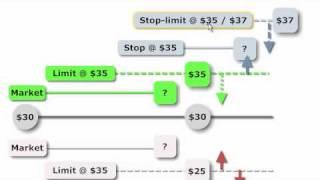

FRM: Order Types (market, limit, stop, stop-limit)

Комментарии:

Thank you SIR

Ответить

Watched a lot of videos, Best explanation till date. Staright to the point and clear

Ответить

👍👍👍tq

Ответить

I cant understand why would you have the sells set for 25 when you're buying for 30? Doesnt that mean you will lose 5 dollars? Why isnt the sells for 35?

Ответить

Does anyone know if the market order has higher priority than triggered stop order(become market order, but previously placed) or not?

Ответить

what does the "stop" part mean... Lets say I bought 1 share of ABC for $100 and I wanna do a Sell-Limit order. If my stop price is $190 and my limit is $200, what actually happens when it "STOPS" what does it stop doing?

Ответить

Great explanation HOWEVER: It is assuming one wants to buy above the current price, and sell under the current price. What about the opposite scenario?

Ответить

is it possible to set something that sells above the price. say i want to lock in profits at 20 price right now is 15 is this possible?

Ответить

Beautifully explained. The best I've seen. Thank you.

Ответить

whats the difference between limit sell and stop-limit sell? im confused.

Ответить

Simple and easy to understand, thanks.

Ответить

Your Chart Beats all the other explanations. Direct and Clear! and is there a way to get that full chart in one frame?

Ответить

This is the best video on this topic

Ответить

Excellent video - very well explained, thank you

Ответить

Well explained. You did a great job!

Ответить

One of the best video explaining this subject

Ответить

Perfect explanation. This should be included to all new brokerage accounts

Ответить

Yep. Definitely the clearest explanation I've seen thus far on this. The ambiguity that other videos left on the distinction between a stop and a limit is rather maddening in retrospect. You've got a new subscriber. Thanks for the time that you put into this!

Ответить

Best explanation I’ve seen yet

Ответить

Best explenation

Ответить

Eloquent and well explained, I just watched another video from what sounded like an eastern European, I could only understand half his poor explanation and profound accent!!

Ответить

Such a great job!

Ответить

ossum vedio ,made my confusions clear today

Ответить

I have a question. suppose the normal price of a stock was 10 and it is on a high ride of 30 and climbing up wards ue to positive news and future gains. I hit a Market order to sell 1000 shares , Will i I get a price close to 30 OR Above if the stock is still climbing above 35 or so ? It says you will get the lowest of the market order for that shares. What if some people had put in an order to buy at USD 4 or USD 7 and those orders being the lowest, will i get those 4 or USD 7 prices for the shares I sell on Market order or or prices where the share is currently trading around 30 and above ... Thank you for the support in advance.

Ответить

Certainly a well organized presentation - especially with the visual graphic. Additionally, organizing the presentation into distinct Buy and Sell sides makes everything clear whereas other videos do not do this and thus confusing as to application.

Ответить

I'm still confused... How does stop limit work if you want to sell at a price higher than current price? If I buy at 30, current price is 35 I can make a limit sell at 40 and hope it gets there....but can I set an order to sell at 32 if it doesn't quite reach 40 and starts to drop?

Ответить

Very clear and perfect way you explained this. Graphical [presentation makes things much easier. Thanks

Ответить

why would you place a buy limit order at a higher price than the current price? that's like going to a store and saying the price of this shirt cost 10 dollars but i'll but it from you at 12

Ответить

fuk this shit

Ответить

Best video I've seen to explain this- thank you

Ответить

This was the clearest example i’ve seen of market orders thank you very much. The only thing left that i’m having trouble understanding is trailing stops

Ответить

Stop-limit order. Triggered @25. Does price have to go to 23? Then placed limit order? then Can sell higher? I don’t understand how it can sell higher if you put in 23 price? Oh wait I think I get it now... wouldn’t a limit order placed above if buying be similar to market order. And a limit order to sell below price also act as if a market order? Where am I wrong here?

Ответить

Hey David thanks for the illustration. This has been the best video yet. Maybe it's starting to click because I've watch so many other videos on the same concept but none of them have shown visually all the type and there uses. The only thing your missing is a trailing stop but it was better not to have added it because this videos fantastically described the basics. Thanks

Ответить

Very clear! Thanks!

Ответить

This was great, been searching for "choosing the stop loss point in trading world" for a while now, and I think this has helped. You ever tried - Seyilliamorn Unflappable Smasher - (do a search on google ) ? It is a smashing exclusive product for discovering how to trade stocks lik a boss without the normal expense. Ive heard some pretty good things about it and my mate got excellent success with it.

Ответить

Which is the best to use

Ответить

Best explanation out there! Thanks a lot

Ответить

if the Market order is for $30 I place limit orders below the $30 market order. That assumes that the market will fluctuate throughout the day and I may be able to buy for less the the $30 market. In other words I may place a limit at $29.75 and it will fill if the market dips to that level. I fail to see the purpose of place a limit, stop-limit at a price greater than the market price. Why not just buy at the $30? You pay more if you place a limit at $35.

Ответить

Very clear

Ответить

Very clear! Thank you! The clearest explanation so far!

Ответить

ugg after countless search this is the so far the best explanation! thank u

Ответить

Best explanation I've seen on this. 10 year old video, too.

Ответить

Great tutorial, best I've seen....

Ответить

OK I think I finally got it. My issue was between limit and stop-limit. Limit's limitation is that the market might not reach or (and more importantly to understand the difference:) can move on super quickly and might not get fulfilled IF the price moved in the wrong direction from THE DESIRED PRICE (simplifying this analogy so it doesn't matter buy or sell side). You had no contingency price in case it moved in the wrong direction. Stop-limit allows you have that contingency price; to build in $35-$37 as a 'buffer', but $35 as the first trigger. The STOP is the signal that your desired price is reached: like a limit order. But you also put in a JUST IN CASE price (almost like a second limit) that is intentionally WORSE than the stop. This is a better guarantee to get it fulfilled than JUST a limit order because if the market moves super quickly in the wrong direction you had a backup worse price.

Ответить

Seems like it would make more sense if you showed the sell orders above the $30 and buy below as that's where people would want to trade.

Ответить

What is the best order type if you want to hide the quantity of stock you want filled?

Ответить

wonderfull, even after 10 years this educational video is absolutely usefull, thank you

Ответить

![Police Officer Shoots Driver of SUV, Allegedly [CAUGHT ON TAPE] Police Officer Shoots Driver of SUV, Allegedly [CAUGHT ON TAPE]](https://invideo.cc/img/upload/VVNsODNEWlJFdFQ.jpg)