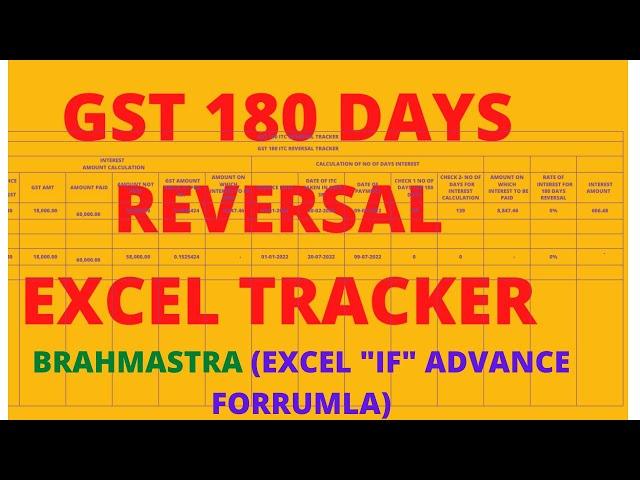

GST ITC 180 REVERSAL EXCEL TRACKER / GST ITC NOT PAID 180 DAYS REVERSAL CALCULATION IN EXCEL/IF USE

Комментарии:

Sir amount on which interest to be paid and at last again interest amount is there why two interest sir.

Ответить

Is it applicable for b to c sales

Ответить

Sir if we are paying i interest as per itc taken that is gstr3b date of filing then it is necessary to calculate 180 days from date of invoice? I am not clear for this.

Ответить

PROVIDE EXACL SHEET

Ответить

Sir, what if we have paid 100% bill amount to supplier but without gst and payment of ITC was paid after 180 days. kindly help on this issue . Is payment of invoice includes gst amount also

Ответить

sir excel sheet not able to download

please provide

SIR WE ARE NOT ABLE TO DOWNLOAD THIS EXCEL SIR, VALID EXCEL SHEET, THANK YOU SIR

Ответить

Sir if recipient doesn't pay to his supplier "gst component" bcs he has not mentioned in gstr1. Will there be any problem?

Ответить

Sir please provide excel

Ответить