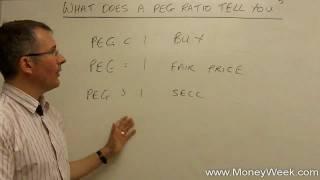

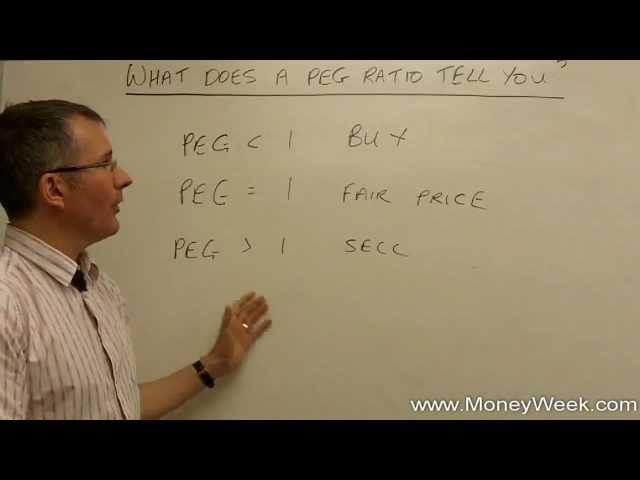

PEG ratio - what does it tell us? - MoneyWeek Investment Tutorials

Комментарии:

Ahmed Kamel - Men Sokat | Official Lyric Video - 2024 | أحمد كامل - من سكات

Ahmed Kamel - أحمد كامل

HCPLive Five at AAD 2024

HCPLive

Paid Media Pros Bloopers - February 2019

Paid Media Pros

China Unveils World’s Largest Amphibious Warship: A Global Power Shift?"

The Global Agenda U.S.🇺🇸 Focus

Marta - TOP 10 GOALS EVER

SportingBR