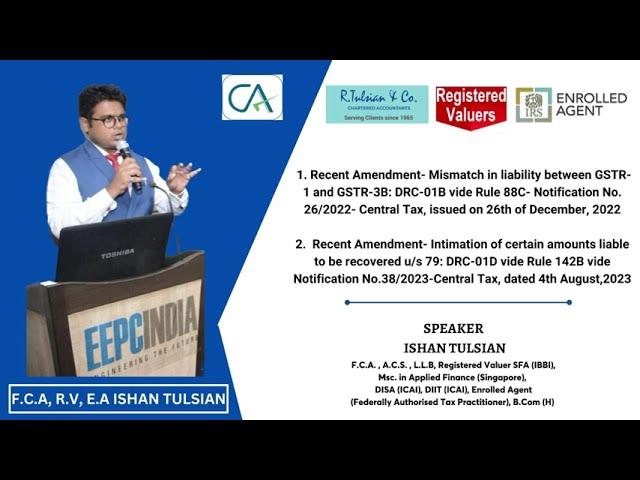

GST Amendments|DRC 01B vide Rule 88C|Liability Difference in GSTR 1 Vs GSTR 3B|DRC 01D|Ishan Tulsian

Hello Everyone,

In this informative video, FCA Ishan Tulsian breaks down few latest GST Amendments. Kindly note that GSTN has enabled Form DRC-01B vide Rule 88C on the GST Portal from 29th June, 2023, to deal with Mismatch in liability between GSTR-1 & GSTR-3B.

Furthermore, Form DRC-01D vide Rule 142B has been notified by Notification No. 38/2023- Central Tax dated 4th August, 2023 in respect of Intimation of certain amounts liable to be recovered u/s 79 of CGST Act, 2017.

Gain a comprehensive understanding of how these changes impact your business and stay up-to-date with the latest GST updates. Don't miss out on this essential knowledge to navigate the world of GST compliance effectively. Subscribe now and stay informed!

In case of any query, feel free to contact us on [email protected], [email protected] or on whatsapp No. +91 6289107303.

Kindly follow R. Tulsian & Co. LLP on Facebook, Linkedin, Instagram and Twitter for latest updates on Income Tax, GST, Companies Act, Audit, Valuation and on other professional Topics.

Regards,

Team R Tulsian

[email protected]

www.rtulsian.com

In this informative video, FCA Ishan Tulsian breaks down few latest GST Amendments. Kindly note that GSTN has enabled Form DRC-01B vide Rule 88C on the GST Portal from 29th June, 2023, to deal with Mismatch in liability between GSTR-1 & GSTR-3B.

Furthermore, Form DRC-01D vide Rule 142B has been notified by Notification No. 38/2023- Central Tax dated 4th August, 2023 in respect of Intimation of certain amounts liable to be recovered u/s 79 of CGST Act, 2017.

Gain a comprehensive understanding of how these changes impact your business and stay up-to-date with the latest GST updates. Don't miss out on this essential knowledge to navigate the world of GST compliance effectively. Subscribe now and stay informed!

In case of any query, feel free to contact us on [email protected], [email protected] or on whatsapp No. +91 6289107303.

Kindly follow R. Tulsian & Co. LLP on Facebook, Linkedin, Instagram and Twitter for latest updates on Income Tax, GST, Companies Act, Audit, Valuation and on other professional Topics.

Regards,

Team R Tulsian

[email protected]

www.rtulsian.com

Тэги:

#GST_Amendment #Liability_Mismatch #GSTR-1_and_GSTR-3B #Notification_No._26/2022-_Central_Tax #Notification_No.38/2023-Central_Tax #EEPC_India #R_Tulsian_&_Co_LLP #FCA_Ishan_TulsianКомментарии:

Сыр качотта,рикотта//Делаем ларь под зерно//

Веселое подворье

OT skills guide: Dispensing varifocals

Optometry Today

Ted Trainer

EcotopiaTV

Milwaukee PackOut Miter saw mobile bench

Brian Way - Mod My Rig - Kaizen Source

![КАК СДЕЛАТЬ ТАНЦЕВАЛЬНЫЙ ТРЕК? [КАК на РАДИО] КАК СДЕЛАТЬ ТАНЦЕВАЛЬНЫЙ ТРЕК? [КАК на РАДИО]](https://invideo.cc/img/upload/OHZjS09BUjNwY3g.jpg)

![Doraemon CM (13:35) 2002年10月5日のドラえもんCM集 (13分35秒版) [春雨さんCM集] Doraemon CM (13:35) 2002年10月5日のドラえもんCM集 (13分35秒版) [春雨さんCM集]](https://invideo.cc/img/upload/VW02dFZJX3VLWkY.jpg)