How to fill Form 15H (English) | Save TDS on FDs | Senior Citizens | Save Tax

Комментарии:

Hello ma'am, should I upload form 15H for my father's PF Withdrawal? It exceeds 50,000

Ответить

Is it compulsory as I’ve placed an fd of 5L for 15 months and the interest is below 50k and she❤doesn’t have any income as she’s a housekeeper. So will they still deduct tds if I don’t submit the form

Ответить

Tq mam

Ответить

Please reply

Ответить

Madam agar asset year 23/24 ka income 482000 hajar bari hai toh ..mera 85000pf toh 15 g form kaise likhu

Ответить

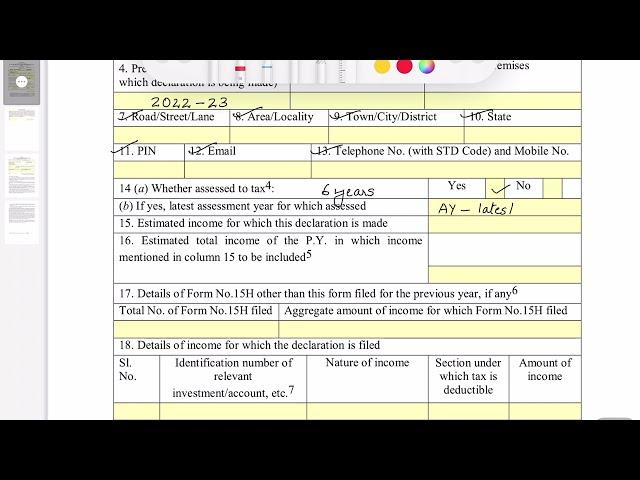

What to fill in No.15,16,17 and 18. if there's no fixed deposit? Pls reply madam

Ответить

Hello Mam,

I had a query with question 14 (a). I do file the income tax return for my parents every year, even though their income is below the taxable income slab, so do I still need to select Yes and mentioned the last income tax return file year?

In point no 18, how to add multiple Fds account no??

Ответить

Voice loud and clear simple however Like column 15 ,16 need more clarity with examples..... thanks

Ответить

I have a doubt . I made an FD of 20 lakh and interest is 1.3 lakh per year . So in column 16 do I need to add base value of 20 lakhs along with inyerest?

Ответить

Hello madam, i dont know whether youre the right person to ask the question, but should a person be filling 15h to save taxes deducted from earned fd interests which has exceeeded the limit of 40k inr earned from interest per year? How much is the maximum limit of annual income (from both salary+ fd interest) upto which no taxes will be deducted after submitting this form? Isnt it 2.5 lac/yr or not?

Ответить

Thank you so much, crystal clear ..you made my day with this simple but with clarity. May God bless you for helping senior citizens. I was thinking of seeing a tax consultant !

Let such videos keep coming.

Informative and good way of presentation.Thanks.

Ответить

Quality content. Thank you so much and god bless you

Ответить

Hi madam sequence (14 )a i am sr citizen income tax filing started 2020 onwards only what should I tick ☑️ yes or No

Ответить

Mam , form 15H contains 2 parts. Part I and part II. Should I fill both the parts.

Ответить

If I have two FD in the same bank, how many 15h forms I have to fill?

Ответить

18. Section under which tax is deductable is 194 A or 197 A. pls clarify

Ответить

Fluent English apne pale nahi padagi

Ответить

Is income mentioned in 16& amt of income in 19 same

Ответить

Hello madam, my grandfather and grandmother are senior citizen 15 lakhs in sbi and canara bank 12 lakhs for each and 10 lakhs in post office. Total 49 lakhs. Now I must do fd , please explain me

Ответить

This video is the same as all other videos. Try explaining the fact for Point 14 (a) - A person who has filed the return or a person who actually paid the tax are two different things. Normally people do file returns for claiming a refund as well and actually don't pay the TAX as they don't fall in the slab but they have to file the return for TDS claim. So the option is Yes or No for them?

Ответить

Hello madam, i am having FD of 3 lakh in a bank for period of 3 years. Total interest i earn will be of about 56k after maturity. How will i fill column 15 and 16? I have FD in other banks too, will i have to submit 15H in other banks too?

Ответить

Good Morning Madam. For what reason in the scss interest, today i received interest which was deducted so far. How can I get a refund? I need to ask in the post office . Thank you in advance.

Ответить

Hello Ma'am, one suggestion while filling up column 18.standard way to fill section is 194A not 194(a).rest all is fine.

Ответить

What is the definition of Aggregate amount of income? Suppose i filed my first 15H form in Apr22, in which estimated income was 55,000 & total estimated income was 1.5lac.

Then i file current 15H form in oct22

What should be "Aggregate amount of income for which form no. 15H filed"

What would be my estimated income in Column 15? Suppose I have an FD of 50,000 for 5 yrs and I will get 25000 as interest on maturing only. Should I enter my estimated income of 25000/- or not??

Note: I think one should enter the annual earned interest only but not total interest earned on maturity.

Hello Madam, thanks for the informative video. Just a query! My father retired on 31st June 2021. He is yet to file the ITR for the last FY (AY 22-23). So, do I need to fill up the ITR for the last FY before indicating the same in the form 15H that the latest AY to be 2022-23 for which the last ITR was filed (Point 14b)?

Ответить

thanks for the video. I have total working exp. of 6 years now and my pf amount is more than 50k. i want to apply for form 31 pf advance and pension withdrawal, do i need to fill and submit15g for tds saving?

Ответить