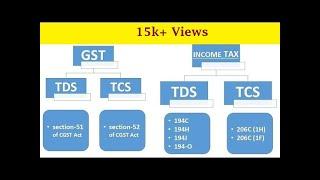

TCS & TDS under GST law and Income Tax Act

Комментарии:

Ganesh shaw - 06.08.2023 23:05

Very nice sir

Ответить

Subhrajit Chakraborty - 10.06.2023 03:47

Thank you sir ❤

Ответить

noor792 - 24.04.2023 12:44

Isme koi change hua hai kya 2023 me ??

Ответить

Vishal Jadhav - 28.01.2023 07:07

Best👍💯 information helpful. How to filing tds tcs return on gst please🙏.

Ответить

Free Thinker - 25.11.2022 13:31

Kuch samaj nahi aya

Ответить

Ziva Motivation - 20.08.2022 07:55

Dono jagah TDS katega me ek govt contractor hun toh kya gst ka credit 26as me nhi dikhega

Ответить

Kan Singh - 05.07.2022 19:52

Nice

Ответить

Varsha Sharma - 02.06.2022 20:38

Thank alot sir I have also problem in tds or TCS but I watch your video that's my query solved.

Ответить

reena kanani - 16.03.2022 15:56

Very good sir

Ответить

akash Verma - 18.02.2022 09:26

Well explanation sir

Ответить

Shreeji computer classes junagadh D R Kariya - 16.01.2022 10:25

Thank you sir

Ответить

Silpi Dutta - 20.12.2021 21:08

Helpful👍👍👍

Ответить

VIKASH KUMAR - 01.10.2021 10:03

The collection of tcs should be done on sale consideration inclusive of GST...u miss that point...

Ответить

archana sharma - 29.11.2020 15:55

👍

Ответить

TCS & TDS under GST law and Income Tax Act

CA Reeturaj Verma

NEET PG Counselling 2023: MCC Stray Vacancy Round Schedule Revised Again

Medical Dialogues

MOMMY BANGS CHANNEL 1st Live Stream

Alvin da Czech Noy

What is the Future of Real Estate in India

Flats and Keys

Türk Tiktok İfşa ve Frikikler 2021

Yobaz İfşa