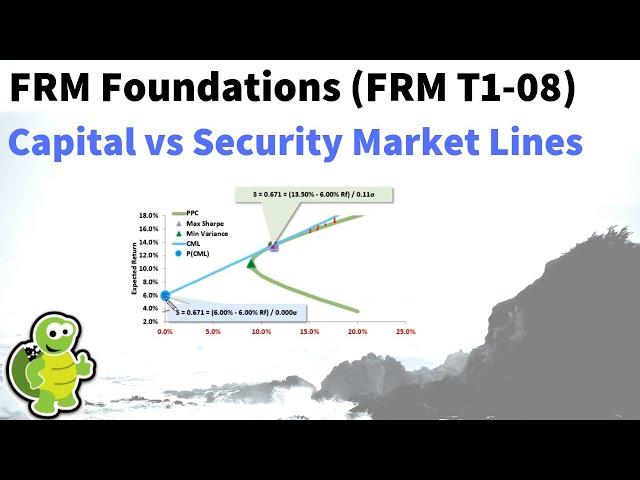

Capital market line (CML) versus security market line (SML), FRM T1-8

Комментарии:

This is confusing. Whats the difference between the SML and and portfolio possibilities curve if both are configuring asset allocation between A and B?

Ответить

Hi, why SML model seems exactly same as CAPM model? Are those actually same things? Thanks

Ответить

why are you using 6% when treasuries are much lower

Ответить

Thanks for the video. I am curious about how did you get the standard deviation of the portfolio. The only formula I know is that: sqrt(wa2.deva2+wb2.devb2+2.wa.wb.covab). I calculated in your example and it is different. Appreciate any comment

Ответить

Best video on the Subject. Thank you very much.

Ответить

where is the excel for this please? thanks for the tutorial

Ответить

I'm confused with some of the notation... if the linear equation reads n + mx, being n the intercept (rf) and m the slope, wouldn't the slope be excess return E(r) - rf (change in y axis) divided by standard deviation of the portfolio (change in x axis) ???? I'm confused because you say it's standard deviation of market, which makes the sharpe ratio, and then multiplies by the standard deviation of the portfolio. Jesus christ.. I will never understand all this !!

Also on a parallel process, what does exactly mean that the CML is above the efficient frontier once it surpasses the tangency point in real life? Does it mean there is a combination of the risk free asset and the market portfolio (risky assets) that makes me earn more than if I just invested all my capital in the risky assets, which always plot on the efficient frontier?? Thanks a lot for your help !

hey great tutorial. I have a question, if the SML accepts all portfolios, how do you know which one is the efficient one? is it the same theory which you use for the efficiency frontier and the CML?

Ответить

Hi professor,

I found this question on a mock exam and while it is intuitive that there is a diminishing ratio of return to volatility because of the concavity of the efficient frontier it doesn't make sense to me that the Sharpe ratio then keeps increasing from the minimum variance portfolio until the optimal portfolio. Please, see the question:

Q. As one moves to the right along an investor’s efficient frontier, a set increase in risk is most likely to lead to:

A) sequentially smaller increases in expected return.

B) consistent increases in expected return.

C) sequentially larger increases in expected return.

Answer is A.

Why sharpe ratio gets higher while we approach the optimal portfolio, then? If I follow my intuition I answer A, If I follow the logic of the Sharpe ratio I answer C

Thank you, a lot !

Dear Sir,

If the volatility of P is 11.2% and what is the Beta of M?

Thank you

The best video I've seen so far. And I have seen them all :-) Thank you

Ответить

Suppose I trade in a market with 1000 stocks total, then I select 10 stocks and optimize for the highest sharpe ratio portfolio. Now in the case of SML, what is "the market"? My 10 stocks or the entire market of 1000 stocks? Can you clarify on this? thank you!

Ответить

thank you. very good and lucid explanation.

Ответить

Thank you, very useful.

Ответить

Awesome video, really helpful! Thx a lot!!!

Ответить

How do you get beyond the market portfolio on the CML? How can you allocate more than 100% to the market portfolio?

Ответить

Excellent way to do a brief analysis on the relevant differences, thank you

Ответить

Hi, it is the best video in this topic I saw it too. You made the simplest way to understand these concepts. Thanks 😊

Ответить

Hello thanks for the video, i have one question: the SML includes only securities or even portfolios? If yes, why in the SML (if we consider it with the securities investment) there is anyway the market portfolio for beta=1??

I

does anyone have Sir Reed Cooper details i want to start an investment with him

Ответить

What does the portion of the convex curve with high volatility and returns below the risk free rate represent. Do those portfolios exist under the theoretical framework?

Ответить

Thank you very much, it helped me so much!

Ответить

Wow. So neatly explained. Thank you very much!

Ответить

Wow this video is amazin thank you so much!!

Ответить

Thank you so much, this video gives me clear answer for the question that seriously confused me

Ответить

Excellent explanation

Ответить

How to calculate volatility of a portfolio with the volatility of Individual stocks given the asset allocation of stocks in the respective portfolio !!

Ответить

Thank u so much sir☺️

Ответить

your didactic is very good. You can tell me what is the best software to work with markovitz portfolio:

MATHEMATICA, R, MATLAB, MAPLE or PHYTON?

THANKFUL.

Thank you!

Ответить

Correct me if I am wrong, but if you look at the CML line and you make the distribution from 0 t o100% percent of rf asset vs market portfolio, you end up on the line between the y-axis and the market portfolio. how do I create a portfolio which is right hand side of the marketportfolio but on the clm?

Ответить

you explained it in such a succinct and clear way. Thank you!

Ответить

Good morning. Can you provide the link to the spreadsheet? Thanks.

Ответить