Комментарии:

Dear Sir,

I have a doubt, need ur help. I am a buyer in a company and i buy frequent machines and parts to my factory from international suppliers. The supplier will send the part through DHL or other courier service and wen the shipment comes to me i pay only custum duty and get my shipment.

I want to know why there is no vat here.

Sir I have a Maksala . Can you please help me how can I pay my tax & how can I impose my tax on my services.

Ответить

Sir does expenses related with consumption also include in input vat like stationery, fuel etc

Ответить

The overview of the vat system was amazingly explained, but I still have some questions I would like to ask. Inshallah, I will email them to you.

Ответить

Expences deduction in vat or no

Ответить

Nice and very summarise to the point. Thank you sir. I am new in Riyadh your videos help me a lot to understand the taxation and zakat system of KSA. IF you have notes or presentationz & can share the please let me know. Thanks again

Ответить

Thank you sir May I contact please

Ответить

It'll help us a lot if you speak without so much breaks as we speak normally because I don't have enough time. You could have make this video of around 5 minutes if u would have spoken normally.

Ответить

XYZ company (based in KSA) is in the business of repairs and maintenance of machinery. A UAE based company sends it's machine to XYZ company to get repaired, XYZ Company repairs and then returns the machine back to the UAE. What are the tax implications on these types of transactions?

Ответить

I want to know about

RCM in Saudi Arabia

And what about if I sale to UAE from Saudi

I want to know VAT

(RCM)

Shall we claim VAT paid for employee expenses like purchase of canteen items, petrol exp for company vehicles given to employees etc?

Ответить

Asalam-o-alaikum sir can you please give your number to clear some points on vat tax regarding our business

Ответить

👍 Please doing more video about saudi vat rules,like deduction .excemption and about zero rated and I want to know more about RCM.please doing.

Ответить

A company not made vat return from 2018, even zaka, now the co. Get vat registered last month, how it can fill vat return qtrly?

Can u suggest?

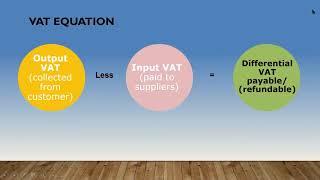

Sir calculation kaise karna hai Vat

Actual invoice value 100 vat paid 15 sale

Purch 50 vat laid 7.5

15-7.5=7.5 vat return

Or 100/1.15= 86.95,

50/1.15=43.47

86.95-43.47=

Dear all - please note my correct mobile 557294327, there is typo error in this video

Ответить