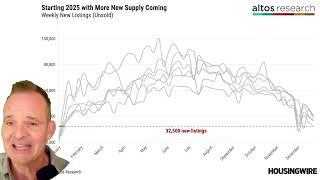

The two big housing market trends to watch in 2025

Комментарии:

You're doing a fantastic job! Could you help me with something unrelated: My OKX wallet holds some USDT, and I have the seed phrase. (alarm fetch churn bridge exercise tape speak race clerk couch crater letter). What's the best way to send them to Binance?

Ответить

The fastest path to affordability is prices falling.

Ответить

You are so good at explaining data in terms that the average person can understand!

Ответить

in Colorado the shortage felt more like a lack of buyers ... but a lot of inventory finally sold near the end of the year

Ответить

!!!I am at the beginning of my "investment journey", planning to put 385K into dividend stocks so that I will be making up to 30% annually in dividend returns. any good recommendation on great performing stocks or Crypto will be appreciated.

Ответить

ITS THE PRICE THATS THE PROBLEM

Ответить

In my Opinion, only the price matters. Until prices crash, nothing changes and affordability remains a disaster. I’m in the Midwest and prices are inching down and homes are sitting and sitting. Especially new builds. I’ve seen a lot of houses beyond 250 days on market. Jobs are dying, businesses are closing, people’s credit is maxed out. I’ve seen more restaurants, car dealerships, machine shops, etc close in the last year than I have ever seen. All unreported by the news. The next 12-24 months is going to be ugly.

Ответить

New listings are going up/normalizing because of the pent up need to sell for life reasons, but buyers have little choice other that to stay out until prices drop or interest rates come down. When Rump puts all the tariffs on other countries and sparks off more inflation interest rates might actually start rising again. Given that the inflation would be much worse and the first time around we came very close to 8, we might see 12 this time.

Ответить

The fed will have to lower rates. We have a national debt that is depending on it. The fed is saying one thing and will have to do another.

Ответить

Thanks, Mike and @AltosResearch

Ответить

Thank you for this Mike. I love your reports. Happy New Year!

Ответить

If new listings normalize but we have another year of dismal demand, is that a sign that home owners are cashing out and renting?

Ответить

Do you have data showing the average age of homebuyers today vs. previous? I'm reading it's at a record high of 56 years old. It would be great to see this trend over time.

Ответить

I appreciate the new charts and different messaging, Mike. 27% inventory and only 4% sales increase YoY 2024 says a lot.

Ответить

I like the more neutral tone of this video. I also like that you used the words “correction” and “correct” with regard to prices as it signals that you see prices as being incorrect rather than being touted and normalized as being a new foundation. In the four markets I’m currently watching, pending/contingent (single family) homes only make up between 11% and 14% of all homes, which suggests to me that January’s and February’s numbers are going to slide. I’m pen in hand and eyes wide open. I plan to buy after the selling panic starts, but before the first bounce of buyer frenzy. I just need these rates to stay strong in the sevens for about six months.

Ответить