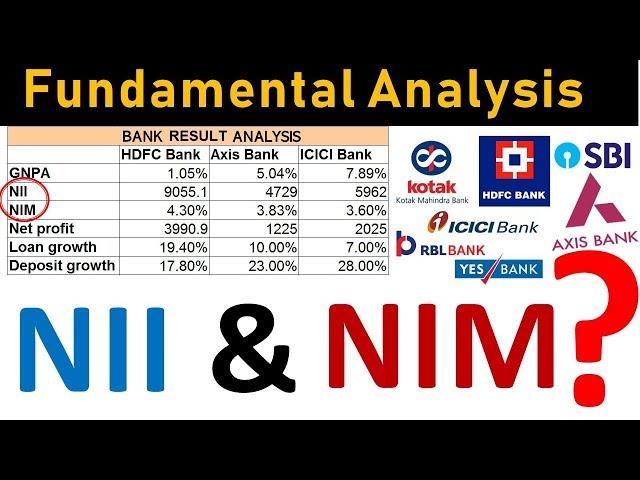

Bank Results Analysis | Net interest income (NII) | Net interest margin (NIM) | Fundamental Analysis

Комментарии:

what is positive earning assets explain

Ответить

Sir video lo advances eni chepparu

Please explain about bank advances

Axis bank more Nim compared to icici, which one better axis or icici?

Ответить

Bro small doubt from my side. You told who had good NIM, it was better bank and performing well. Example one bank has more NPA's then denominator(avg of perf assets) decreases since they don't have more PA, then total value NMI increases. So atlast NPA directly proportional to NMI. Can you talk about it or comment on it.

Ответить

Thank you

Ответить

Thank you

Ответить

good explaination.

Ответить

Thank u bro

Ответить

Thanks for providing valuable information bro..

Ответить

🙏🙏🙏🙏🙏🙏🙏🙏🙏🙏

Ответить

It means , NII and NIM values always depends on performing assets and non performing assets. If they have more performing assets, bank will have good growth. Thank you Jai Hindh

Ответить

GNPA meaning

Ответить

You explaining very clearly bro why there will be any doubts

Superb bro

Hats off for your dedication

Your purpose for making quality informative and both educational purpose videos is great Sir.I request you to make more videos on fundamentals analysis.

Ответить

Anna iam Vinay .......I want to learn like u ..can u pls tell me where u learn from these things

Ответить

Hi , please make a vedio on ratios and ratio analysis and intrinsic value of a share

Ответить

upstox global investment gurinchi chepandi annaya

Ответить

Sir naku already emkay globel shermarket lo account undi eppudu naku demart account teesukovaxha plz chapandi sir

Ответить

Bro EBIDTA data oka company ki YOY taggithe adi positive ga impact chestundaa or negitve haa bro

Ответить

Hai brother 🥰

Ur information giving in this channel is so valuable. Thanks for that. From where can I get that company results PDF.

హాయ్ ఫ్రెండ్ ! ఒక కంపెనీ ఉదాహరణగా తీసుకొని పూర్తిగా ఫండమెంటల్ అనాలసిస్ ఎలా చేయాలో చూపించే ఫండమెంటల్ అనాలసిస్ కోర్సు చేయండి . రకరకాల sectors ఎలా చూడాలో చెప్పండి ప్లీజ్ .

Ответить

Thank you so much anna.

Anni categories ki fundamental analysis cheyy anna.

Miru chala goppa varu

Ответить

Brother for SHORT TERM CAPITAL GAINS 1,600 do I need to pay any TAX. I have no other income i.e below 2.5 lac

Ответить

Amazing Explanation.

Ответить

ధన్యవాదాలు మిత్రమా

Ответить

Gnpa అంటే ఏమిటి అని చెప్పలేదు sir

Ответить

Anna nii&nim ni akkada chudali plz cheppandi

Ответить

How average to be calculated.

Ответить

nim gurinchi understand kala seperate video cheyandi sir

Ответить

chala bagundi sir me voiice super sir excellent ga undi

Ответить

Bro me formula prakarmam chuste nim negative lo el auntundi bro

Ответить

@Daytradertelugu

Please tell me best website to check balance sheet and company results

Anna options trading lo loss ki futures lo loss ki difference enti

Ответить

@ Day Trader తెలుగు anna oka doubt anna

NIM concept lo average interest earning assets amte performing assets ani cheppavu but NIM value positive and high ga Vunte bank growth avuthundi ani cheppavu kaani NIM value positive and hight ga raavali amte ( as per formula) average interest earning assets entha takkuvu ga Vunte antha NIM value perguthundi anna. But interest earning assets ( performing assets) low ga Vunte bank ki loss kada anna.

Eg: 1)NII for HDFC is Rs.50

Average interest earning assets ( performing assets) for HDFC is Rs.200

NIM for HDFC : (50÷200)*100 = 25

2) NII for ICICI is Rs.50

Average interest earning assets ( performing assests) for ICICI is Rs.300

NIM for ICICI : (50÷300)*100 = 16.67

Conclusion: ekkada average interest earning assets ( denominator in formula increase ayye kodhi NIM decrease avuthundi kaani average interest earning assets (performing assets) normal ga increase ayitee banks ki manchidi kada bro. Ee doubt ni kochum twaraga explain cheyyi bro.

Anna maku aslu miru a vidhanga fundamental and technical anlysis chesi oka stock lo invest chestharo cheppandi bro

Ответить

Bro mee bagane chepthunnaru meeru yedhaithe explain chesthunnaro adhi meeru hand writing lo kakunda type chesinavi points chupunchandi bro all computerized explanation please bro

Ответить

Good bro

Ответить

👌👌👌👌👌👌👍👍👍👍👍🙏🙏🙏🙏

Ответить

Why day trader is your chanle name

Ответить

Super bro

Ответить

🙏

Nachindhi anna ❤

Anna daily వీడియోస్ చెయ్యండి... విదేశాలలో స్టాక్స్ లో invest చెయ్యవచ్చా.. ఇండియా నుంచి.... మలేషియా, సింగపూర్, కెనడా, ఇంగ్లాండ్, జపాన్ మార్కెట్ లో

చెప్పగలరు

Equity shares kuda performing assets ga chudacha ?

Ответить

Excellent bro

Ответить

Excellent revanthi garu

Ответить

👍👍👍

Ответить

Great 10k to 200k what a journey

Ответить

![6 2 STDIN STDOUT and STDERR 455] 6 2 STDIN STDOUT and STDERR 455]](https://invideo.cc/img/upload/c09RSHBrYlUwR3g.jpg)

![Update And Restore iPhone Using iPsw Firmware [MacOS Big Sur] Update And Restore iPhone Using iPsw Firmware [MacOS Big Sur]](https://invideo.cc/img/upload/b1dPdEhId2U4Tnk.jpg)