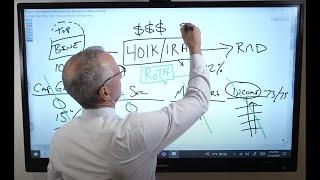

Minimizing Retirement Taxes: How To Keep More Of Your Hard-earned Money

Комментарии:

Minimizing Retirement Taxes: How To Keep More Of Your Hard-earned Money

Financial Fast Lane

Trailblazer being SMUG AF | Honkai Star Rail

Streetwise Rhapsody

Një ide e leht për SYFYR Me spinaq dhe gjize

FastRecipes Gatime Te Shpejta

[映画紹介] Netflixで話題になっている19世紀ヨーロッパ背景の不倫映画| Netflix1位新作

映画弁当 : The movie

Show Targets and Highlight Variances With REFERENCE LABELS in Power BI New Card Visual

Jason Davidson (Power BI)

Shockwave CGI top view copyright free with green screen background

Absolute JERRY Films

![[映画紹介] Netflixで話題になっている19世紀ヨーロッパ背景の不倫映画| Netflix1位新作 [映画紹介] Netflixで話題になっている19世紀ヨーロッパ背景の不倫映画| Netflix1位新作](https://invideo.cc/img/upload/QWZlTFpuZW5vd1I.jpg)