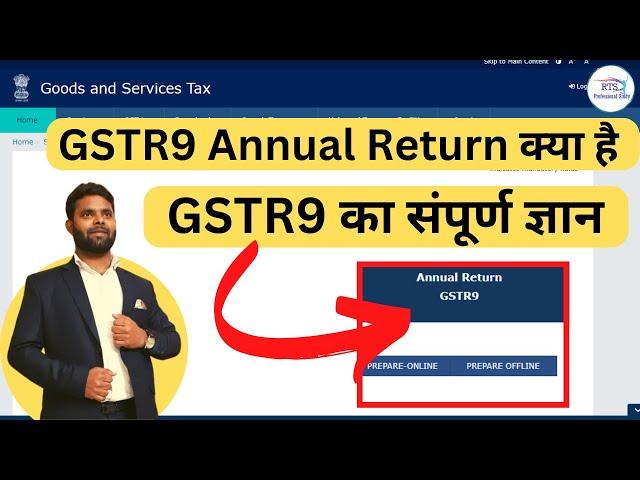

What is GSTR 9 Annual Return | What is Gstr-9 in Hindi

What is GSTR 9 Annual Return | What is Gstr-9 in Hindi

Form GSTR-9 is an annual return to be filed once for each financial year, by the registered taxpayers who were regular taxpayers, including SEZ units and SEZ developers. The taxpayers are required to furnish details of purchases, sales, input tax credit or refund claimed or demand created etc.

Topics timing

Enroll Course

Online Course-https://rtsprofessionalstudy.com/online-course/

Our Paid Service

Paid Services-https://rtsprofessionalstudy.com/our-paid-services/

Tax Sarthi's Book-https://www.amazon.in/s?i=stripbooks&rh=p_27%3ATax+Sarthi&ref=dp_byline_sr_book_1

Follow Us on

Twitter-https://twitter.com/RtsProfessional

Facebook-https://www.facebook.com/rtsprofessionalstudy

Instagram-https://www.instagram.com/rtsprofessionalstudy/

Linkedin-https://www.linkedin.com/in/rts-professional-study-093111146/

Website-https://rtsprofessionalstudy.com/

WhatsApp Group-https://chat.whatsapp.com/GHsuInhlDiuD3zXNiNMqm6

Telegram channel -https://t.me/Rtsprofessionalstudy

Tags:-

#gstr9

#annualreturn

#rtsprofessionalstudy

#whatisgstr9

search for :-

what is gstr-9c

what is gstr-9 and 9c

is it mandatory to file gstr-9

gstr-9 due date

gstr-9 limit

how to file gstr-9

gstr-9 pdf

gstr-9 format

DISCLAIMER

This video is merely a general guide meant for learning purposes only. All the instructions, references, content or documents are for educational purposes only and do not constitute a legal advice. We do not accept any liabilities whatsoever for any losses caused directly or indirectly by the use/reliance of any information contained in this video or for any conclusion of the information. Prior to acting upon this video, you're suggested to seek the advice of your financial, legal, chartered accountant, tax professional advisors as to the risks involved may be obtained and necessary due diligence, etc may be done at your end.

Form GSTR-9 is an annual return to be filed once for each financial year, by the registered taxpayers who were regular taxpayers, including SEZ units and SEZ developers. The taxpayers are required to furnish details of purchases, sales, input tax credit or refund claimed or demand created etc.

Topics timing

Enroll Course

Online Course-https://rtsprofessionalstudy.com/online-course/

Our Paid Service

Paid Services-https://rtsprofessionalstudy.com/our-paid-services/

Tax Sarthi's Book-https://www.amazon.in/s?i=stripbooks&rh=p_27%3ATax+Sarthi&ref=dp_byline_sr_book_1

Follow Us on

Twitter-https://twitter.com/RtsProfessional

Facebook-https://www.facebook.com/rtsprofessionalstudy

Instagram-https://www.instagram.com/rtsprofessionalstudy/

Linkedin-https://www.linkedin.com/in/rts-professional-study-093111146/

Website-https://rtsprofessionalstudy.com/

WhatsApp Group-https://chat.whatsapp.com/GHsuInhlDiuD3zXNiNMqm6

Telegram channel -https://t.me/Rtsprofessionalstudy

Tags:-

#gstr9

#annualreturn

#rtsprofessionalstudy

#whatisgstr9

search for :-

what is gstr-9c

what is gstr-9 and 9c

is it mandatory to file gstr-9

gstr-9 due date

gstr-9 limit

how to file gstr-9

gstr-9 pdf

gstr-9 format

DISCLAIMER

This video is merely a general guide meant for learning purposes only. All the instructions, references, content or documents are for educational purposes only and do not constitute a legal advice. We do not accept any liabilities whatsoever for any losses caused directly or indirectly by the use/reliance of any information contained in this video or for any conclusion of the information. Prior to acting upon this video, you're suggested to seek the advice of your financial, legal, chartered accountant, tax professional advisors as to the risks involved may be obtained and necessary due diligence, etc may be done at your end.

Тэги:

#Rts_professional_study #GSTR_9_Annual_Return_2021-22_|_How_to_File_GSTR_9_Annual_Return_|_Annual_Return_GSTR_9_Due_Date #GSTR_9_for_F.Y._2020-21|How_to_file_GST_Annual_Return|How_to_file_GSTR-9|GSTR-9|GST_Annual_Return #GSTR_9_Filing_for_FY_2021-22_|_Clause_wise_Analysis_with_Practical_issues #Mismatch_in_ITC_in_GSTR_9_Annual_return_what_to_do_case_study_|_GSTR_9_ITC_MISMATCH #Upload_HSN/SAC_code_in_GSTR_9_Annual_return_with_tally_prime_|_upload_hsn_code_in_gstr-9 #GSTR_9Комментарии:

What is GSTR 9 Annual Return | What is Gstr-9 in Hindi

RTS Professional Study

Free EVS Enough For Becoming Virtual Assistant?Online Earning | Basma Tahir Rana

Qasim Ali Shah Foundation

N64 Facts YOU Probably Didn't Know

Cultured Vultures

Enrique Urbizu, Goya a Mejor Dirección en 2012

Premios Goya

desafio piscina routine/ check description

Tres Da Vlogs

Yahşi Cazibe 15. Bölüm

Yahşi Cazibe

Славянское божество Перун, покровитель воинов и всего мужского рода, бог громовержец.

Andrei Hrapeichyk (YBIVASHKA)

Дешевая мышка vs дорогая - Как мышка влияет на скилл \\ Как выбрать мышку

i-Gamez | Компьютерные клубы | Константин Прохоров

Макс Корж - Жить в кайф [Official Music [HD] Video] + Текст

WHYCDE: 2DAM -Today Music

Бьянка feat. St1m - Ключи

BIANKA

COD: Modern Warfare 2 Season 3 Roadmap Reaction.

AnthonyDayTV

![Макс Корж - Жить в кайф [Official Music [HD] Video] + Текст Макс Корж - Жить в кайф [Official Music [HD] Video] + Текст](https://invideo.cc/img/upload/b2t2OHI5UHdHbkE.jpg)