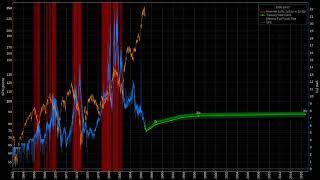

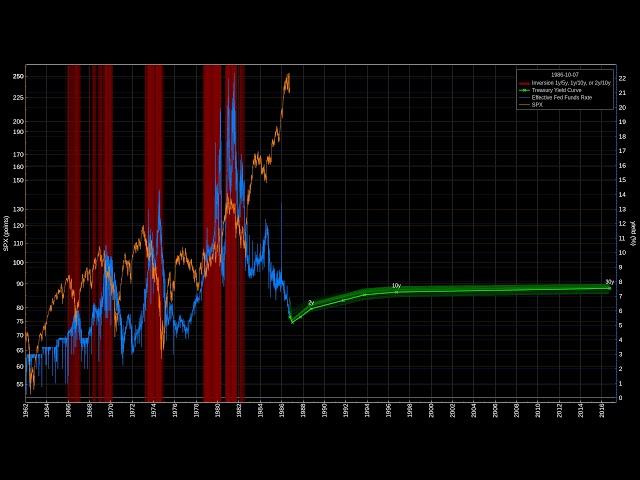

Animation of the US Treasury Yield Curve with Inversions from 1962-01-01 to 2019-04-01

The dancing green line plots the yields of all constant maturity treasury notes.

The trailing blue line shows the efficient 30 day Federal Funds rate.

The orange line is the broad stock market SPX index.

The background of each day is painted red if an inversion of the 1y/5y, 1y/10y, or 2y/10y yields occurs. The darker the red color, the greater the inversion.

Watch the yield curve and the stock market index change over the decades, notice their behaviour in times of crisis. The video ends with the current inversion around April 2019.

More about the yield curve and inversions: https://en.wikipedia.org/wiki/Yield_curve#Inverted_yield_curve

The Federal Funds rate data was taken from FRED (Federal Reserve Bank of St. Louis), series DFF: https://fred.stlouisfed.org/series/DFF

The US Treasury yields data was also taken from FRED, series DGS1MO, DGS3MO, DGS1, DGS2, DGS5, DGS7, DGS10, DGS20, DGS30, e.g. https://fred.stlouisfed.org/series/DGS30

Across the decades the various durations were sometimes not emitted, which is visible by points being added or removed from the green curve.

SPX data was taken from Stooq.com, series ^SPX.

The trailing blue line shows the efficient 30 day Federal Funds rate.

The orange line is the broad stock market SPX index.

The background of each day is painted red if an inversion of the 1y/5y, 1y/10y, or 2y/10y yields occurs. The darker the red color, the greater the inversion.

Watch the yield curve and the stock market index change over the decades, notice their behaviour in times of crisis. The video ends with the current inversion around April 2019.

More about the yield curve and inversions: https://en.wikipedia.org/wiki/Yield_curve#Inverted_yield_curve

The Federal Funds rate data was taken from FRED (Federal Reserve Bank of St. Louis), series DFF: https://fred.stlouisfed.org/series/DFF

The US Treasury yields data was also taken from FRED, series DGS1MO, DGS3MO, DGS1, DGS2, DGS5, DGS7, DGS10, DGS20, DGS30, e.g. https://fred.stlouisfed.org/series/DGS30

Across the decades the various durations were sometimes not emitted, which is visible by points being added or removed from the green curve.

SPX data was taken from Stooq.com, series ^SPX.

Тэги:

#yield_curveКомментарии:

Skatepark Wasserburg am Inn

Tom Cat Skateboarding

Нью Джерси Дэвилз - Нью Йорк Айлендерс Обзор матча 16.04.2024

NHL HOCKEY CHANNEL

BIG NEWS REVEALED! PREMIER HIRING SECURED FOR STELLAR TEAM! GOLDEN STATE WARRIORS NEWS

Warriors News Fan Update

Aşk ve Umut 91. Bölüm

Aşk ve Umut

Far Cry 5 (Part 1) My first Far Cry game!

Meghan Yeah

Чайки 2015

Kosmos 08