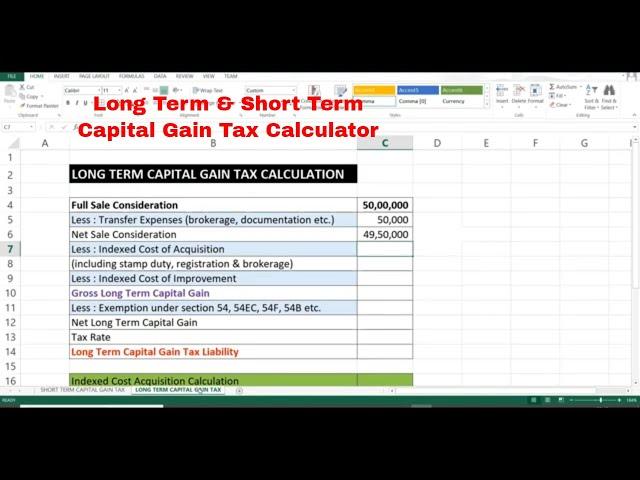

Capital Gain Tax on Sale of Property | Short Term and Long Term Capital Gain Tax Calculator

Комментарии:

Knowledgeable

Ответить

Nice explaination very good example.

Ответить

Very useful sir

Ответить

Agar 3 logo ke naam par property h to kese agal karenge or percentage kese nikalenge

Ответить

🙏 Sir ji!

Year 2000 me plot purchase liya tha

Use 2022 me 4800000 me sale Kiya

How to get exemption.

26/12/2012 को एक प्लॉट खरीद किया 290000 में रजिस्ट्रेशन के अनुसार । आज की डेट में 799632 में बेच रहे हैं ।ये भी dlc रेट के अनुसार ही है।

Ответить

Sir can you give me the calculation about my property sell gain tax

Ответить

Thanks for teaching

Ответить

can you share this excel?

Ответить

Dada capital gain sale and purchase as per market price lena hei kaya actual price lena hei

Ответить

Bhai.. Super Super video. Seriously appriciated!!

Ответить

Hi Team

Is it better to pay Ltcg tax and deposit the rest amount in the homeloan account to reduce the Home loan amount as the Home loan interest incurred in 5 years or should invest in REC bonds.

Which one is beneficial considering inflation and other changes in market.?

Kindly guide

Can we get exemption for two flats out of capital gain. But Section 54 and 54 F differs. Kindly explain. Thank u

Ответить

Beautifully explained

Ответить

Nice

Ответить

Sir,

West Bengal me ek 'Para Teacher" 'Samagra Shiksha Aviyan' ke employee hain. SSA/SSM EK JIONT VENTURE PROJECT HAIN CENTRAL GOVT(60%) & STATE GOVT(40%).

IS LIYE ITR 1 ME EK PARA TEACHER KI NATURE OF EMPLOYMENT KIYA HOGI -STATE GOVT. OR OTHERS?

PLS Reply...

Stamp duty isko kahan par minus karna hai

Ответить

Very useful & informative video. Sir, I wish to know how to fill ITR 2 online if a residential house owned by 4 four persons equal share and sale to 2 persons equal share details as under

FMV 1.4.2001 40 L

Indexed COA 135 L

FVC 295 L

LTCG 160 L

LTCG for every Owner 40 L

Investment as under to claim full exemption as under

1. Residential house 1st 25 L

2. Residential house 2nd 10 L

3. Tax saving bonds REC 5 L

Total investment 40 L within time limit

Is this ok

I purchased a flat from APHB in the year 1997 by paying 10% of the amount of the flat 8500/-(at that time 85000/- later it is reduced to 73000/-) on the basis of EMI. Accordingly I paid EMIs up to 2003 total EMI amount more than 100000/- and I paid total cost of the flat. In the year 2013 the flat is registered for 73000/- In the year 2022 the flat sold for 1700000/- How much is the Long term capital gain and the percentage of tax.

Ответить

Sir, please explain indexed cost of Acquisition? I didn't understand.

Ответить

Good explanation

Ответить

what is itr form for capital gain and business

Ответить

nice video sir

Ответить

Sir ye excel sheet share kere download ke liye

Ответить

Hi sir ,

Had taken home loan in 2010-2011 against the home. and sold it at 2021.

While calculating capital gain do we need to deduct the home loan amount which I paid to bank to close the loan.

Wat will be the property gain in case of home loan?

Please need your guidance

Nice explanation. What amount and items to be calculated under cost of improvement ?

Ответить

vacent plot sale kia ok paper m vacent likha ,je pta ni vacent mtlb nd sale deed hgi lekin plot pr boundry wall ki th ]usme b krcha hua th 1.50lac cash krch hua bricks cement labour etc cash paid to kya yh b - hga ca[pitl gain tax m agr hoga to kaise mje kya krna pdega

Ответить

Super video brother

Ответить

Bahut samjhane ka tarika bahut badhiya

Ответить

Bhai lajawab

Ответить

Can you share the excel sheet of the calculator

Ответить

Good stuff, how can I contact you?

Ответить

Is Short term long term. Capital gain counts from flat registration date after 2 yrs or from when to count 2 yrs??

Ответить

Hello Sir....I have 2 Questions related to Long Term Capital Gain (Sale of House Property)?

is Service Tax & Vat included in Cost of Acquisition and can it be indexed?

is Stamp Duty & Registration Charges included in Cost of Acquisition and can it be indexed?

After selling flat, within how many months I have to pay tax if I do not invest any money in Bond.

Ответить

Thoroughly explained !!

Question : is there any education cess or something like that on counted tax ??

Very good explaination...!

Ответить

nicely explained - very useful.... thanks !

Ответить

appreciable video with an easy language

Ответить

Simple but powerful.......

Ответить

Pl send your mob no- I have to talk to you regarding capital gain tax saving

Ответить

Sir aapka mob no mil sakta hai, aap se bat karna chahta hun, ek dealer mera dhan de nahi raha ,income tax ke nam per dara raha hai,mai 100% disabled person hu ,pls help me.

Ответить

How to calculate capital gain on equity shares and stocks please guide in Excel worksheet ASAP

Ответить

Sir Good morning, I request to know that if the property is in 6 or 7 survey numbers then is tax calculated on basis of survey no appreciation or on the total sale amount, as market value for different survey numbers are different. Kindly reply please.

Thanks

Ganesh

cost of acquisition main, do we also consider for exemption EMI paid during period for longterm capital gain

Ответить

Sir, maine ghar ke liye loan liya 2015 construction agreement ke saath main aur mera registration (Saledeed) hua 2020 main sirf land ka ab main meri property bechna chahata hu, aur samne nayi property buy bhi kar raha hu to main kya short term capital gain tax mai aaunga. Please reply 🙏🙏

Ответить

Full sale consideration amount. Kise khte h circle rate ko. Stamp duty p. Ya Jo amount mila ho ACC m. Vo kya HOTA h. Circle rate stamp duty sbki jda h is area ki.

Ответить

Hello sir, maine ghar ka renovtion karaya tha 2012 me ghar lene k baad , usme mera 3 lakh karcha hua, kya usko longtermcapital gain me expemption k lie use kar sakte hai, maine jo kahrcha kia uska koi bill nahe hai mere pass.

aur property buy karte time maine 2 lac rs registry k lie the kya wo bhe long term gain me exempted ho sakte hai.

Ap bht aache se smjte h sir ji.

Short term capital gain . Tax

Save krne k liye new property purchase krte h to tax save hoga plz rply sir ji