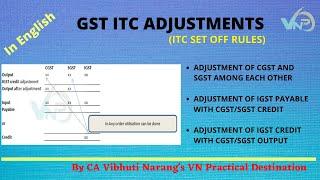

GST ADJUSTMENT RULES IN ENGLISH // GST SET-OFF RULES IN ENGLISH

Комментарии:

@sivashankar2862 - 25.12.2021 16:42

Mam request to provide class on practical oriented with live example whlie filing GSTR 3B

Ответить

@rounakkothari4542 - 06.06.2021 17:25

Maam credit wil deduct in next transactions

Ответить

@srabanibanerjee8011 - 02.03.2021 15:10

Madam I have a question. If igst payable, cgst & sgst credit balance then what will do?

Ответить

@avinashchavan360 - 23.12.2020 05:42

I filed gst3b as nil , as there was ITC to be claimed , but now in November 2020 filing it's not showing in 2A but it's showing in previous month 2A which have been filed as nill

Ответить

@shivamgupta7556 - 06.11.2020 14:41

Mem balance sheet aur profile loss kaise final karte hai accountant finalation per video banae mem ..please help me mem ..meri job fashi hai .. balance sheet finalation per video banae..

Ответить

Interesting NPCs - Yarbrough

Kris Takahashi

QUADRUPLE DOUBLE ON MANUTE BOL BUILD IN 2K24!!

landobeastman LIT

Later by Stephen King Best Audiobooks Horror Novel

Great Horror Audiobooks

An Unconventional Upgrade - Intel $5,000 Extreme Tech Upgrade

Linus Tech Tips

![Ideas for Decorating the Newest Happy Planner Guided Journal [Pride Collection 2023] Ideas for Decorating the Newest Happy Planner Guided Journal [Pride Collection 2023]](https://invideo.cc/img/upload/NExtZ3ZuU1pOanU.jpg)

![[4K] 040323 FULL BLACKPINK-Dont know what to do & LoveSick Girl ~ 2023 BORN PINK IN KUALA LUMPUR P1 [4K] 040323 FULL BLACKPINK-Dont know what to do & LoveSick Girl ~ 2023 BORN PINK IN KUALA LUMPUR P1](https://invideo.cc/img/upload/UW5LaVo0ZjdjUTU.jpg)