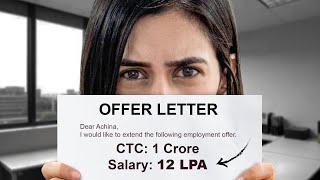

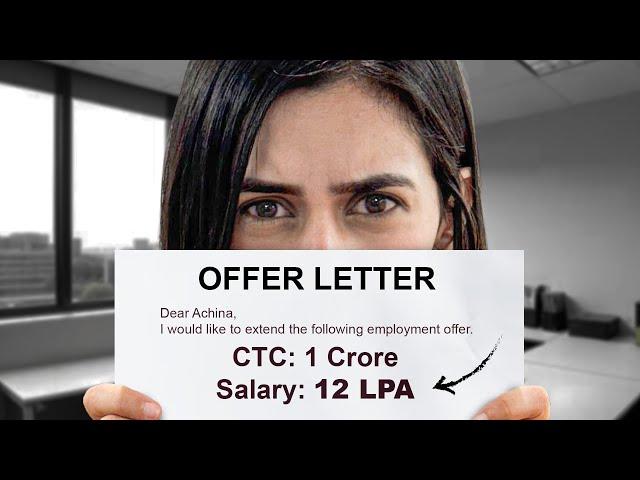

The Truth About ₹1 CRORE SALARY Package | CTC vs In-hand Explained

Комментарии:

Pro Editing without any doubt but I feel the video is slightly out of focus. Red camera always struggle with autofocus.

Ответить

Why these things for free?

It must be in course of 2000rs

Such a fresh unheard topic being discussed,

Ответить

First time learning about it.I honestly thought someone will get 25lakhs in hand 😂 Now it makes sense!

Ответить

The speaker is cute btw

Ответить

Hr is the most stupid department of any industry

Ответить

Pls make a detailed video about trading in India market and us market, forex 🤝

Ответить

I thought you are fornnier

Ответить

Clicked because her eyes are damnnn perfect

Ответить

So insightful! Thanks for the video

Ответить

A 16 yrs old here understanding corporate life

Ответить

All of this we are learning in income tax where we have a chapter named income under the head salary

Ответить

लड़की वालो को 50 lakh CTC बताने से शादी हो जाती है दीदी😅

Ответить

Afaik only service based companies and some big tech do this. Rest of them i.e good startups and quant companies which actually offer 1cr do not inflate their CTC . You would be surprised how transparent are quants about their salaries.

Ответить

Wow ma'am you are amazing.. I found your channel few days back but I should say you are ingenious ❤🎉....best and standard content

Ответить

Niggesh is totally an authentic indian name , it means an ' eyeful'

Ответить

Lopez Angela Johnson Helen Thompson Sarah

Ответить

Beggers cant be choosers.. all the reputed companies wont chnage their salary structure to suit your needs.. so forget about the negotiation.. company who might negotiate will be very small and unreputed.. so this video is not much on use for 99% of the ppl .. and u try to act pricey there will 100 ppl waiting for any opportunity they can brag at whatever salary

Ответить

I thoroughly enjoyed your content, it was truly exceptional.

But here is a little correction. On buyback of shares, Company is liable to pay tax @23.296% (20+12% surcharge + 4% HEC) and no tax liability arises in the hands of shareholders. And in case of acquisition of a company whether be it amalgamation, demerger, etc.. The capital gains tax arises only when the shareholder eventually sells the shares received as part of the swap.. So In nutshell, No Capital gain arises in the hands of shareholders as on the date of acquisition, rather it is deferred until the shares are sold by the shareholders.

Achina, your presentation is simply awesome. Good job team, eye opener for all people. Love you ❤

Ответить

Looking forward to join your organisation . Please provide mail id

Ответить

May students doing suicide because of these fake ctcs.

Ответить

❤

Ответить

Niggeshh? Really?😭😭😭😭😭😭😭😭😹

Ответить

How to speak like the way ypu speak ,your delivery is awesome

Ответить

Achina Mayya is a national treasure and must be protected from the British Museum.

Ответить

Good Explanation👍

Ответить

the first guy name "nigesh kumar"👀

Ответить

I recently got a job as a fresher(software engineer -1), but there is not much difference between base and ctc, in my case it is 11.27lpa ctc and 10 lpa as base. So, i would say, there is still some companies which doesnt care about it.

Ответить

Here's a tip for newbies: Always ask the HR to break doen your in hand remuneration. Ask them to explain every Cost To Company line. You have a right to this information. This will give you an estimate of your value and exactly how much the company is taking from you. Don't sign the offer letter until this is broken down and explained.

If the HR refuses to explain, then don't join. There is a chance that there is a hidden write off that is not explained to you. It could end up being a scam, a money laundering operation or worse, one of the horrible horror stories you hear online. You may think it may not happen to yoh and you'll probably be right. But it does happen so keep alert.

You are worth so much more than the pittance a company gives you. So keep the CTC in mind for next interview.

Thank you for the video😊

Ответить

Basic, Hra, Spe. Allowance, and reimbursement amount are good for employee as it is directly added in your account if submit bills you get tax exemption else you get cash in the wnd of quarter or year, pf contribution having option on what amount you wanted to deduct from salary, gratuity should not be part of salary package offered, if offered who can ask that money even if you left organisation in a year.

Ответить

CTC does not have a legal definition as such. So when HR says that you asked for 25lpa CTC so you cannot ask 25lpa as basic salary. Just say, from my perspective the CTC stands for my basic salary.

Ответить

Wow !!😮 🔥

Ответить

Indians need to stop working for US based companies for pennies and dimes.

Ответить

Kya naam he bhai 😂😂😂 n word bolna ka style thoda casual he 😂😂😂

Ответить

Niggesh kumar 😂

Ответить

Alright

Company name : nk securities

CTC : 1 cr+

Includes base + bonus only no stocks

First year compensation 1cr+

Role : quant

I like how people even the old gen often confuse CTC with salary in hand. Usually in the marriage market people put CTC in bio data later its known how much they actually get is quite laughable cause some parents also tax children like loans under their name,etc.

Just dropping my two cents

For a person like me whose father earns just 20,000 a month, I'm pretty sure even after deductions the per month salary would still be above 50,000 and I will be on the moon with that much per month salary.

Ответить

BASIC salary of HRA also includes dearness allowance and commission on turnover basis 😅

Ответить

Excellent

Ответить

you content is great

you deserve more popularity

❤

Ответить

I am a 2021 IIT Roorkee graduate. And this CTC vs basic/in-hand salary thing is absolutely true. It's all stocks or joining bonus or one-time bonus after a few years of working there. It's not bad but neither is it the honest truth.

Ответить