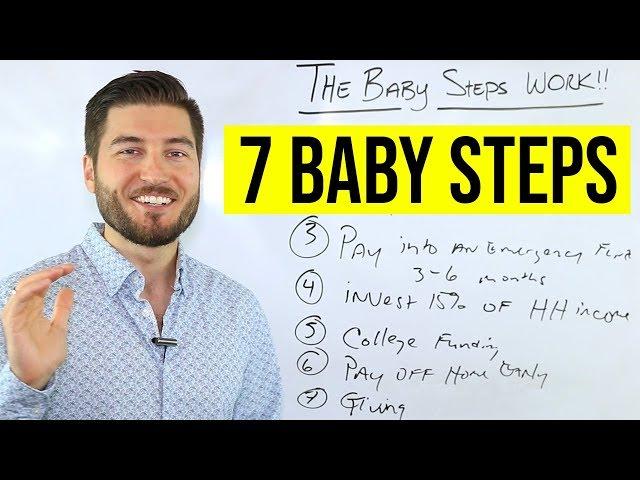

Why Dave Ramsey's 7 Baby Steps Work

Комментарии:

Do you follow the 7 baby steps? Why or why not?

Ответить

I'm not seeing anywhere where you would save any money other than step number three, and pay off your home early I don't see how that is possible in today's society with a average income.

Ответить

If I save up 3 to 6 months living expenses, that would be $15-$30,000 just sitting there which I could use to pay off my debt instead

Ответить

I think it would be a good idea to mention to people in step 2 that it’s a good idea to keep ONE credit card open, then charge small things on it (things you would spend anyway each month), then pay that card off every month so that your credit score builds up. It’s NOT a good idea to have no credit card at all as that damages your FICO score. People should be told this.

Ответить

Why would someone want to put money into a college fund if they don’t have kids? How does that benefit us financially. Please explain.

Ответить

Where do you keep the emergency fund money? Wouldn’t it be a good idea to tell people to put money into a savings account where there is a high yield? Why does nobody mention this?

Ответить

Managing money is different from accumulating wealth, and the lack of investment education in schools may explain why people struggle to maintain their financial gains. The examples you provided are relevant, and I personally benefited from the market crisis, as I embrace challenging times while others tend to avoid them. Well, at least my advisor does too, jokingly.

Ответить

should i pay off debt (step 2) before putting money into a savings or vacation fund?

Ответить

I am 52 and I am behind the 8 ball but I starting to get retirement life together

Ответить

Despite my persistent efforts to work, save, and contribute towards financial freedom and early retirement, but the economy so far since the pandemic has eaten away most of my portfolio, I'm now faced with a critical decision: should I continue investing in these unstable markets or explore alternative sectors?

Ответить

It's so weird to me, I'm from Belgium and any debt besides a single credit card (which shouldn't be more than 2k each month), mortgage and perhaps a car is very rare. Of course college/uni costs about 2k per year over here so we don't need to go into debt for that, well at least most people.

Ответить

The thousand dollars emergency fund could it be in the an Bank account

Ответить

Rule number 1, don’t ever get on debt! Never get a mortgage, invest and work with your money, stop making other banks rich, spend 10 years working like an animal by the time you’re 30, you’ll have a million dollars in cash and a house paid off and can retire at 40. Key to beat the system and become successful is not to be part of the system and the chain. Good luck.

Ответить

On what part of the baby steps do i have to save for the down payment of my house? 🤷🏽♂️

Ответить

Dave might have a deep belief in his system of money but as far as his faith goes he swears the lord's name on the radio and that's blasphemy.

Ответить

In today's day $1000 equivalent might be $20000.

Ответить

Great. Thanks.

Ответить

Its about changing ones mindset and habits. You chip away at your debts and you get an emergency fund. In doing so you have financial freedom/breathing room. Then you actually have money to invest towards retirement. A lot of people cant utilize credit cards responsibility. A lot of people take on large amounts of debt... Then you have an event like covid that happened and you have no income. Well now you lost most of what you had.

Ответить

yeah if you hit the lottery you can go to baby step 6 😆👍🏽

Ответить

Where or how I can split this funds? Different banks accounts? Betterment portfolio?

Ответить

Older video, concept hasn't changed.

Handwriting jokes (writing quickly for a video, i get it).

I keep reading your #7 as "Guns". I'm a big fan of your steps over his.

The peace of mind is what really the goal for paying iff mortgage as early as possible. You just never know when life happens. Accidents/Death. A lot of people focus on other stuff and all of a sudden life happened and they can't afford their mortgage and it's hard!

Ответить

Dave’s steps work but you will be leaving money on the table chasing eliminating debt rather than maximizing returns.

Ответить

You’re not stuck on 5 as 4, 5, and 6 are simultaneous. 4 and 5 don’t stop either so you’ve not started yet but you aren’t stuck.

Ответить

Should always be doing number 7

Ответить

I imagine these baby steps last a while because I have 30k in debt besides my house. I can't even imagine how long that will take to pay off.

Ответить

I’m 2 years old and watching finical advice videos 🙃

Ответить

You know just the casual baby step of paying off your house.

Ответить

if im in step 3 how much should I be investing into my retirement ?

Ответить

Hey, Marco I heard you mention your parents are from eastern Europe, what part of Eastern Europe your from?

Ответить

Im in the uk so investing is different step 7 confuses me tbh not sure where the million dollars or what ever it converts to comes from at the end sorry for being dim

Ответить

This is for homeowners 😒 would love steps to own a house.

Ответить

Step #1 buy your own bench!

Ответить

College is a scam, aim for affordable college

Ответить

As someone who doesn't want children, my step 5 will be to beef the emergency fund to a year of expenses. As you get older, it will be more and more difficult to get rehired after being laid off/fired. Age discrimination is absolutely real and it does take more than 6 months in a lot of cases to get hired again. 2009 was brutal to my parents and learning from that experience, it will give me extra peace of mind to have 50k in the bank that can last me even two years. Also some illnesses or injuries may take up to 6 months to get better and another 6 months to get back to working again.

Ответить

4a, Pay 5% of your income into your HSA.

Ответить

Got to get Dave Ramsey's book.

Ответить

5000 would be better for emergency fund

Ответить

The best financial advise you can give young men, is not to get married...you forgot that one.🤣🤣🤣

Ответить

Following Dave’s baby steps have panned out to be one of the smartest moves I've made financially. After I got introduced to investing by him. I’ve made good returns with expert guidance.

Ответить

Your mortgage payment minus your mortgage balance equals 15% for retirement.

Ответить

When you're wealthy😊 like me you would understand how the world revolves around money 💰

I hope you all get rich 🥰

I started to..I was working on step 3..then I had a meltdown ( old family drama) then ended up spending all the money I had saved. Not all is lost! I'm starting to see the cause of my life long self sabotage. I have started over and will be ever mindful of how I handle my emotions and other people.

Ответить

I'll continue later got to 3. Thank you.

Ответить

I think $5k emergency fund now days is more reasonable. $1k won't get ya anything really..

I won $2500 from the TX Lottery & it's going into that Savings account, then $300 a month after that. I'm 52yrs old & I've been on SSI/DI since I was 37.

My Spouse works but minimum wage & we've cancelled our $120 a monthly cable bill & $100 ext warranty on our paid off with cash cars.

Total we make $44k a year. We pay $700 rent & $280 electric bill or less..

'Come to dragons reach to discuss the ongoing hostilities like the rest of the great warriors?"

Ответить

I would seriously consider finding other options there should be more information then emergency emergency emergency wtf

Ответить

save money ,work hard to give it away ? hahah okay

Ответить

One question. With 55K in student loan debt, should this stop me from buying a starter home? I plan on pushing $1200-1300 a month to my loan and should still have enough income.

Ответить

![Lego movie 2. [2019] The Second Part. Emmet Brickowski, Wyldstyle & General Mayhen. Lego movie 2. [2019] The Second Part. Emmet Brickowski, Wyldstyle & General Mayhen.](https://invideo.cc/img/upload/Y3NhZmF4anRwMDI.jpg)