How to Analyze a Rental Property (No Calculators or Spreadsheets Needed!)

Комментарии:

Thanks, very informative.

Ответить

On 1% Rule is that total property cost including interest?

Ответить

No banks want to

loan any money to us for any property, let alone rentals that could make money. Credit score is 780! $4000 mo in disposable income too. This world is a game.

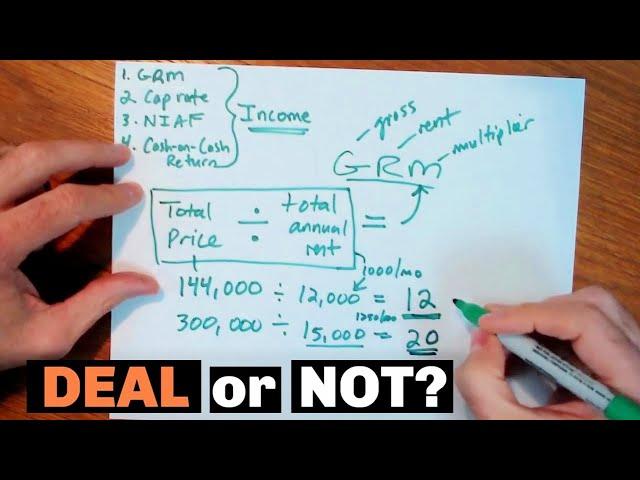

It seems to me that the GRM and the 1% rule are redundant. My logic is as follows:

The 1% rule says:

Monthly Gross Rent <= (0.01)*(Total Purchase Price).

Therefore, the "Total Annual Rent" <= 12*(monthly gross rent)

<= 12*(0.01)*(Total Purchase Price).

At that point, GRM is:

GRM = (Total Purchase Price) / (Total Annual Rent).

= (Total Purchase Price) / 12*(0.01)*(Total Purchase Price)

=8.33

Therefore, the 1% rule is the same as saying that the GRM <= 8.33

Is this true, or am I missing something?

Will this 1% rule works with the current mortgage rates, the high home rates and the low rent? Most of the profits were wiped off with the current mortgage rates

Ответить

You know what would make doing these calculations really easy and repeatable? A spreadsheet 😂

Ответить

In my opinion, house prices will continue down as people leave the state and prices correct due to market pressure. The problem with Florida is the property taxes increased based on the boom and the cost or inability to obtain homeowners insurance. Florida's in for a rough 5 years imo.

Ответить

These numbers weighs be crazy to get in New Zealand, our property market is crazy.

Ответить

Could he explain how profit or rent is effected by taxes on that income how is income rent taxed into these equations

Ответить

Just to add a little to what Coach is saying regarding the 1% rule. Your class C and D properties are often going to look like world beaters when it comes the 1% rule, often looking like 2% or better on paper. Just keep in mind the vertical appreciation isnt going to be what an A or B property is and they will require a greater percentage of your repair reserves given the lower rent range and the types of tenants. These can be good cash flowing properties just not good appreciation properties.

Ответить

Insurance, water bill, vacancies, evictions, clean up, rehabs, water heaters, roofs, No one has ever paid money owed in eviction. Forgot the word. Not in 25 years. 20 evictions easily.

Ответить

Years ago I bought a property and it's paid off but buying property today at over inflated price , nope.

Ответить

I’m teaching my daughter how to invest in real estate and this is a great tool. I have always done a quick 1% test to see where the property stacks up in the current rental market. Quick and easy. Then I move to the more in-depth review. But the ability to walk away from a bad deal is key. Thanks, great video.

Ответить

Would "Net Income After Financing" be the same as "Cash Flow?"

Ответить

SP500 dividend is < 2% but the growth far outperformed real estate over the last (lets say) 50 years. Real Estate growth was around 4-5% over that timeframe. Still could be a good option if you can get 7-8% rental income, but you also need to consider the hassle and headache of being a landlord.

Ответить

No spreadsheets needed lol

Ответить

Warren Buffet should tell that to all the analysts he has using Excel to analyze businesses for him.

Ответить

What if the rent does not cover the long payment??!

Ответить

Can you send me the cheat sheet? Great video. Very informative.. thx

Ответить

My rental is no longer 1% . Only can raise monthly 10% a year.

Ответить

Can’t trust a Clemson fan

Ответить

Unfortunately, math on paper always works well, while in real life, is somewhat different. These calculations on rent roll is not including repairs while you rent since renters do not take care of the property as well as owners, also the percentage of "vacancy" is not included in the formulas of rent roll.

The buyblow and sell high is no longer a viable opportunity in overvalued market as it is right now. Flipping properties? Good luck with that!

you can use AI now, bunch in the real estate listing and Ask Grok question easy bb

Ответить

This is a scam to promote Real Estate sales. Costs, void periods, economic downturns, non-paying renters are all ignored plus you need a big pile of cash to buy multiple properties. Retire? This is a full time, stressful job!

Ответить

obvious staff, 3rd grade math thinking

Ответить

You love to hear yourself ramble on! So much for one sheets of paper. LOL.

Ответить

You’ve been nice. But just clearly shown why the bank lender makes all of the money while you’re doing all of the hard work for them . You’re taking all of the risk but the bulk of the return goes to the lender.

1. The deposit - you earn 0% . It’s dead money. The bank makes 12% per year by investing that deposit in stocks ( average annual return since 1893)

2. The monthly bank loan payments. The bank makes 12% investing it in stocks .

3. Costs of maintenance and repair- you pay.

4. Defaults- you pay the bank .

5. Taxes- you pay

Leverage the bank is making 4*12% on the loan .

Then look at average annual loan rates + inflation + property taxes+ income taxes+ capital gains taxes over the past 25 years . Then compare to average annual house prices.

The bank doubles its money far faster than you ever will, without doing any work and watching you. What’s more it doesn’t lend you ‘ real cash’. Just digits on a spreadsheet . Thin air to them .

Finally, just remember you don’t ‘ own’ any of the properties until the loan is fully paid off. You ‘own’ a piece of paper: the Title deeds . The lender can take the property at anytime before the loan is repaid .

If you’d just invested $10,000 in Apple in 1992 from your bonus ( me) . Did nothing . Now worth $3.8 million. Property doesn’t have the same returns with 100 X the hassle.

Ответить

Been doing this for 20 years but didn't do this basic stuff ...but I was doing the same grm 5 or less is ideal in illinois, great content

Ответить

👏

Ответить

I was looking this kind of information. Thanks... very helpful 😊

Ответить

I am not in the market to rent.

But, no way would I rent for $2k/month for a $200k house.

That is a rip off.

No wonder people can no longer afford to live.

Great video ❤

Ответить

Your rules do not apply in Australia. You could not buy one property in Australia applying your 1% rule.

Ответить

Thank you so much! great video! I took notes and learned a lot. God bless you.

Ответить

When do you get to the point.

Ответить

I usually can play videos at 1.5x, although to full gather the facts, I had to keep rewinding. Thats means it was condensed and full of good info. Great job, I have heard of everything here, but never have I been able to put it all together. Thanks

Ответить

Can we get an updated videos to this. This real estate environment is very different

Ответить

Just save up and buy your first one with cash, don't finance anything. Then it won't matter and you can use the payment to save up for the second one paid in full with cash. Don't give your money to the banks in the form of interest. My brother in law has 12 rentals and he is retired. I think he works at least 20 hours a week on those rentals. Let me tell you its not passive income, and you need a soul made of coal to kick single moms and their kids out on the street when they can't pay the rent. No way could I do it, not in a million years. How about the biker gang that won't pay that you have to risk your life to evict. No way. 😮

Ответить

U talk to much get to point

Ответить

I have learned more from this single video than I have learned after watching real-estate videos across the last 8 months ( at least 50-60 videos and shorts). Thank you for this informative and super clear video. Much appreciated! -- First-Time Homebuyer

Ответить

After a few minutes of searching available properties in my market I found approximately 0 that meet the 1% criteria. Even to break even cash flow my own house required a 100k down payment.

Ответить

In Australia the rule would be 0.25 rule 😂

Ответить

Gosh..... most of the properties in vancouver bc dont come close to the 1% rule. Lol. 1 bedroom is roughly around 400k and can rent out for about 2.5k a month.

Ответить

No 190k property would rent for 2k! Lmao 5yrs ago must be wild. 190 is a fucking dump, no one's paying 2k to live in a place where 190. Dumb rule

Ответить

I don’t understand the NIAF divided by down payment. Isn’t your example 2.5% where does 33% come from?

Ответить

So.

Here is my dilemma.

I am trusting the real estate agent and she’s saying that we can get 2900 on a rental property which is below the 1% rule as the house is 320,000

The thing is when I do research the square footage for the same type of townhomes they are renting for less than 2900

This is on Zillow

I’m seeing them rent from 23 to 2600 but I’m not 100% sure because they are still listed

I’ve seen the prices drop every month rent on Zillow, which is not a good sign

The mortgage, taxes, insurance, HOA is going to come to approximately 2350 a month

I was thinking anything 200 or more than that would be good.

2900 would’ve been great

I’m pretty confused as one I do not know I can get 2900 or what I can get for rent

I’m also confused as I feel like the market here in Florida is starting to take a downward spiral

The good part is that I close in February

It was only $100 to hold the house as an incentive they have going on

So if I back out, I lose 100 bucks.

No big deal! But I am so eager to get started!

This would be me and my partners first rental property

And we want to buy two to for a year

Any suggestions?

Maybe we shouldn’t be looking in Florida as the boom of 2022 has come to an end

Texas, Tennessee, Arizona, Vegas?

I’m open to any suggestions or ideas but I want to get started

But I also keep hearing you say take your time

🎉🎉🎉

Ответить

![How To Inject LEGENDWARE V4 CRACK.DLL [LINK IN DESC] How To Inject LEGENDWARE V4 CRACK.DLL [LINK IN DESC]](https://invideo.cc/img/upload/QWYxRHRuV0NvUGg.jpg)