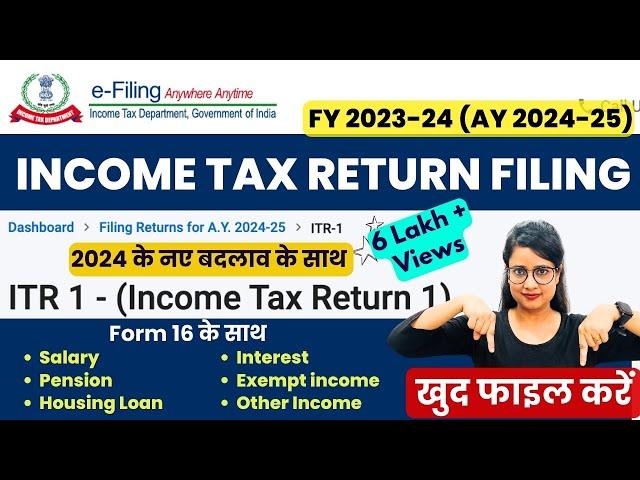

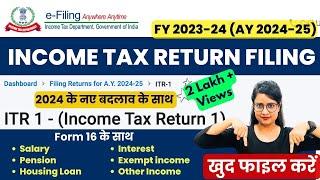

File Income Tax Return online A.Y. 2024-25 (FY 2023-24) | ITR-1 2024

Комментарии:

Mam plz upload videos in english

Ответить

Mam do you also provide services for filling ITR n how can we contact you

Ответить

@CAGuruJi why ITR 1 is disabled in my case ??

Ответить

Maim salary person h uska tax jayada deduct hua h to form 10E कैसे fill kare, sirf government employees ke liye complete process batao, और form 10E कैसे fill kare 1.5 लाख ta 2.5 लाख तक के टैक्स को refund कैसे करे, जिससे कि pura refund हो जाये

Ответить

@CAGuruJi I need help with the 80ggc option. In your video, you said it will appear later but I could not find that option. Can you show it once please?

Ответить

Ma'am ITR course ki certificate issue kartey ho kya

Ответить

Wo batao

Ответить

Army ka itr kase bhare

Ответить

Very nice and useful information

Ответить

👍👍👍👍👍

Ответить

ITR1 मे 80C &80TTB OLD Resume मे कटोती नहीं होरी हैं।बताऐ

Ответить

Ais open nahi ho raha hai

Ответить

Mam can u tell me how to file itr 23-24 AY 24-25 for a SG Pensioners

Ответить

please share 10E form

Ответить

👍

Ответить

Need video for NRI ITR file

Ответить

मैम 80TTA की छूट का लाभ कैसे लें l

Interest को पहले Income में जोड़ना है फिर बाद में माइनस करना है क्या ?

यदि ऐसा करेंगे तो छूट कहां मिला

my brother is a CG pensioner (Air Force) and SG pensioner . So what kind nature of employment I would select. please Inform me.

Ответить

Can you pl tell how to submit itr 1 for defence personnel getting disability pension

Ответить

so far no tax is deducted from me , should I still file income tax ?

Ответить

Mam how to claim dream 11 and rummy circle 4.5 lakhs

Ответить

Hello Maam !

Maam I m a central government employee...!

मेरे payslip मे NPS , salary का 10% कट जाता है और फिर government भी 14% देती है.... तो maam my question is can i file NPS 50000/- in 80 Ccd1b.... Jo mere pay slip se NPS K liye cut ho jata?

Explain pls

Mam , me Central govt employee hu mera HRA deducted ho jata hai govt quarter allotment ke liye to me u/s 80GG me deduction dikha sakta hu

Ответить

Mam, namaskar!

Exempt income per personal loan amount aur mutual fund ki withdrawal amount dal sakte hain.

Mam one of my friend has surrendered his sbi ulip policy after 8 years and he has profit of 3 lacs on his investment of 4 lacs, so will he be taxed this 3 lacs

Ответить

Interest payable on borrowed capital not allowed to fill in my case

Salaried person

very informative video

Ответить

Ma'am mera itr filing Nehi hora hai

Ответить

thanks

Ответить

very useful .....

Ответить

Mam please mention in details whether intt.on Term deposit for ₹50000.of Sr.citizens is exempted in case of new regime & standard deduction also.please mention

Ответить

Contact kar sakta hu ? muje it return karna hai

Ответить

Where to mention Amount from Mutual funds

Ответить

Ma'am kisi company ka itr kesi bare

Ответить

I love you Mam

Ответить

TechMahindra limited wala konsa nature of emoloyment choose karega Ma'am

Ответить

thank u mam

Ответить

"खुद फाइल करें" ऐसा लिखने की वजह से बहुत लोगों को आईटी की नोटिस आती है😂😂

Ответить

Madam ji paramilitary force ko jo ration money milte ha khana khane ke liye bo itr me pure exemption hote ha please reply thanks

Ответить

Services option me 26 AS ka option nahi aa raha hai

Ответить

Mem Army person ki video dal do please

Ответить

Mem me army person hu mujhe ci Allowances mila hai kis section me Deduction karna hai please btana

Ответить

Uske liye kya karna padega

Ответить

Mam mera home loan kat raha hai

Ответить

Mam can u teach us how to file for incometax exemption for st tribal

Ответить

Madam ji rajasthan government employees ka RGHS deducted hota hai...uska bhi deduction milta hai kya ITR me....pls reply

Ответить

Nice explanation mam

Ответить

ITR CLASSES KITNE KA COURSE HAI

Ответить

Mam- income tax mam 70000 kta h pr TDS m 26000 show Kr rha h ,itr 1 fill Kr rhe h to only 26000 refundable show Kr rha hai waki show nhi Kr rha please reply mam

Ответить

![Plague doctor dance [original] Plague doctor dance [original]](https://invideo.cc/img/upload/QWlfNW5FaFNpYlU.jpg)

![[Eng-Sub] BL-Series Ep1 [Part1/4] គ្រាមួយ ~ The memories [Eng-Sub] BL-Series Ep1 [Part1/4] គ្រាមួយ ~ The memories](https://invideo.cc/img/upload/d0JoWFBGVFJzMTY.jpg)