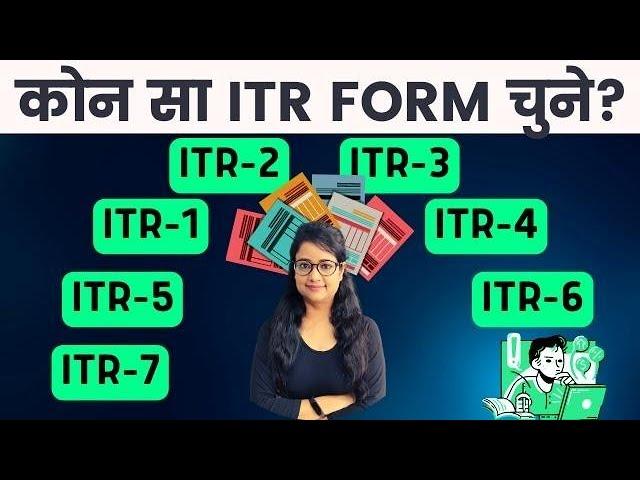

Income Tax Return filing AY 2023-24 | How to choose ITR forms | Which ITR form for Income Tax return

Комментарии:

Yemin 411. Bölüm | The Promise Season 4 Episode 411

The Promise Official

Carry-On Trailer #1 (2024)

Rotten Tomatoes Trailers

Морские дьяволы Сезон 2 (с 9 16 серии)

Film's world

OK Daily - Лучшее [224]

OK-Live-Daily

![OK Daily - Лучшее [224] OK Daily - Лучшее [224]](https://invideo.cc/img/upload/QXMwQTRnd3diZTE.jpg)