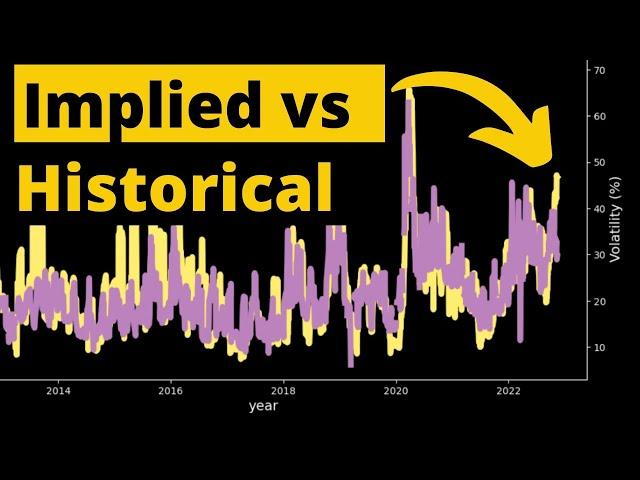

Historical vs Implied Volatility with 10yrs Options Data!

Комментарии:

Thanks for watching all, looking forward to hearing your responses to my last question of this tutorial!

Ответить

Is it possible to calculate iv in Excel sheet sir ..pls make a video on implied volatility 🎉

Ответить

Hey, do you know the best place to find monthly fundamental data for stocks, over the span of decades? For back testing. And one that takes into account survivorship vials for delisted stocks.

Ответить

I forward your question to ChatGPT4, and here is the reply:

"Yes, in a perfect world without arbitrage opportunities, the implied volatility for a call and a put with the same strike price and expiration should be the same. This property is a result of put-call parity, which is a fundamental principle in options pricing that defines a relationship between the price of European put and call options of the same class (i.e., with the same underlying asset, strike price and expiration date).

However, in the real world, slight discrepancies can occur due to factors such as bid-ask spreads, transaction costs, and liquidity issues. These differences, while typically small, can result in slightly different implied volatilities when calculated from observed market prices of put and call options.

That said, if you see a significant difference between implied volatilities of a put and a call with the same strike and expiration, it might indicate an arbitrage opportunity, a problem with the data, or a violation of some assumption of the Black-Scholes model or the conditions required for put-call parity to hold."

Hi everyone, can someone ask this important question ,please ?:

If you buy a call/put option that only has intrinsic value, then you can almost forget about Theta an IV because the option price movement will not be affected by them?

is that right? :

Theta and IV only applies to the extrinic value part and not to the intrinsic value part of the price of the option?

Else, if you buy a call/put option with both intrinsic and extrinsic value, but, the amount of intrinsic value is bigger than the extrinsic value , you can only lose money if your option ends OTM?I mean, even if end up losing all the extrinsic value, because your option ends ITM (you get right the direction of the stock movement) , still has intrinsic value (and bigger than the one it had when you bought it)

You can only lose (because of theta and IV) the extrinsic value part , not more than that?

Thanks in advance

thanks for your site with code examples

Ответить

Interesting question, but I don't have the answer! But may I suggest a topic for a futrure video. As you know the US market is now having a lot of high yield etf. It would be very interesting to be able to evaluate the risk on some of those etf that use synthetic covered call strategy: writing calls on security that the etf do not owns!😁

Ответить

Great video. Loved it ❤️

Ответить

In my intuition: Yes, in theory, they should be the same, but option prices are a product of supply and demand. Minor differences are to be expected between the two. If the difference is bigger than the spread + TC, I would say that (if the option is American,) maybe a speculation on an increase in interest rates can increase the value of a Put more than a Call. Looking forward to hearing the answer!!

Ответить

Blah blah . There is zero Alpha in this bullshit . Let's make a complex thing incredibly more complex and get buried in a never ending loop of analysis paralysis . Simplify the complexity without losing the nuance . Realised volatility is all you need unless you think you can grind out a small living trading options . Options are insurance . Not many insurance companies go broke So fair to say easiest money in options comes from selling insurance not buying it . This guy is making zero money from trading and making it from promoting things to buy where he gets a kickback . Just like he has previously mentioned the conflict of interest brokers have . This just out of uni ' expert ' has the same conflict .

Ответить

Looking forward to the next vid

Ответить

Just a guess: since the world is primarily long, puts are more often bought for tail protection, and therefore carry a volatility premium.

Ответить

Clients' life plans could be the reason of the premium difference.

(๑˙❥˙๑)

In theory they can't be different ~ otherwise there is an arbitrage between lifting the cheap and offering the rich. The difference is explained by the implied discount rate which one can infer by inverting the stock option put-call parity approximation:

C-P = S - K*(1-rt) - Dividends

(C-P+D-S)/K + 1 = rt

((C-P+D-S)/K + 1)/t = r

Once you've priced against that discount rate then the IVs should be equivalent. However market effects like a borrow squeeze can alter this. For shorter term options with smaller interest rates and small dividends this is a good approximation.