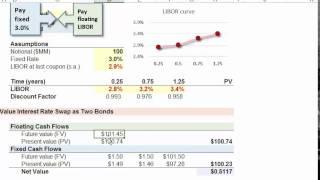

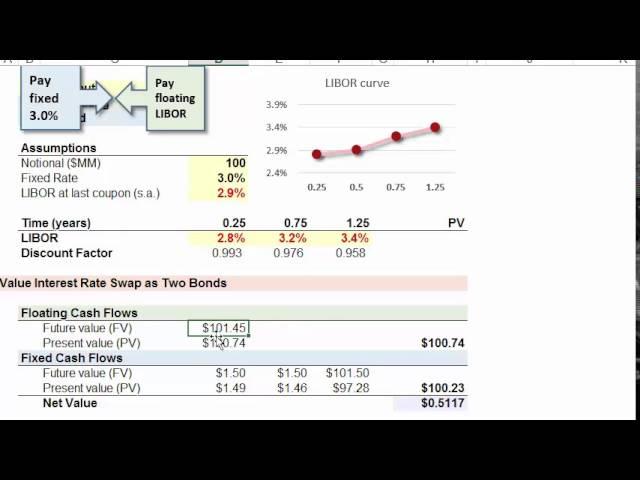

FRM: Interest rate swap (IRS) valuation: as two bonds

Комментарии:

Hi David, understood everything but the part with determining the floating rate coupons... can you elaborate on that?

Thanks for the video!

Thanks a lot David. It was really helpful! an old fan.

Ответить

could someone give me more explanation on why the floating leg becomes par after the payment (reset date)??

Ответить

Hi David! Thanks heaps for the video. It was really concise and to the point. Can you please put the excel file here as well? Cause in the other videos, sharing the excel file helped a lot. Cheers

Ответить

Hi David! I am confused with your discount factors. Can you explain please why do you use continuous compounding? It's unrealistic, isn't it? In your example there is a semiannual compounding, should not your discount factor be like 1/(1+libor/2)^(n*2)?

Ответить

Thank you David, Can you give brief clarification on how to calculate daily floating and fixed legs values?

i use to evaluate daily PnLs so i would like to know how to calculate them on a daily basis with using of LIBOR. take any of example and give me.

thanks for the video. and would you mind explain why fair price of float bond in 3 month is at par? thanks a lot again!

Ответить

I spent hours looking at the note, couldn’t figure out. But this video cleared the concept

Ответить

Excellent illustration .. do u have the valuation spreadsheet for this IRS, please?

Ответить

Can some one answer please ?

Why did we use the discount factors of the FLOATING rates to calculate the present value of the FIXED cash flows??

Thank you. I have spent hours trying to figure out how to price it and I couldn't figure out how the floating rate bond is worth only one cash flow. duh!

Ответить

thanks

Ответить

why did we use the discount factors of the FLOATING rates to calculate the present value of the FIXED cash flows??

Ответить

Thank you so much!! Very well-organized and clear. You just save my midterm-exam from getting zero!!

Ответить

Thanks for the video!

When looking on Bloomberg on a swap calculator, there is a DV01 per leg, but only one PV01. Can you discuss the differences here?

Thank you for the uploaded video.

My question is: why did you state that the floating rate bond in 3 months (that is the PV of all future cashflows by then) will be equal to the par value?

Hi David, thanks for this video!

Is there a similar one for currency swaps?

Thank you very much for the video. I am a lawyer and though as lawyers we don't need to go so deep when we deal with swaps, understanding the underlying functioning is quite useful!

Ответить