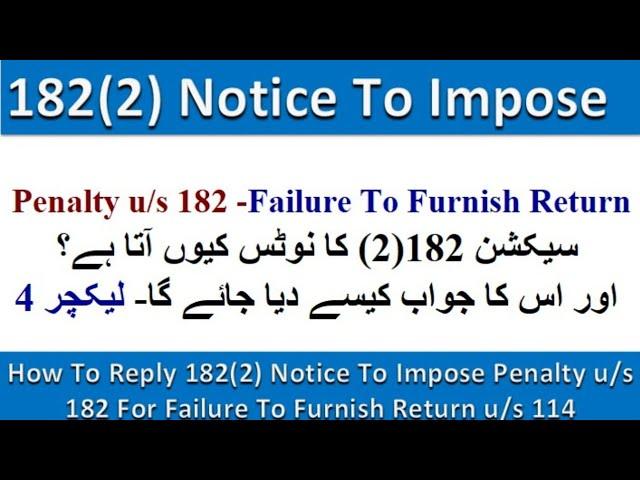

How To Reply 182(2) Notice to impose Penalty u/s 182 for failure to furnish return u/s 114|Lecture 4

How To Reply 182(2) Notice to impose Penalty u/s 182 for failure to furnish return u/s 114|Lecture 4

Learn About Pakistan taxation including E-Filing of both sale tax and income tax

E-Filing

1. Monthly sale tax return

2. Withholding Statement 165

3. Reconciliation of sale tax return

4. Reconciliation of wealth

5. Annual income tax return of Salary Individual

6. Annual income tax return of the Company

7. Annual income tax return of Business Individual / Retailer or Trader

8. Annual income tax return of AOP

All the above sections will be covered with practical examples and online filing.

Income tax Includes

1. Section-149 Income from Salary

2. Section-155 Income from Property

3. Section-153 Payment of goods, services,s, and contract

4. Section-147 Advance income tax

5. Section-148 Import

6. Section-231AA and 236P Advance tax on certain banking transaction

7. Section-231B Advance tax at the time of registration of the private motor vehicle

8. Section-235A Tax collection from domestic electric bills

9. Section-236 Tax collection from telephone users

10. Section-236B Advance tax on the purchase of domestic air ticket

11. Section-236F Advance tax on cable operator and other electronic media

12. Section-236G Advance tax on sale to the distributor, dealer, and wholesalers

13. Section-236H Advance tax on sale to retailers

14. Section-236I Advance tax by educational institutions

15. Section-236U Advance tax on insurance premium

16. Section-236X Advance tax on Tobacco

17. Section-236Y Advance tax on remittance abroad through credit, debit, or prepaid cards

18. Fine and penalties

19. Section-177 Audit

20. Treatment of provision for bad and doubtful debts

Sale Tax Includes

21. What is sale tax or indirect tax and concept of VAT

22. Difference between Input and Output tax

23. Further tax and extra tax

24. Calculation of Sale tax

25. Advance sale tax

26. Withholding Sale tax

27. Debit and credit notes

28. Admissible credit

29. Annexures A, B, C, F, H, J, and I with a practical example

30. Supply and purchase register

31. Stock or consumption sheet

32. Concept of Punjab Revenue Authority (PRA) and Sindh Revenue Authority (SRB)

Regards

Muhammad Qasim

Please Make your Habit of Five Time Prayers, If You Want to Succeed in Every Aspect of Your Life.

Allah Bless you.

#penalty

#notice182(2)

#notice114(4)

#notice182

#penalty182(2)

#incometaxreturn

#incometaxreturn2022

#taxreturn2022

#fbr

Learn About Pakistan taxation including E-Filing of both sale tax and income tax

E-Filing

1. Monthly sale tax return

2. Withholding Statement 165

3. Reconciliation of sale tax return

4. Reconciliation of wealth

5. Annual income tax return of Salary Individual

6. Annual income tax return of the Company

7. Annual income tax return of Business Individual / Retailer or Trader

8. Annual income tax return of AOP

All the above sections will be covered with practical examples and online filing.

Income tax Includes

1. Section-149 Income from Salary

2. Section-155 Income from Property

3. Section-153 Payment of goods, services,s, and contract

4. Section-147 Advance income tax

5. Section-148 Import

6. Section-231AA and 236P Advance tax on certain banking transaction

7. Section-231B Advance tax at the time of registration of the private motor vehicle

8. Section-235A Tax collection from domestic electric bills

9. Section-236 Tax collection from telephone users

10. Section-236B Advance tax on the purchase of domestic air ticket

11. Section-236F Advance tax on cable operator and other electronic media

12. Section-236G Advance tax on sale to the distributor, dealer, and wholesalers

13. Section-236H Advance tax on sale to retailers

14. Section-236I Advance tax by educational institutions

15. Section-236U Advance tax on insurance premium

16. Section-236X Advance tax on Tobacco

17. Section-236Y Advance tax on remittance abroad through credit, debit, or prepaid cards

18. Fine and penalties

19. Section-177 Audit

20. Treatment of provision for bad and doubtful debts

Sale Tax Includes

21. What is sale tax or indirect tax and concept of VAT

22. Difference between Input and Output tax

23. Further tax and extra tax

24. Calculation of Sale tax

25. Advance sale tax

26. Withholding Sale tax

27. Debit and credit notes

28. Admissible credit

29. Annexures A, B, C, F, H, J, and I with a practical example

30. Supply and purchase register

31. Stock or consumption sheet

32. Concept of Punjab Revenue Authority (PRA) and Sindh Revenue Authority (SRB)

Regards

Muhammad Qasim

Please Make your Habit of Five Time Prayers, If You Want to Succeed in Every Aspect of Your Life.

Allah Bless you.

#penalty

#notice182(2)

#notice114(4)

#notice182

#penalty182(2)

#incometaxreturn

#incometaxreturn2022

#taxreturn2022

#fbr

Тэги:

#182(2)_notice_to_impose_penalty_u/s_182_for_failure_to_furnish_return_u/s_114 #how_to_reply_182(2)_notice_to_impose_penalty_u/s_182_for_failure_to_furnish_return_u/s_114 #what_is_182(2)_notice_to_impose_penalty_u/s_182_for_failure_to_furnish_return_u/s_114 #why_182(2)_notice_to_impose_penalty_u/s_182_for_failure_to_furnish_return_u/s_114_is_coming #notice_to_impose_penalty_u/s_182_for_failure_to_furnish_return_u/s_114 #how_to_reply_fbr_notice_182Комментарии:

How To Fix iPhone 13 Pro Yellow Screen Without Replace LCD

CamFix Restore

Sky Glass Ass Commercial

Xaxtix

Basic SwiftUI — ШМР iOS 2024

Young&&Yandex

![M.O.D. | Berlin | DEAD END [1993] M.O.D. | Berlin | DEAD END [1993]](https://invideo.cc/img/upload/WWFzaDdmdjVnOUo.jpg)