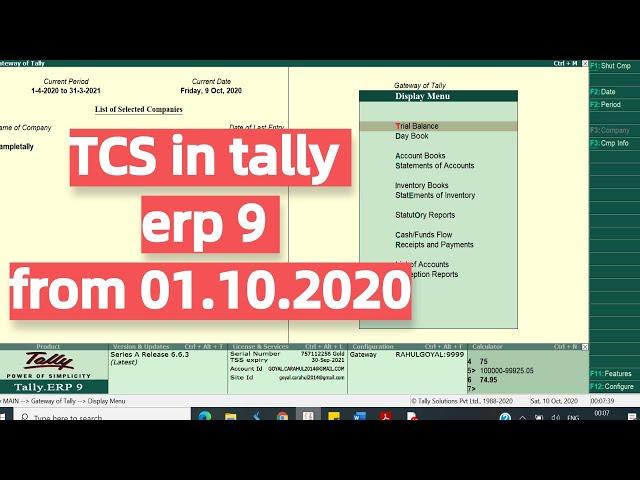

How to enable TCS on sale of goods in tally Erp 9.0 from 1st Oct 2020 | TCS in tally erp 9

Комментарии:

Sir jab voucher entry karte h to date above batata he to kabhi below of current period batata he

Ответить

Problem

Ответить

Tui akta bokchoda aktu dhere dekha te hoy

Ответить

Tcs Taxable value pr kar ta h Bhai

Ответить

Bhiya TCS purchase k bill par aa h to uska entry hum krenge ki

Ответить

Maybe Tcs payment Receive hone ke time me kata jata hai sale karne ke time pe nhi .

Ответить

Very good

Ответить

Sir wine ke kaam main c.gst or s.gst nahi lagta sirf tcs lagta hai uska calculations kaise kare please reply...

Ответить

Love u Bhai for genuine video

Ответить

While creating ledgers of SGST and CGST , will we have to take the percentage of calculation as 9% or 0% ?

Ответить

Nice video thanks sir. Ok

Ответить

Good explanation

Ответить

Explain properly

Ответить

Sir , BASIC value par tcs calculate kar rha mere system pe , TOTAL VALUE par nahi kar raha haj , please solutions dijiye..🙏🏻🙏🏻

Ответить

thqqq so much sir 🙏🙏

Ответить

Iska theory hai sir send kijie n pic please sir

Ответить

You are recording it at the time of sale of goods but it will be collected on receipt of sales consideration.

It means when we will receive sales consideration from a party above rs 50 lakh, we will collect tcs then on rs exceeding the threshold limit.

Therefore, according to me we can determine our liability on the date of receipt only not on the date of sale.

Please clarify?

Good sir 👍

Ответить

Sirji aapno vidio khubaj saras banavyo chhe parantu tame santi thi samjavo khub jadapthi n samjavo

Ответить

Hello sir last year ek party ka 206C1h apply huwa tha... Kya is saal bhi first invoice se hoga yaar after 50 lacs ka sale hone par

Ответить

Thank sir for better explain

Ответить

Help me sir

Ответить

Tq so much

Ответить

Sir mere mein credit 118.00

Dikha rha hai

Sir maine tally kiya hai sir please aapke company me mera job lagwa dijiye sir please please please please please please sir mujhe job ki jarurat hai please sir

Ответить

Thank you

Ответить

Sir aapka under galat hai eska under current assets hoga

Ответить

Sir this is wrong it is not be calculated on invoice...it will calculated in consideration of sale

Ответить

Hello sir cash bill pr auto tcs calculate ho rha jabki nhi hona chahiye

Ответить

Sir tcs taxable value pr lgta h

Ответить

Thnx RAHUL Ji,

Ответить

TCS on sale of goods applicable from 1st Oct 2020 u/s 206C(1H) is applicable on receipt of payment not on sale

Ответить

Sales bill me tan no kaise show hoga?

Ответить

Thank you so very much Sir.

It was a great help.

Already subscribed your channel

sir cartage me tcs kese add kare

Ответить

Gst amounts pe tcs nhi ktrga

Ответить

Thank you so much for this help. 👍👍💐

Ответить

Tnku

Ответить

Month end total amount per tcs entery kaise hoga tally per

Ответить

😉😉😉😉😉😉😉😂👌🏻

Ответить

Purchase and sales tcs with

Ответить

How to increase decimals of tcs value?

Its coming like 222, 227 but we want it should come like 222.20 , 227.56 etc

WE HAVE 500 stock item, any shortcut

Ответить

Me ek video dekha hu usme to ye bataye h

Me suspension me hu kon sa right ki.

Sir with pan 0.1%h aur without Pan 1% h

Ответить

Very clearly understand

Thnku u Sir

Thanks sir very helpful video

Ответить

purchase ke entry kasi legi tally me jis invoice per tcs laga ho, plz make a video.

Ответить

Thank you rahul ji

Good explain

TCS Ka purchase bill kaise receive kre

Ответить

![Warframe U22.5 Spira (Prime) Guide und Build/Moddung [Deutsch/German] Warframe U22.5 Spira (Prime) Guide und Build/Moddung [Deutsch/German]](https://invideo.cc/img/upload/WVZrU3pIODkzRjA.jpg)