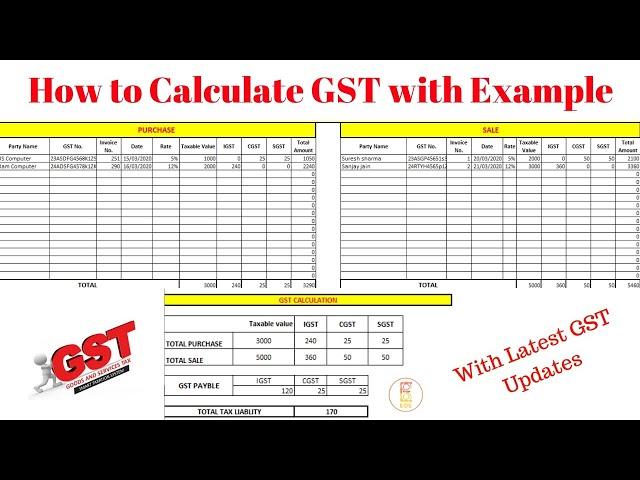

Sale Purchase | GST Calculation

Комментарии:

MERA FORMULA GALAT HO RAHA HAI TAXABLE VALUE PAY

Ответить

Thankyou for your information. After this calculation how to enter in GST portal please explain.

Ответить

Kohi stock or profit ta adjustment Nehi Mila sir

Ответить

Good bahut sahi hai

Ответить

PASSWORD

Ответить

Taxable value kya hota h tax ya bill mai jo khareed hoti hai uski ammount

Ответить

Can u share excel sheet

Ответить

Sir how can we know the amount for 5%, 18% and 28% from all the entries we have entered?

Ответить

Super explanation i clearly understand and demo ia very useful.

Ответить

Dang sa sekhao pass mai dekha kr yr kuch dekha nhi rha . Lagta h tum bs views k chakar mai aya h

Ответить

Zoom karke dekao be

Ответить

Nice

Ответить

Tanx it really helps me

Ответить

Very helpful thank u so much

Ответить

Thanku sir 🤗🤗

Ответить

Thank u bhai

Ответить

But opening ITC hoga uska kya kare

Ответить

Very helpful video for me thank you brother...

Ответить

Sir mera transport ka kaam h Maine new phone kharida to wo gst me minus hoga ya nahi

Ответить

Bohot acha samjhaya thanks video banane ke liye

Ответить

Es ko e mail Mai kase send kre

Ответить

Issame Quantity Nahin Hain . . . . . ?

Ответить

Yeh to ekdum simple calculation hai . Ap vo calculation bi samjyo jisme ek ke igst input hai output nhi hai , ya jisme igst out hai input nhi hai ya jayada hai alag alag calcution samjana chahiye tha

Ответить

Nice explanation

Ответить

Thank you Sir for this video

Ответить

Thank you sir for this video...👍

Ответить

Bahot achhe se bataya ty sir

Ответить

WELL DONE..........

Ответить

good

Ответить

And one on how to make ITR and profit loss statement

Ответить

Make one on who to open gst portal and how to fill data and file GST 3b monthly and quarterly

Ответить

Mast hey bro . 👍👍👍

Ответить

very helpful video..

Ответить

👍

Ответить

badhiya bhai

Ответить