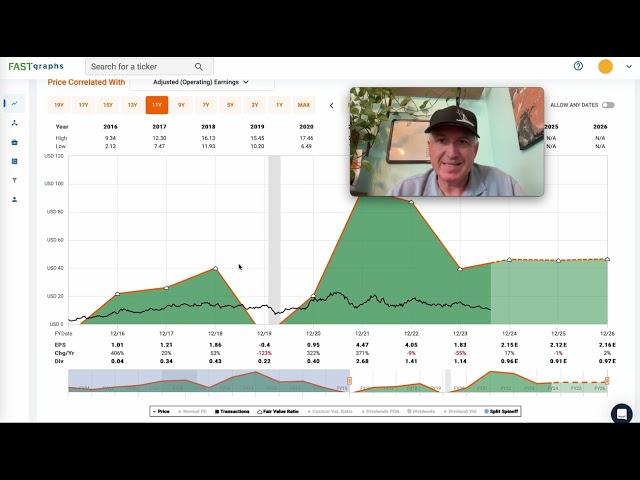

Steel Industry Stocks: Analyzing Cycles, What & When To Buy ($STLD, $VALE, $X, $RS, $NUE, $CLF)

Комментарии:

STLD is run by amazing capital allocators and owners who hold a large amount of the stock. They bought back 35% of their shares since COVID and went on an acquisition spree with high margin steel processors/fabricators. They continue to buy back a truckload of stock (5% of total outstanding LTM) with hot roll coil spot prices in the toilet. Look at X and CLF, they’re much more tied to the spot price of the commodity they produce.

Ответить

Vale is iron ore...

Ответить

i have had nucor since oct 2022. couldn't be happier with a company's funamentals. i pretty much left it alone but now see that it should have been sold at around 190. tempted to sell and buy oil.

Ответить

Too much focus on numbers and total disregard for mgmt and business quality.

Ответить

Awesome video. I appreciate the time you put into making these. Could I ask for your thoughts on Bitcoin?

Ответить

nice!

tempted to open a NUE position, but in case of recession, need more MOS...also, don't like that much cyclical with high capital invested!

Thanks for this one. I was really curious about STLD and happy that it went also into your quality list potentially for the future!

Ответить

Great video. Love these industry comparisons

Ответить

Any thoughts on Rio Tinto?

Ответить

![[ Wisadel ] Arknights Annihilation 5 - Ursus Frozen Abandoned City feat. Ifrit [ Wisadel ] Arknights Annihilation 5 - Ursus Frozen Abandoned City feat. Ifrit](https://invideo.cc/img/upload/VVdWTFJsbE5vYi0.jpg)