How Market Makers Stop You Out | 2020

Комментарии:

How Market Makers Stop You Out | 2020

Connor Pollifrone

Гиги за Шаги (версия Майнкрафт)

HUNTERS

Супертест ножа или смерть легенды?! Наш тест "Крысы"

MesserMeisterStore

Boruto Dub English 212 213 214

Himuro Kiss

Ahut Sa Lotop - More Justice (Mackmuzick Jam Session 2 )

Mackmuzick Studio

流感本周進入流行期! 疾管署:就診人次恐上看10萬@newsebc

東森新聞 CH51

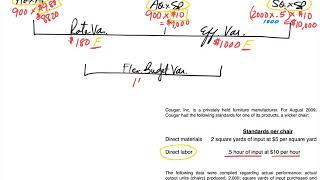

Standard Costing - DM & DL Variance Calculation Examples and Journal Entries

Dr. Brian Routh (TheAccountingDr)