IRS Releases New Inflation Tax Brackets. What This Means For You

Комментарии:

Every American should just stop paying taxes this has to stop!!

Ответить

Taxes are such a motivation killer, each paycheck hundreds of dollars going somewhere I barely feel I get any kind of return on. Especially watching politicians bicker about the national anthem or whatever instead of working on issues. Like $100 bucks an hour per person to watch them all get waylayed by a guy who's not doing anything but filling the air with junk

Ответить

I admire you young man your good

Ответить

Crazy I paid less during trump and we were doing fine. Love how the left makes problems just to make solutions which just enrich the rich and make the poor suffer more.

Ответить

May I suggest....having graphics prepared vs handwritten notes. Much easier to read.

Ответить

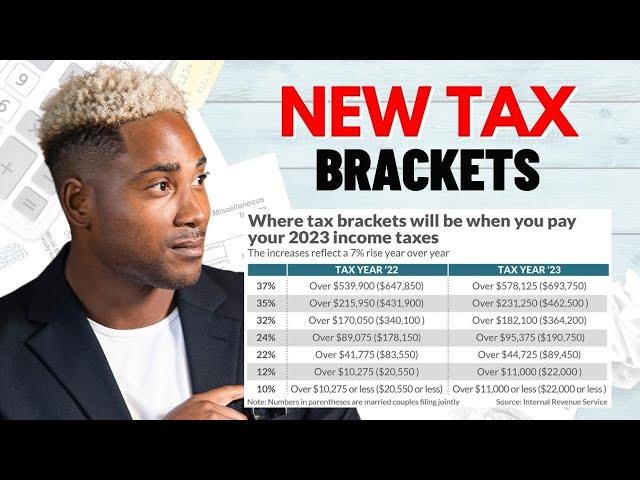

What I don't like about this video is that it perpetuates this rampant myth that if you cross into the next tax bracket ALL of your income gets taxed by that next tax bracket's percent. I know Karlton knows how it actually works, but he never clears that up in the video, which leads to people thinking that if they 'cross the line' their return will be smaller than if they stayed under.

To be clear, if you cross from the 12% bracket to the 22% bracket, your income DOES NOT get taxed 22% in its entirety. ONLY the chunk of money above $44,725 gets taxed 22%. The chunk of money between $11,000 and $44,725 gets taxed at 12%. And the chunk of money $11,000 and under gets taxed at 10%.

Again, 'crossing the line' WILL NOT result in a lower return, all other things being the same.

I pay 46%...

Claims 0

TAXATION IS THEFT

Ответить

I don’t know where they got that 8%. Looks like 50% at least.

Ответить

imagine paying 22% and imagine the government also doing taxation without representation by printing and borrowing money from the federal reserve to give to other countries. Awesome

Ответить

Paying taxes is like buying stock in a company that is continually in the red.

Ответить

All these comments are looking like the start of the Revolutionary war.

Ответить

🧠

Ответить

24% wtf damn

Ответить

Tax is a scam

Ответить

I’m working longer and harder these days. Neighborhood, health care, roads and infrastructure not looking good. Grocery stores closing, climates changing and taxes all over garnished by the government for whatever reasons. This is insane.

Ответить

In the USA we only mention Federal taxes, but in Europe, they group all taxes including SSN and medicare and healthcare etc. and say it's too high it's 40%.

If you take 32% Federal in USA + 7% state + 8% SSN + 2% medicare + Healthcare, etc. then it's way more than in Europe

These tax brackets mean nothing. Just flip cars buy and sell cars from private source with cash, IRS doesn't know how much you bought the cars for and how much you sold the car for coz your dealing with cash. Suppose buying and selling cars made you $300k per year cash, and you report $100k per year income to the IRS, technically you didn't pay tax on the other $200k. Just use cash to pay your bills from currency exchange IRS can't see nothing. In Illinois all cash only businesses operates in a similar way, not just one person but you've got thousands of cash businesses doing the same shit. I've never seen IRS coming after them for fraud they've been doing that for 30+ years.

Ответить

I looked at my pay stub and calculated the taxes and it showed im paying 24% per pay check when my yearly salary is $44,500 for 2023. I also have defer comp so that would be even lower. Would you happen to know why this might be the case? Thank you

Ответить

This fkn bs. That 12% jump to 22? 🤦🏽♂️

Ответить

I want to know this is before standard deduction?

Ответить

Wtf

Ответить

So single people get unfairly punished.

Ответить

I like your video presentation. It is informative too, at the same time. Thanks a lot for your guidance!

Ответить

The damn government steals half my income through their “tax everything” system. Everything I buy is taxed.

Ответить

Dies this applies for a 1099K too?

Ответить

If the IRS really adjusted for inflation, our taxes would be way lower.

Ответить

Taxes are so confusing and overwhelming for me and I don’t feel like I can afford an accountant but I haven’t really looked into it. I appreciate your videos

Ответить

Taxation without representation

Ответить

Yeah, IRS raises tax brackets and the Fed raises interest rates. What a racket. Anyone that votes, for the sons of bitches should go to jail with them.

Ответить

IRS Taxing you so they can make a living. Another words, they are legal robbers. They sit on their butt and design a plan to rob you. You all need to protest and take your hard earning money back. IRS should not be exist.

Ответить

Inflation, bank collapse, severe drought in the agricultural belt, recession, food shortages, diesel fuel and heating oil shortages, baby formula shortages, available automobile shortages and prices, the price of living place. <It's all coming together and it could lead to a real disaster towards the end of this year (or sooner). With inflation currently at about 6%, my primary concern is how to maximize my savings/retirement fund of about $300k which has been sitting duck since forever with zero to no gains.

Ответить

Those tax brackets are illegal!

Ответить

Hel we’re pretty much working at a 50/50 split . Between us and the government. Unbelievable.

Ответить

In short, you are worse off

Ответить

You don’t know how taxes work?? You make 100000 and you fall in 24% tax brackets!! 😂

Ответить

Thanks for teaching. I needed that.❤❤❤

Ответить

😂 They wasted so much money giving it to all the other countries and now want the American people to pay more for their incompetence. Becarful who you vote for.

Ответить

The reality is taxable years ENDED by LAW , passed by the 83rd Congress on August 16, 1954. See 26 CFR 1.0-1 paragraph (d). Any enforcement of the non-existent tax took place on August 17, 1954 but there was NO tax to ENFORCE as the income tax died/expired the DAY BEFORE!!!

Ответить

If you draw, Social Security, will this affect how much taxes you pay on your Social Security? We are retired and draw Social Security.

Ответить

im getting taxed at 24 percent i made 46 thousand

Ответить

I feel I’m living in the Ronin Hood cartoon with prince john raising taxes every chance he gets

Ответить

Its Phelps (ie left wing, aka "bidenomics") economics.

Government creates massive inflation then soaks the inflated money back, leaving everyone involved broke except government who now holds the deflated money then hands out welfare as it sees fit

No matter how much they take out it’s a waste of our money

Ответить

Aren’t ya’ll glad all your taxes are going to other countries?

Ответить

F the I.R.S.! Keep continuing to make it worse for the hardworking American while rich billionaire POS keep getting away with not paying their share. Makes real sense

Ответить

The middle-class individual gets shafted every time.

During the year and at the end. How does the government expect people to live? I might as well buy a van and live out of it. It's ridiculous.

With Market tumbling, Inflation Soaring, Is the stock market actually getting better or could this be the regular new year market manipulation to entice new investors? I'm currently sitting on $500k inheritance and just wondering what better assets than stocks to invest in right now

Ответить

The rising interest rate can surely control inflation, but won't prevent erosion of the eroding purchasing power of the US dollar. I have learnt my lesson this time. The banks can't be making money off my money, while inflation eats into it. I have set aside 650k to invest in the stock market now, since that keeps up with inflation, but I don't know how to get started.

Ответить

![[TTB] #UFL BETA INDEPTH REVIEW! - FROM A MANUAL PLAYERS PERSPECTIVE - PROS, CONS, AND MORE! [TTB] #UFL BETA INDEPTH REVIEW! - FROM A MANUAL PLAYERS PERSPECTIVE - PROS, CONS, AND MORE!](https://invideo.cc/img/upload/c3VOUEVDY3NQWDQ.jpg)