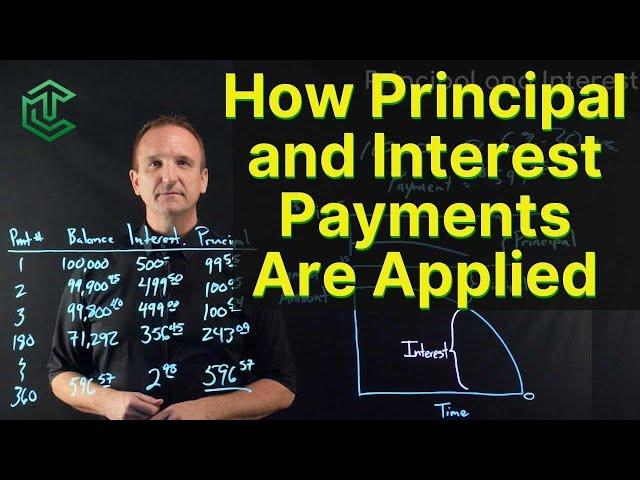

How Principal & Interest Are Applied In Loan Payments | Explained With Example

Комментарии:

What lessons or concepts would you like me to teach you? Tell me below! - Trevor

Ответить

My name is Jonas, and I want to share with you on how I got my instant loan from supreme finance with in 24hours, so if you are here looking for an online loan, reach out to them now and you will have your loan and thank me later,

Best regards.

This is the trick banks use to screw you over. That way they take "their interests" first (profit), at the very beginning when you first start to pay off your loan. That way when you want to close your loan earlier, they dont loose on any interests, so by closing your loan earlier you dont save anything.

Ответить

I wanted to see how much was the total price of the loan 😢

Ответить

So to simplify on a 30 year loan with 6 percent fixed interest rate you are 6 percent in interest of your remaining balance yearly. The monthly principal drops monthly very slowly in beginning and quicker at end of term.

Thats why they say you pay a lot of interest early in loans. They want to get more early with this conplex formula. Seems a bit scammy but all loans seem to work this way. Best thing you can do is get lowest interest rate to start and if you can manage it pay extra each month to shorten the term and save on interest.

I hate how my accounting & Finance classes couldn’t explain this concept this easy

Ответить

How to right at the mirror that way?

Ответить

How did you determine 6% interest I half a percent? What would be a fair interest/principle ratio for $370K mortgage at 7.375%?

Ответить

Well I guess if I pay off principal only that should reduce the amount of interest significantly

Ответить

Hey there, why can’t be the principal be 100,000 devided by 360 (months)? Why does the principal have to change every month?

Ответить

This finally clarifies for me why more of the payment goes to interest at the beginning. For some reason that didn't make sense to me before.

Ответить

How did he get the $599.55???? How did he calculate this amount???

Ответить

nice

Ответить

Thanks for being very clear

Ответить

this is so fucked

Ответить

How does it seem like he’s writing backwards?

Ответить

6% of 100k is only $6k . However , $599.55 a Month for 30 years equates to $215,838 . Which means it’s literally like 115% interest . If it was 6% interest you would only pay $106k total . Is anyone ever told , “ hey just so you know this is actually a 115% loan and we are telling you it a 6% loan “ . I don’t understand the interest rate thing at all … 6% of 100 is 6 . Not 215 . You end up paying $215,838 on a $100k house while being told it’s only 6% . I don’t understand how this is fair or how this works .

Ответить

Thank you! I couldn’t figure this out…your explanation was so easy to follow ❤

Ответить

6 percent of 100,000 is 6,000. So why would paying 600 a month for 12 months times 30 years cost 215,000?

Ответить

i decided not to think about this, it's so sad. i'll just think about it's a future investment and that's how bank make money

Ответить

So, out of this $100k loan, how much interest would the person have paid in the 360 months?

Ответить

Thank you so much i was over here thinking principal and interest was added ontop of your monthly payment. But thanks to you know now i know principal and intrest is then monthly payment lol

Ответить

I see

Ответить

You're so good. Your video is the only one that gives me so much clarity. Thank you so much.

Ответить

Awesomeness

Ответить

Is this included with Tax? Do you have to pay a tax along with it

Ответить

How do you calculate a payment loan of €1500M with interest 5.5% in 25 years. How much would you pay each year?

Ответить

This is a great explanation. For the consumers that are looking to make principal payments, you should do a similar video that shows the effect.

Ответить

Does this only apply to mortgages or is this the same for personal loans?

Ответить

What I’m confused about.. if it’s 6%, that would make the total loan for $106,000 but it certainly wouldn’t be like that. It would be thousand and thousand more!

Ответить

Thank you for this. I had a quick question. Why is the half percent interest $500, how did you come to that number.

Thank you again!

How did you get 599.55/month

Ответить

I’m not sure what I’m getting confused about currently but I’m doing the 6% as sort of a sales tax. In my mind I’m thinking the total would be $106,000 instead of $215,838. What part am I not understanding

Ответить

So we paid almost $80,000 in interest at the end? Almost double of what the what was borrowed.

Ответить

Great video, thank you. Banks would never tell you their actual profit strategy, they only reveal the interest rate and payment term. They also say there would be no penalties to pay off a loan earlier, but when you try to do so you get to realize that the original amount didn't change much actually, despite having made payments for a couple of years. This is what happened to me when I tried to pay off my car loan earlier. I hate such hidden strategies that are not shared with the layperson for them to understand how it works and decide whether they want to go for such a loan.

Ответить

Wow… had a question and you answered!

Ответить

Thanks for the info! Broke it down very well!

Ответить

So when you pay off that principle early what happens to the interest rate? Like if you owe 10,000 and instead of 140 a month with like 90 dollars interest, if I started paying the payment and then 500 a month on the principle, how much interest money would I be paying month to month?

Ответить

That was well put together

More of same

i would think 6% interest rate is a good deal for a 100k loan. how do you end up paying 215K?? is this a good deal? someone explain please

Ответить

Thank you so much, this gave me a perfect understanding. :)

Ответить

how long will it take 7 percent interest 30 years. $112,500 dollars 30 years. but I will pay extra $500 dollars towards the principal, can I calculate that, how long will it take to paid off, thank you

Ответить

So what is the final cost of the loan out of pocket at the end of the 30years?

Ответить

This is very useful, but you know you can slow down a bit, as it involves a lot of numbers!! And many people don’t understand numbers as fast as you do..

Ответить

So Carlton…. What complicated matrix and magic formulaic impossibility did you happen to be acquainted with that divinely provided you with the figure of $599.95????

Funny how you can calculate the NON-complicated INTEREST RATE, seeing that the complicated matrix and recondite spreadsheet macros don’t apply to it because MANUAL calculations aren’t divinely inspired.

For the sake of simplicity and rudimentary clarity.

The SIMPLE , NON-magic PRINCIPLE & INTEREST calculations are as followed:

Outstanding Unpaid Principal = $100,000.oo

Fixed Interest Rate= 0.06 aka 6%

Loan Term=360 maths…aka 30-yrs.

FIRST INTEREST PAYMENT = $500.oo

calculated as such-$100,000.oo multiplied by 6%[0.06] equals $6000.oo then divided by 12.

FIRST PRINCIPAL PAYMENT= $277.77.

calculated as such-$100,000.oo divided by 12 equals $8333.33333 then divided by the TERM OF THE LOAN…aka 30yrs..equals $277.777778.

Simple arithmetic !!!! , no magic macros, no complex calculations, no complicated formula!!!!

ALL MANUAL CALCULATIONS minus the FRAUD!!!!

Am I the only one that thinks it’s so cool how he can just write backwards with his left hand with cool neon markers?? I’m assuming he’s normally right handed? because he mostly holds with his right but switches to left to write backwards?

Ответить

This was absolutely fantastic. Dives straight into the details but still explains things so smoothly to the point anyone will get it. Thanks a bunch!

Ответить

Can you do one for auto loan ? Principal payments I've been looking can't find a good video

Ответить

Thats the problem with loans. People take the amount they borrowed and multiply it by the % of the loan. If you under pay your loan, it can even grow over time, meaning you'll never catch up. Credit card debt is deadly. Always look for max payments (some car dealerships put a cap on the amount of interest you will pay). Don't sign til you do some math or find someone to do it for you. There are good formulas for Amortization online. Once you figure out your monthly payments multiply it by the number of years/months you'll be paying that loan, find the total, and subtract the original price. This is how much you are paying in interest on TOP of that car. Then take that and divide it by the original price. Multiply by 100. That is the ACTUAL percentage you paid on top of the original price. A 6% loan over a long time can result in 50% of the original price, and the smaller the percentage you are paying off, the longer that loan will grow.

Ответить

Very good video! 👍

Ответить