Income Tax Notice: Avoid These 5 Red Flag Cash Transactions #cash #incometax #finance

5 Cash Transactions prompting income tax notice

1)Cash deposits that aggregate to over Rs.10 lakh in one financial year, and in one or more accounts (other than a current account and time deposit) of a person.

2) Cash deposit or cash withdrawal aggregating to fifty lakh rupees or more in a FY in or from one or more current account of a person.

3)Payment of credit card in cash of more than 1 Lakh Rupees

4)Cash payment of Rs.10 Lakh or more for purchase of Bank draft or for payment of Banker’s Cheque.

5)Cash deposit of Rs.10 Lakh or more for Fixed Deposit Receipt.

1)Cash deposits that aggregate to over Rs.10 lakh in one financial year, and in one or more accounts (other than a current account and time deposit) of a person.

2) Cash deposit or cash withdrawal aggregating to fifty lakh rupees or more in a FY in or from one or more current account of a person.

3)Payment of credit card in cash of more than 1 Lakh Rupees

4)Cash payment of Rs.10 Lakh or more for purchase of Bank draft or for payment of Banker’s Cheque.

5)Cash deposit of Rs.10 Lakh or more for Fixed Deposit Receipt.

Тэги:

#income_tax_notice_for_high_value_transaction #income_tax_notice #notice_on_high_value_transaction #tax_red_flags #taxes_on_cash_app_transactions #taxes_on_cashapp_transactions #large_cash_transactions #income_tax #irs_red_flags_to_avoid #5_red_flags_when_investing_in_cryptocurrency #bank_transcation_limit_for_income_tax #income_tax_rules_on_saving_bank_account #avoiding_income_tax_penalties #high_value_transaction #red_flags #income_tax_information #cash_transactionsКомментарии:

Income Tax Notice: Avoid These 5 Red Flag Cash Transactions #cash #incometax #finance

CA Mridul Kumar Gupta

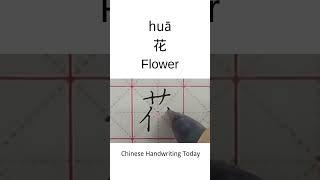

How to write Flower in Chinese character | Amazing Chinese Calligraphy | Satisfying Handwriting

Chinese Handwriting Today

приколи қрбони чол

vahdat_tj

Sivapuranam (Thiruvasagam) (சிவபுராணம்) with Lyrics in Tamil

Hindu Devotional Songs

Harsh Vardhan Keyboard play, KGF Theme Full Video

Amandeep Singh

The Campus Tour | University of Illinois Urbana-Champaign (UIUC)

University of Illinois Admissions