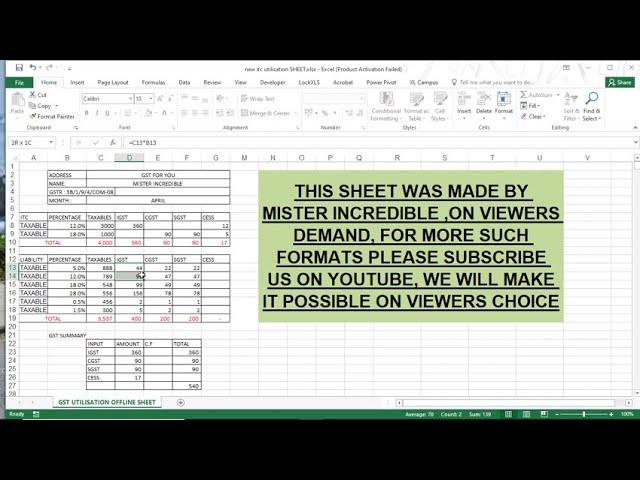

NEW (G.S.T) ITC UTILISATION SHEET (EXCEL) TOOL

Playlist for everything

https://youtube.com/playlist?list=PLefWDTv3mDQowIAnfe8UV1qMudPR36NBq #Mr. #Incredible INCEDIBLE GAMING: ITC UTILISATION SHEET TOOL NEW (EXCEL)

LINK TO DOWNLOAD https://drive.google.com/file/d/1CfAMdesW8KlJGzIejR6-T6crP3FvbsXl/view?usp=sharing

"Understanding GST: A Beginner's Guide"

"GST 101: Everything you need to know"

"GST for Small Businesses: How to Navigate the New Tax System"

"GST Compliance: Avoiding Penalties and Fines"

"GST for Freelancers and Independent Contractors"

"GST for E-commerce: How it Affects Online Sellers"

"GST Refunds: How to Claim Them and What You Need to Know"

"GST Returns: Filing and Record Keeping Tips"

"GST Input Tax Credit: How to Claim and Utilize it"

"GST Impact on Industries: How Businesses are Adapting".

"GST YouTube Title Ideas"

Sunpreet Singh

Suggest titles for GST for YouTube

"Understanding GST: A Beginner's Guide"

"GST 101: Everything you need to know"

"GST for Small Businesses: How to Navigate the New Tax System"

"GST Compliance: Avoiding Penalties and Fines"

"GST for Freelancers and Independent Contractors"

"GST for E-commerce: How it Affects Online Sellers"

"GST Refunds: How to Claim Them and What You Need to Know"

"GST Returns: Filing and Record Keeping Tips"

"GST Input Tax Credit: How to Claim and Utilize it"

"GST Impact on Industries: How Businesses are Adapting".

Sunpreet Singh

Description for it

2 / 2

"In this video, we will walk you through the basics of the Goods and Services Tax (GST) in India, including what it is, how it works, and how it affects different types of businesses. Whether you're a small business owner, freelancer, or just curious about the new tax system, this guide will provide a comprehensive overview of GST and help you navigate the changes."

"This video is designed to give you a comprehensive understanding of GST. From the definition of GST to the different GST rates, we will cover everything you need to know about GST in India. Whether you are a business owner or just someone who wants to understand the GST system better, this video will help you to stay informed."

"In this video, we will discuss GST specifically for small businesses in India. We will cover the GST registration process, compliance requirements, and how to claim input tax credit. Additionally, we will provide tips and best practices for small business owners to navigate the GST system effectively."

"GST compliance is crucial for businesses in India, as non-compliance can result in penalties and fines. In this video, we will discuss the various compliance requirements under GST and provide tips to help businesses stay compliant. We will also discuss the process for rectifying any errors or omissions in GST returns."

"Freelancers and independent contractors are also affected by GST in India. In this video, we will discuss the GST registration process for freelancers and independent contractors, compliance requirements and how to claim input tax credit. We will also provide tips on how to navigate GST as a freelancer or independent contractor."

"GST has a significant impact on e-commerce businesses in India. In this video, we will discuss how GST affects online sellers, including the registration process, compliance requirements, and how to claim input tax credit. We will also provide tips and best practices for e-commerce businesses to navigate the GST system effectively."

"GST refunds can help businesses to reduce their tax liability. In this video, we will discuss how to claim GST refunds, the documents required and the process involved in it. We will also provide tips on how to avoid common mistakes while claiming GST refunds."

"Filing GST returns can be a complex process for businesses. In this video, we will provide tips and best practices for filing GST returns, including how to keep accurate records and how to avoid common mistakes. We will also discuss the process for rectifying errors or omissions in GST returns."

"Input tax credit is one of the key features of GST in India. In this video, we will discuss how to claim input tax credit, the documents required and the process involved in it. We will also provide tips on how to utilize input tax credit effectively to reduce the overall GST liability."

"GST has had a significant impact on different industries in India. In this video, we will discuss how GST has affected various industries, including manufacturing, service, and trading sectors. We will also provide insights on how businesses are adapting to the GST system and the challenges they face."

https://youtube.com/playlist?list=PLefWDTv3mDQowIAnfe8UV1qMudPR36NBq #Mr. #Incredible INCEDIBLE GAMING: ITC UTILISATION SHEET TOOL NEW (EXCEL)

LINK TO DOWNLOAD https://drive.google.com/file/d/1CfAMdesW8KlJGzIejR6-T6crP3FvbsXl/view?usp=sharing

"Understanding GST: A Beginner's Guide"

"GST 101: Everything you need to know"

"GST for Small Businesses: How to Navigate the New Tax System"

"GST Compliance: Avoiding Penalties and Fines"

"GST for Freelancers and Independent Contractors"

"GST for E-commerce: How it Affects Online Sellers"

"GST Refunds: How to Claim Them and What You Need to Know"

"GST Returns: Filing and Record Keeping Tips"

"GST Input Tax Credit: How to Claim and Utilize it"

"GST Impact on Industries: How Businesses are Adapting".

"GST YouTube Title Ideas"

Sunpreet Singh

Suggest titles for GST for YouTube

"Understanding GST: A Beginner's Guide"

"GST 101: Everything you need to know"

"GST for Small Businesses: How to Navigate the New Tax System"

"GST Compliance: Avoiding Penalties and Fines"

"GST for Freelancers and Independent Contractors"

"GST for E-commerce: How it Affects Online Sellers"

"GST Refunds: How to Claim Them and What You Need to Know"

"GST Returns: Filing and Record Keeping Tips"

"GST Input Tax Credit: How to Claim and Utilize it"

"GST Impact on Industries: How Businesses are Adapting".

Sunpreet Singh

Description for it

2 / 2

"In this video, we will walk you through the basics of the Goods and Services Tax (GST) in India, including what it is, how it works, and how it affects different types of businesses. Whether you're a small business owner, freelancer, or just curious about the new tax system, this guide will provide a comprehensive overview of GST and help you navigate the changes."

"This video is designed to give you a comprehensive understanding of GST. From the definition of GST to the different GST rates, we will cover everything you need to know about GST in India. Whether you are a business owner or just someone who wants to understand the GST system better, this video will help you to stay informed."

"In this video, we will discuss GST specifically for small businesses in India. We will cover the GST registration process, compliance requirements, and how to claim input tax credit. Additionally, we will provide tips and best practices for small business owners to navigate the GST system effectively."

"GST compliance is crucial for businesses in India, as non-compliance can result in penalties and fines. In this video, we will discuss the various compliance requirements under GST and provide tips to help businesses stay compliant. We will also discuss the process for rectifying any errors or omissions in GST returns."

"Freelancers and independent contractors are also affected by GST in India. In this video, we will discuss the GST registration process for freelancers and independent contractors, compliance requirements and how to claim input tax credit. We will also provide tips on how to navigate GST as a freelancer or independent contractor."

"GST has a significant impact on e-commerce businesses in India. In this video, we will discuss how GST affects online sellers, including the registration process, compliance requirements, and how to claim input tax credit. We will also provide tips and best practices for e-commerce businesses to navigate the GST system effectively."

"GST refunds can help businesses to reduce their tax liability. In this video, we will discuss how to claim GST refunds, the documents required and the process involved in it. We will also provide tips on how to avoid common mistakes while claiming GST refunds."

"Filing GST returns can be a complex process for businesses. In this video, we will provide tips and best practices for filing GST returns, including how to keep accurate records and how to avoid common mistakes. We will also discuss the process for rectifying errors or omissions in GST returns."

"Input tax credit is one of the key features of GST in India. In this video, we will discuss how to claim input tax credit, the documents required and the process involved in it. We will also provide tips on how to utilize input tax credit effectively to reduce the overall GST liability."

"GST has had a significant impact on different industries in India. In this video, we will discuss how GST has affected various industries, including manufacturing, service, and trading sectors. We will also provide insights on how businesses are adapting to the GST system and the challenges they face."

Тэги:

#goods_and_services_tax #offline_tool #ITC_utilisation #ITC #input_tax_credit #GST #CarryMinati #INCREDIBLE_GAMING #GAMING #bookkeeping_practical #bookkeeping_practice_exercises #bookkeeping_practice_test #bookkeeping_practical_training #bookkeeping_practice_questions #bookkeeping_practice_set #bookkeeping_practice_software #bookkeeping_practice #management_software #bookkeeping_practice_online #bookkeeping_controls_practice #assessmentКомментарии:

PROBLEMA COM O MOTORHOME NA CHAPADA DOS VEADEIROS. T02E17.

Sete Mares Travel

Adidas Gold Pendant

MadeByHuss

Mr Bean's CAR DISASTER! | Mr Bean Funny Clips | Classic Mr Bean

Classic Mr Bean

Cubanlink Bracelet Tutorial

MadeByHuss

|SS 715| Raccordo Bettolle - Siena | parte 2 Feat. TheDriver

Giorgio Tiraboschi

Rimworld Alpha 18 | BETA PATCH | Part 101

Benjamin Magnus Games