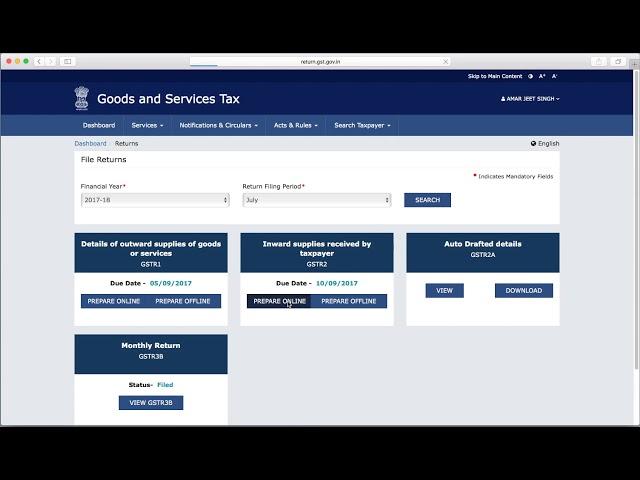

GSTR 2 Return, Prepare Online & Reconciliation with GSTR 2 A

Комментарии:

Agar hamne GSTR1 fill nhi kiya toh kya kare

Ответить

sir mane gst le rakhi hai or mane kuch bhi buy or sell nahi kiya hai to me kaise gstr2a ko fill karu

Ответить

Explained in speed .....not useful

Ответить

Hello sir , please thoda dhere 2 bola kijiye aap lgatar bolte hi jate h

Ответить

Nice video thanks

Ответить

Sir how to file gst return with out tally pls guide us.

Ответить

I am not getting GSTR 2 option in my user profile.

Ответить

Sir why did you stopped making videos? Please Sir continue making video...you are the best GST trainer..the way of your explanation is awesome... please make videos..

Ответить

Thank you

Ответить

Thank You Sir, Beautifully explained, Nice Video

Ответить

Sir CMP 02 ke liye request daal Diya hu par mere pas koi bhi purchase nahi hai aur na hi koi stock hai to itc03 file Kar na padega Kya mujhe composition scheme ke liye

Ответить

Very use full video Sir ham register dealer se goods purchases kiya jo ki Quarterly return file karte hai lekin mai monthly return file karta hu to fir mai ITC keyse lunga.

Ответить

Very thanks to u sir

Ответить

E commerce me gstr2 file krna hota hai kya?

Ответить

Is filing 2a is compulsory if not filed yet what will b the consequence

Ответить

Sir Mene gstr 2 me ek invoice jo supplier ne add nhi Kiya tha wo Mene add kar diya. But Abhi muje wo delete karna hai to kese Karu?. Kunki delete wala option highlight ni ho rha

Ответить

nice v.. thank u sir

and make more v.. this type

Sir agar apke paas only gst related topics ki dvd hai toh pls btaye...?

Like jisme online gst returns fillings ke bare mein lecture ho and gst ka study material ho..

Must reply

Advance amt registered supplier ko dete hoto kaha dalna sir

Ответить

Agar hum koi purchase nahi kiye hai lekin 2A show hota hai to use denied kaise kare

Ответить

Sir, mene agust month ka gstr2A accept nahi kiya or gstr3B return file kardi, avi usko October me file karne se kuch problem hogi kya, please suggest me sir.

Ответить

SIR EXEMPT PURCHASE INOVICE HONE PER KYA KARE

Ответить

GOOD JOB SIRJI GLAD TO WATCH UR VIDEO ...

Ответить

Itr 1 _ Individual for fy 15-16, 16-7 and 17-18 ekhon ki return file korte parbo jodi hoi tahole advice.

Ответить

Hello Sir,

Can we edit the invoice details and add missing invoices now as GSTR-2 is suspended by the government. Please suggest.

Sir kia GSTR2 file krna must hai.

Ответить

Just now checked GSTR 2. It is still not available for the further course of action. When it will start.

Ответить

Very Helpful 🙏👍

Ответить

sir mere client jinko hamne jan2018 me sale kiya tha ... to unko gstr2a me wo invoices show ni ho rahi to kya missing wale ko adit karake ...usko approve kar du to kya ye sahi hai ... please help

Ответить

sir bhut ...khoob

Ответить

Sir in my gstr 2 show wrong bill cradit so i want cansel this bill in my gstr2

Ответить

Sir pls govt work contract kese gstr bhare pls bhataye.

Ответить

very nice vedio sir

Ответить

gstr2 bharne me late ho jay to phir kaise file karen

Ответить

HSN code dena compulsory ha kya??? GSTR 2 ma aur GSTR 2 ki last date kya ha fill karna ki April 2018 ki

Ответить

Dear sir mera ek question tha sir mere gst r1 ke b2b invoice ke gross amount ki value me kuch difference aa rha hain telly se kam aa rhi hain taxable value match hain or gst value match hain m chahta hoo ki gst portal ki invoice ka deta download ho sakta hain to mujhe plzz btaye kaise

Ответить

Sir मुझे एक जानकारी चाहिए आप मेरी मदद कीजिये sir यदि कोई केवल gstr 3B ही भरता है जुलाई से जनवरी तक। ओर आगे भी तो कोई प्रॉब्लम तो नही है।।

Gstr 1 नही भरी हो। जबकि B2B invoices भी है।

Sir, if GSTR-2A is correct, then do i have to file it or it gets automatically filed? Please help.. I just had to pay Rs.7960 for GSTR-3B Nil Return Filing Late fees. So, I need to know if I have to pay late fees for GSTR-2 also.. :(

Ответить

Who is composite dealer?

Ответить

Sir I want gst and income tax class online I leave in Bihar madhubani any facility available kindly provide fee and charge for query or help provide mobile no.

Ответить

bht hi acha video

Ответить

sir ji GSTR 2A me view karne k bad agar kuch invoices missing ho to hi GSTR 2 me entry hogi kya

Ответить

Change fant size

Ответить

nice

Ответить

hello sir mene gstr 3b me unragistered peron se purchasing inter state me show kar di h apki video dekhi thi bad me pata laga ke unragistered se supply inter state me nahi show kar sakte ab bataye sir mujhe kya karna hoga pls rply

Ответить

sir, maine Sept - 2017 ka GSTR 3B & GSTR 1 return Nil File Kiya Hai. Lekin ab Sept-2017 ke 3 Purchase Invoice aaye hai. aur Hamare GSTR 2A Me dikhai de rahe hai. Ab mai GSTR 2 Kaise file kare. Please Help.

Ответить

Sir, agar supplier ka bill gst 2A me show nahi ho raha hai to kya uss case me bhi gstr 2 file karna padega?

Ответить

Sir debit note ka entry kanha aur kab karna hogs pls bataiya

Ответить

i have filed all return except gstr2 . also not able to file due to error so what happen if not ?

Ответить

Sir mere nn GSTR2A KA option aa RHA hai

Gstr 2 ka nhi