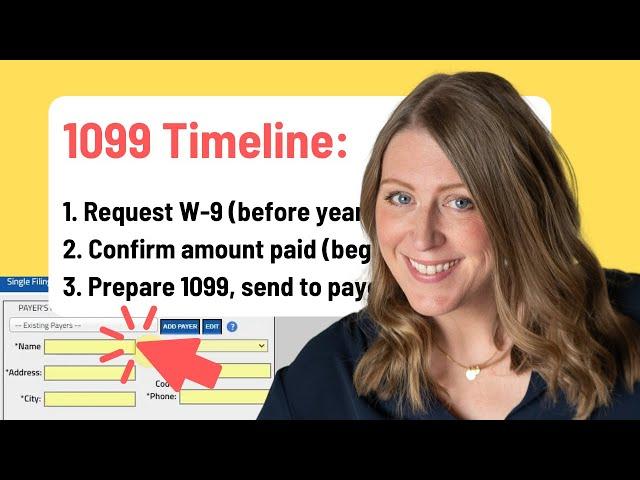

1099s: how to create and file online (who gets a 1099?) tutorial for bookkeepers

Комментарии:

🎉im a first time filer as ssa is only income, my employer and i both paid estimated total taxes for social security and Medicare , what do i need to put in box3 and box5

Ответить

Thank you!!!

Ответить

Hello, I made a mistake, how can I fix it? I put payer as the client and the client as the payer i did submit this i need to submit other 1099 again or is any way to fix the one already submitted

Ответить

Great job! Thank you.

Ответить

What about contractors that did work for me in December 2023 but I am not paying them until January 2024? Can I include that December expense in the 2023 1099 NEC?

Ответить

Awesome tutorial, just what I need!

Ответить

Hello! To clarify- if a contractor is paid a via several payment methods, i.e. some payments by check and some payments by by something like PayPal, the 1099-NEC needs to be filed, but the total amount paid to the contractor on that 1099 should ONLY include the amounts paid by check, and not the amounts paid via PayPal and whatnot, is that correct? So essentially, the 1099 wouldn't include all payments sent to that contractor for the year for both PayPal and by check, only the 'eligible' payments (by check) sent to them for the year?

Ответить

You stated any type of Corporations or S-Corps do not need a 1099 if you hired them as a contractor. Do you know the tax code on this? Please advise and thank you for all your information!! Very helpful!!

Ответить

I have been a caregiver for a local family part time for a year. My only source of income. What income tax form would I fill out? Thank you. Bless!

Ответить

Thanks! Very informative. As a business small business owner and "not" a book keeper, do you or someone you know someone I can work with to file a 1099 for a few employees I have? thanks in advance! Tony

Ответить

I thank you for sharing your knowledge in this video, you just saved me from overpaying someone substantially to complete this simple task.

Ответить

Let me correct what I mean. I still don't have too many clients in this business I am doing. I made a typographical error when I was explaining this; but, I hope you understand what I mean.

Ответить

Hi! Just starting out bookkeeping business. I am getting a lot of catchups from clients who want to prepare 1099s before anything. Is there a way to do that on Quickbooks Online if They are not set up as clients?

Ответить

Hi my husband have truck business and for we need 1099 what we need to fill mam which one 1099

Ответить

I found this very helpful, thank you! There is a link on the IRS website to order the 1099 forms. Is the only difference in going this route having to complete by pen and mail in vs typing and electronically filing?

Ответить

I had the same question as Cheryl Bowman. I have used the 1099 feature through QBO. It IS a little clunky when "finding" all the vendors that should get 1099s, but after that, I thought it was super simple and you don't have to manually enter data. It pulls it all from their QBO vendor profile. Intuit sends the vendor an email that walks them through how to log in and download the digital 1099 AND they also snail mail them a copy. I can't remember the pricing. It was done in blocks, like 1-5 1099s is $XX, 6-10 is XX. I thought the pricing was reasonable.

Ответить

Hi, why we do not need to send the 1099 to the payee with the payment term credit card? Sorry if I missed anything here? Thanks

Ответить

I like all of your videos it’s very helpful

Ответить

Thank you for sharing this video about preparing a Form 1099. Although it sounds interesting, I have never done this before. I think I would need more of an explanation of this, so I can understand it better.

Ответить

When you create a vendor there's a box to check that tracks 1099s

Ответить

How come you don't use the 1099 feature in QuickBooks?

Ответить

Thank you! Very helpful!

Ответить