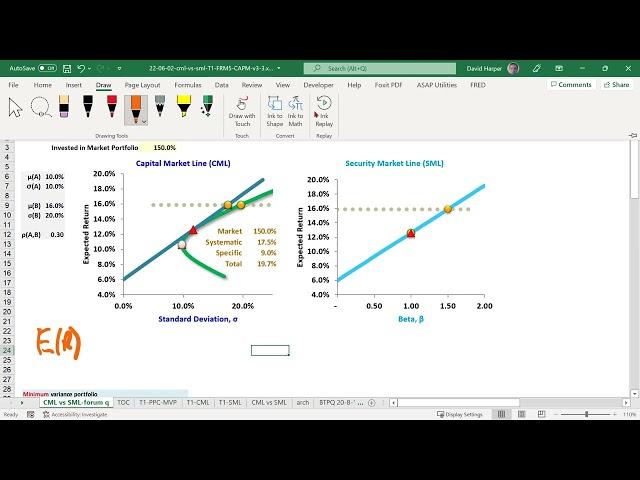

The SML is a general CML (informal FRM tip series)

Комментарии:

The SML is a general CML (informal FRM tip series)

Bionic Turtle

Розлучення. Переїзд

Іван Сайченко

CUD W ROSSMANN

Kacper Beauty Ekspert

Then and Now:ANT Farm cast

T.Y D.K

Что Вам рассказать о косметике?

ROSILAK канал о педикюре и уходе за ногами

Pete Art & Band feat. Herbert Prohaska - Whole Lotta Shakin’ Goin’ On

Mei Musikstunderl

Best Of Craziest Pranks | Just For Laughs Gags

Just For Laughs Gags