Connecting the Income Statement, Balance Sheet, and Cash Flow Statement

Комментарии:

从哪里跌倒,就从哪里站起来!【大棒秀】

DaBangji 大棒记

Plastic Surgery Prof Dr Ercan Karacaoglu Abdominoplasty Abdominoplastie

Medgolife - ميدغولايف

IELTS Sınavı Nedir? Nasıl Hazırlanmalı?

aba Yurt Dışı Eğitim

Как убить Танцовщицу из холодной долины (DS3)

Egorix 1.3.2

倒數24小時-60年來競爭最烈 美總統選舉進終極決戰|搖擺州變造王者|美國人同時為世局發展揀領袖[美2024大選專輯EP07: 10-11月]

廣傳媒Media Analytica

Reverse Dame Tu Cosita

Borovak

Why It Took 13 Years to Engineer The Taco Bell Crunchwrap

Half as Interesting

Лайфхак как хранить наушники и не запутывать

DIY идеи для творчества - Tutorials Russian - Русский

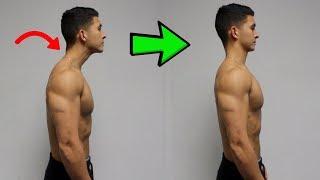

FIX Forward Head Posture! (Daily Corrective Routine)

Jeremy Ethier

![倒數24小時-60年來競爭最烈 美總統選舉進終極決戰|搖擺州變造王者|美國人同時為世局發展揀領袖[美2024大選專輯EP07: 10-11月] 倒數24小時-60年來競爭最烈 美總統選舉進終極決戰|搖擺州變造王者|美國人同時為世局發展揀領袖[美2024大選專輯EP07: 10-11月]](https://invideo.cc/img/upload/c2hUM0pMYlBoV3Q.jpg)