Комментарии:

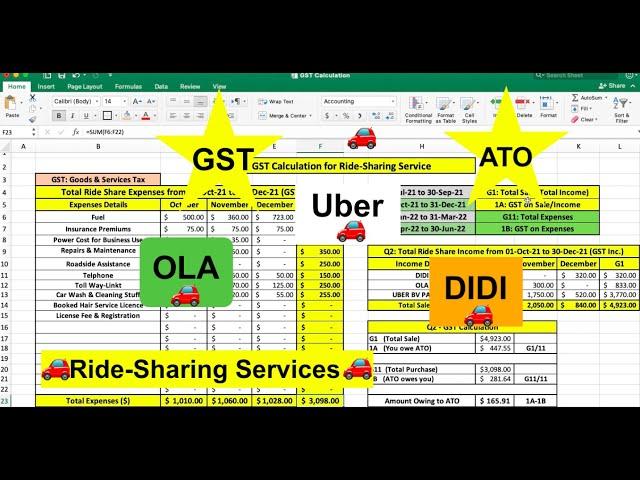

Hi @khalid, I want to know how can I include the repayments for my carloan, so I am paying 600 a month so should I include the whole amount or just a part the total monthly payment. thank you

Ответить

Hi Mate, just a quick question, how we lodge yearly income statements if earning is less than $500 for the year. It is mainly in June. Thanks

Ответить

Hey brother,

Can you please share the Excel sheet for me please.

Fuel you can show expenses

Ответить

Basically you made 1,660 for 3 months profit. How long are you driving the for a day? What about the depreciation of the car. Loan repayment if any?

Ответить

Very Helpful. Thanks

Ответить

Hi khalid

When we lodge BAS can we reduce full amonut of fuel cost or should go with 0.72 per KM?

If driven more than 5000 km per quarter what should we do?

Thanks very much brother, where could I get a copy of the excel spreadsheet. Cheers

Ответить

How are you paying only $75 for insurance premium? Every quote I get for rideshare insurance is $300+

Ответить

Very Helpful Khalid, Thank you. Can you please send me your template please.

Ответить

Is the total sales what uber put in your account or the gross amount before uber takes their fee

Ответить

Salam Aliakmon brother Khaled, thank you for your really easy and clear calculating UBER GST. We still need more from you, how I can have the Excel file to calculate my UBER GST, secondly, can you please put another video showing how we can calculate end year report. shokran

Ответить

What about the fees?

Ответить

Hi Khalid, Thank you for making such a helpful video. I have calculated my Gst based on the excel file above. Just confirming if it's ok to put the Uber earning from the bank statement?

Ответить

Very helpful video brother. Thanks so much . For this tax agents charge us minimum 70$ to 200$ for lodging BAS.

Ответить

Thanks Khaled. Could you please share the excel file in the comment part

Ответить

What a helpful video, thanks Khalid, but how can i get this excel sheet please? If you could send me much appreciate it.

Ответить

What a helpful video, thanks Khalid, but how can i get this excel sheet please? If you could send me much appreciate it.

Ответить

How come you are earning under $75000 and still paying GST ? Is it only applied to ride sharing occupation ?

Ответить

The best but the worst thank you!!

Ответить

Thanks for the helpful video, I am wondering why You divide it by 11 what is the logic?

Ответить

Thanks for your great effort //

Ответить

Power cost for business use what’s that ?

Ответить

can i get this excel file

Ответить

hey brother loved your video. can you clear me one thing my car is on finance i pay 580$ per month inc GST how to claim it back.

Ответить

can you please share the excel?

Ответить

Please make a tutorial video on doing the BAS for uber, and show options of using on trip mileage and car depreciation. Also, please show how to claim the GST paid in the cost of a new car. Thank you.

Ответить

Hi , why you do not include the Uber Service Fees and On trip Mileage under expenses without putting a value to remember deducting them in the BAS.

Ответить

Thanks for the video. I do not need to do GST calculation if I am only doing Uber for total yearly income below the GST threshold.

Ответить

Asalamalaikum brother Jazakallah khair Allah bless your family happy family together just I want to know I apply first time shall I do same please give me a solution Jazakallah this is sultan 💐💐💐💐💐💐🌹💐💐💐

Ответить

Hi Khalid, does income mean the money I receive in my bank from Uber? Or the one from tax summary?

Ответить

Hi Khalid, if I have started Uber in 1/11/2022 so I will filling my 1st GST on next quarter, which is due date in January 25th, I’m right???

Ответить

Thanks for the video. I'm working out if it is worth me doing delivery driving but this video concerned me a bit. I wonder if you can clarify if the numbers are a true representant of averages over 90 days as these numbers basically show you can only profit 27% to put in your bank and 73% runs away with expenses and GST. This seems very high costs for such little amount you get to keep in your pocket. Thanks for clarifying.

Ответить

Very helpful video, mate! Just want to know how does toll include in this calclation? I know Uber reimburse you for toll, so I am guessing that's included in the Total income as well as in the expenses?

Ответить

You are a legend. Keep shining

Ответить

Hi

Can you send me a template?

thanks for the great video , what is 11 you dividing , is that standard for every year , if not what is for 2022 thanks

Ответить

SIR I AM NO JUDGE BUT I CAN SEE YOUR FUEL EXPENSES DOESN'T MATCH YOUR INCOME RATIO . IF YOU ARE USING IMAGINARY FIGURES PLEASE CORRECT IT STILL. THANK YOU,

Ответить

can you please send me the template

Ответить

hey. Do i need to record my daily odometer readings via ato app?

Ответить

Hi. Just wondering why you didn't included Ride share service fess in your expenses

Ответить

Hello, thanks for the video very helpful full. will you please send me the excel file as well?

Ответить

Can you please send it to me? I sent you an email.

Ответить

Very helpful video thumbs up to you!

Ответить

What insurance are you with? $75 a month?

Ответить

Can you please send this to me?

Ответить

which expenses we can claim if uber eats is second job while using the same vehicle for both jobs? pls reply

Thanks

Hi Khalid could you please send me the template

Ответить

In December you earn 840 dollars but you spend 700 plus on fuel how it is possible?

Ответить