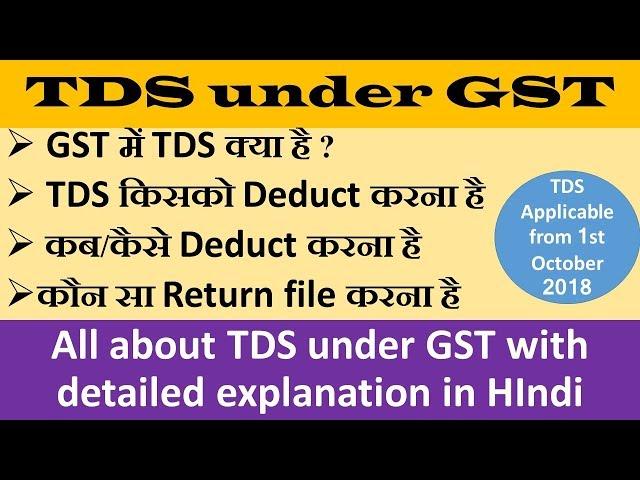

TDS under GST, ALL ABOUT TDS IN GST WITH DETAILED EXPLANATION WITH EXAMPLES

Комментарии:

Ableton Live 9 Mastering Trick Inverting Phases with Utility - Preserving Your Ears Tip

Production Music Live

HOW TO BE POGI LIKE RAMON BAUTISTA

Ra Rivera

Oshiq G‘arib va Shohsanam dostonidan "Naylayin"

Sobir Turatov