trend reversal trading and US market analysis for 1 May 2023

Are you ready to uncover the best opportunities in the markets? Look no further than this video by Jukka Karinen, discussing various sectors and stocks with detailed analysis and insights.

You'll learn about a wide range of industries, including technology, healthcare, and consumer discretionary. You'll also get a glimpse into Jukka's own portfolio, with long positions in a few technology and semiconductor companies.

We'll dive deeper into monthly chart analysis and discover how past market behaviors can guide your investment decisions. From the Great Recession to present day, you'll see how signals and Karinen Momentum color changes can indicate the best times to buy or sell.

Key content:

00:00 Introduction and explanation of why monthly charts matter

00:47 The importance of timing and examples of previous reversals

01:32 Jukka's cautious bullishness on the markets

02:17 Going through the monthly picture for all the charts

03:10 Analysis of different sectors, including energy, financials, and basic materials

04:41 Overview of healthcare, consumer discretionary, and telecommunications sectors

05:30 Real estate and communication services analyzed

06:21 Jukka's thoughts on biotech, retail, and home builders

07:15 Discussion of Symmetry and potential big moves in the markets

08:41 Overview of Dow Jones and IWM

09:27 A look at the volatility index and Bitcoin and Ethereum

10:15 Analysis of XLE and XLF sectors

11:01 Jukka's thoughts on shorting financials

11:45 XLB trade: why I took the trade off even though the chart still looks bearish?

12:21 Long positions in tech (watch to learn what they are!)

13:15 A beautiful chart for real estate

14:38 Short biotech and retail?

15:32 A long position in a strong stock to play the semiconductor sector.

16:18 XOP could be a potential short idea, just like the energy and clean energy

17:44 SPX monthly charts: buying opportunities based on reversal triggers and why this matters today

19:22 Dollar cost averaging and building positions based on monthly reversal triggers - why this could make sense?

Join us and take your trading to the next level with the Reversal Catcher System.

Visit https://reversalcatcher.com for more information on the technology we use.

See the blog article with exact option trade information at: https://optioninvestors.club/blog/post/market-analysis-1-may-2023

You'll learn about a wide range of industries, including technology, healthcare, and consumer discretionary. You'll also get a glimpse into Jukka's own portfolio, with long positions in a few technology and semiconductor companies.

We'll dive deeper into monthly chart analysis and discover how past market behaviors can guide your investment decisions. From the Great Recession to present day, you'll see how signals and Karinen Momentum color changes can indicate the best times to buy or sell.

Key content:

00:00 Introduction and explanation of why monthly charts matter

00:47 The importance of timing and examples of previous reversals

01:32 Jukka's cautious bullishness on the markets

02:17 Going through the monthly picture for all the charts

03:10 Analysis of different sectors, including energy, financials, and basic materials

04:41 Overview of healthcare, consumer discretionary, and telecommunications sectors

05:30 Real estate and communication services analyzed

06:21 Jukka's thoughts on biotech, retail, and home builders

07:15 Discussion of Symmetry and potential big moves in the markets

08:41 Overview of Dow Jones and IWM

09:27 A look at the volatility index and Bitcoin and Ethereum

10:15 Analysis of XLE and XLF sectors

11:01 Jukka's thoughts on shorting financials

11:45 XLB trade: why I took the trade off even though the chart still looks bearish?

12:21 Long positions in tech (watch to learn what they are!)

13:15 A beautiful chart for real estate

14:38 Short biotech and retail?

15:32 A long position in a strong stock to play the semiconductor sector.

16:18 XOP could be a potential short idea, just like the energy and clean energy

17:44 SPX monthly charts: buying opportunities based on reversal triggers and why this matters today

19:22 Dollar cost averaging and building positions based on monthly reversal triggers - why this could make sense?

Join us and take your trading to the next level with the Reversal Catcher System.

Visit https://reversalcatcher.com for more information on the technology we use.

See the blog article with exact option trade information at: https://optioninvestors.club/blog/post/market-analysis-1-may-2023

Тэги:

#price_trend_reversal #new_york_stock_exchange #option_trading #long_term_investing #technical_analysis #buy_low_sell_high #buy_the_dip #sell_the_rip #simpler_trading_with_better_indicatorsКомментарии:

trend reversal trading and US market analysis for 1 May 2023

Option Investors Club

【北海道ローカルCM】1998年の大晦日に放送されたCM②

【懐かCM】落石ちゃんねる

BGH OST b get,s controled

BGH SOUDATRACK OFICIAL

Weird Strict Grandma! | Roblox

Janet and Kate

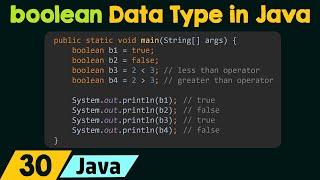

The boolean Data Type in Java

Neso Academy

The Feminine Holy Spirit: God Moving Over the Face of the Waters; Wisdom; Mother of Israel

The Unexpected Cosmology

BGH OST VETSRAK

BGH SOUDATRACK OFICIAL