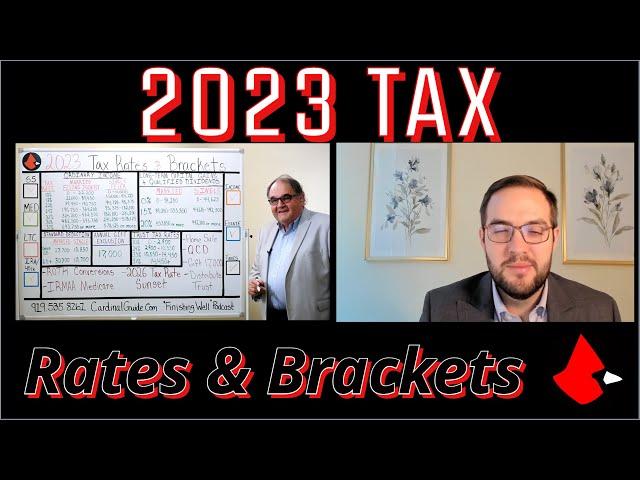

2023 Tax Rates & Brackets for Retirees

Комментарии:

I wish the homeowners home sale cap gain deduction had been indexed for inflation, because it's not worth what it once was.

Ответить

I plan on making 145,000 and will have 30k max for a 401k deduction and a 27,700 standard deduction married filing jointly. My goal is to be in the 12% tax bracket. Does this sound correct to you? Thanks 👍

Ответить

EXCELLENT! We are retired with the house paid off, no debt, $2 million in retirement funds. This summer we are selling the house for $300k, moving to a more expensive location where houses are $400k. The choice is to take $100k from retirement or get a mortgage for $100k. It is a difficult choice to figure out. Withdrawl from retirement means an increase in federal income tax bracket from 12% to 24% and retirement fund growth at least 4% per year. So would it be better to take out a $100k mortgage and pay off from retirement and stay in the 12% tax bracket?

Ответить

This is really helpful and educational information! Thank you for correcting my thinking on several taxation issues.

Ответить

Great video!

Ответить

What if a retired individual had IRA distributions and CD/savings accounts interest for the year, was unaware and therefore did NOT withhold taxes or make any estimated taxes for Tax Year 2022, is there anything this individual can do now to avoid IRS penalties and interest?

Ответить

Thanks for this GREAT VIDEO!!! I too did NOT know that no matter how much I made, it’s taxed in those brackets!!! Awesome!!!!!! You guys made me very happy today!!!!!!!

Ответить

I dont understand why they go off your gross for ssi and medicare because thats not what goes in your pocket

Ответить

You both are fantastic and I look forward to learning from you!

Ответить

Tom - "More money is better than less money." Truth. Loved that line - put it on coffee mugs and t-shirts.

Ответить

Thanks for Information.... Look forward to seeing break out Video's to this Bracket one.

Ответить

I sold my home this past May 2022 that I lived in from 1999 until May 2022, i brought the house in 1999 for $124,900 and sold it May 2022 for $324,900,. I am married so do i have to claim that income that i made off the house as capital gains or include the money on my income. I brought my new home on May 10th and old home sold May 18th. I did refinance after the old home sold since i wasnt allow to do a recast and put a large amount down for a 15 year note. Also I wish i was little Johnny.

Ответить

This is EXACTLY why elections matter. Dont let what you think of some persons hair style or how they tweet determine if you vote for them or not. Its about the POLICIES of the person/party. Simply put, DEM candidates want to take as much of your money as they can - and give it away. GOP candidates want to let you (and businesses who create jobs) keep as much money as possible. Its that simple ... so vote your self-interest and not based upon what they say about somebody on social networks, podcasts, or on TV!!!!

Ответить

With everything going on right now, the best decision to be on any creative man's heart is having a profitable investment strategy.

Ответить

Thank you for simplifying some complex often misunderstood tax rates .

Ответить

Thank you very much I like your presentation.

Ответить

Informative, thank you.

Ответить