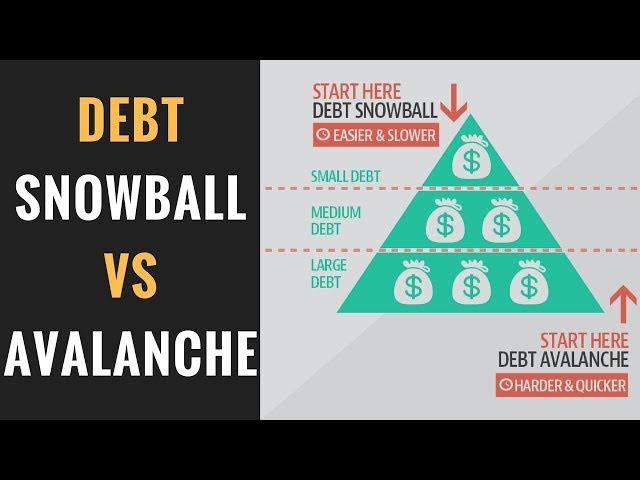

Debt Snowball Vs Debt Avalanche | Which is the Best Debt Payoff Strategy?

Комментарии:

For what it's worth - I believe your math is incorrect for the snowball method. The total time to pay off the full debt in the real world using these numbers would be 30 months and it would cost ~$7362.17 in interest. I think where you went wrong is assuming that the balances of the debts remained the same while you were paying off one debt. This is incorrect. For example - if you were making $750 payments to the credit card for 23 months (as required seeing how that's the minimum) while you were paying down the other debts, by the time you started adding extra to the payment in month 24 - the balance would only be ~$12817.79. I don't understand why you calculated the numbers this way when in reality, the balances change while you're making payments.

There are people out there who need a plan regardless if they're doing snowball or avalanche, but this may mislead people in how to carry out the plan or which to pick.

You STILL have to pay your $300 student loan payment during the 9 months you are putting that $200 of what you are saying to use the $200 syudent loan payment tpwards your car payment so you would have to earn of find an EXTRA $300

Ответить

Avalanche seems great… if you have an extra 1k laying around. For actual poor people who have maybe an extra 100 a month, snowball is much less scary and stressful, even if you end up paying more on the way. I personally use a mix of both , paying off smaller debts under 1k to free up funds and see faster results. Then I focus the extra funds on the largest interest balance to feel like I’m getting somewhere with it. Great vid!

Ответить

I started with Avalanche been doing it for 8 months have seen my interest amount to go down significantly but will switch it up to snow debt next for another 6 months then ill go back to avalanche.

Ответить

I am going to try the avalanche method for 2024. Especially with tax season coming.

Ответить

Your snowball is wrong dave always starts with credit cards first just lists the credit cards from smallest to largest

Ответить

Finally debt free, this video started my journey 4 years ago

Ответить

This is very miss leading if you don’t factor in the actual interest applied to the totals owed…

Ответить

If one pays the "minimum" payment on a debt, each month the debt grows w/ the accumulated interest. So, while focused on "snowballing" down one debt, the other debts are "snowballing" up. I always pay the interest, before the billing cycle closes. That is, pay minimum when due and pay interest before added to nexf month's balance. (ex.,$4,000 @ 29%, minimum pmt, $169, int, $109; you're only paying $60 towards principal and adding $109 to the debt.)

Ответить

Thank you

Ответить

I'm so petty when it comes to paying off debt. So the LEAST amount of interest that I can pay on any loan is the way I'm going! I don't want them (the bank) getting any more money from me then I have to give!! DEBT AVALANCHE all the way here! But I do understand the good feeling of seeing a bill drop pff (snowball method).

Ответить

I'm a debt avalanche person but that's because I am diligent and strategic with my finances. These student loans are concerning and I will have them paid off.

Ответить

All can work very well assuming you have more coming in then going out and hence there lies the problem

Ответить

Great info! Debt Avalanche is the way to go, its kind of like a reveresed investment, pay into it, forget about it and 16 months later its gone. The key is dont look at the amount owing, just know its going to pay off.

Ответить

i was in the market on a pre approval for a house for 3 months. The market is shit. I still want to buy a house but after seeing how much interest I have been paying per month on the only cc out of the 5 i have that carries a balance i decided to take 4600 of my savings and just paid the card off. It basically removed my buying power for a home but the 3 month preapproval period is nearly over. The way i figure it is the market is shit and by removing over a hundred bucks a month in interest alone i will be able to just put what i was paying a month on the card right back into savings now on top of what i was already doing which was a thousand a month. Did i make the right decision?

Ответить

Wanna know how to get out of a hole? Quit digging

Ответить

Debt snowball makes zero mathematical sense. I've never liked Dave Ramsey (for several reasons) and his debt snowball method is stupid and illogical to me. Always pay off the higher interest debt first.

The thing about emotions makes no sense to me as a logical person. Why would I be happier paying more interest and taking longer to get out of debt? Seems completely stupid.

Debt snowball if you don't have any emergency savings. Having a smaller number of minimum payments per month frees up income for emergencies

Ответить

Great video. I have a guy telling me about the Snowball, but my first argument was that I would end up paying more in interest over time. Thanks for proving I was right! ha ha. I will take the avalanche method. This saves time and saves money.

Ответить

If you're looking at math alone, if you can get a very low interest consolidation loan, then pay that off, it would be the most mathematically efficient. It has a high failure rate, though.

Ответить

The best debt payoff strategy is the one you start and ultimately complete. Adherence is key. Anything else leaves you in debt. It doesn't have to be debt snowball, and it doesn't have to be avalanche. It could be a homebrewed cockamamie approach that only you can stick to. If you're ultimately successful, that's what matters. In the end, debt-free is debt-free.

Ответить

I'm using both with my own twist.

Ответить

what about the cash flow index method?

Ответить

For me seeing less and less bills motivate me to keeping going 💪🏾 knock out one at a time.

Ответить

I use the shock and awe method

Ответить

just perfect. i finally found the info i needed to make my plan

Ответить

I used the snowball method and now I'm down to just student loans. It definitely felt like the best option. It also freed up money very quickly

Ответить

Loved how you used your chart!

Ответить

“Selling so many things that’s the kids think they’re next” 😭😭😂😂

Ответить

Similarly I do the biggest payment first I don't really think about the interest rate I just take out the biggest payment. But that was Once upon a Time 🙂

Ответить

With the snowball, if you listen to testimonials, I noticed that as people made more progress they upped their intensity - working more hours, selling more things. It’s really incredible the amount of psychology.

And don’t forget! After you pay off that debt, keep that intensity going to save a bunch of money - that’s where we went wrong lol…

"For the sake of simplicity, I'll fuck up the maths by not including interest/payments so i dont actually tell you accurate time frames between the two" literally just do the maths correctly, wtf?

Ответить

Holy crap it makes a difference. Very glad to see a video that does the math. I may do things in a hybrid method — do the INTEREST-BEARING debts first (credit cards), then the INTEREST-FREE debts (iPad on Verizon, paying back some money my parents loaned me, etc) — do the interest-bearing first from smallest starting balance to largest starting balance. That gives you some of the snowball psychological benefits and then also is faster and way cheaper — I’m getting over $110 added per month just in interest on my two former-credit-card balances.

Ответить

I personally think that something often unaccounted for in this debate is that it doesn't take into account outside events. For instance, I think a benefit of the debt snowball method is you free up the number of minimum payments. As you do this, more money is available to you per month. In the event of some unforeseen payment, you can allocated money towards that rather than paying off debt that month but you are still able to make the minimum payments on the remaining debt. If you use the debt avalanche method, (at least in the beginning), this may not be the case. It only works in this situation if you are able to free up money from interest. But then you still have minimum payments to make each month on the low interest ones. In the end, I think it's preference.

Ответить

I think you have to write out the interest saved each month versus the debt snowball and that will be the constant motivator. And using a hybrid for the cheaper ones under $2000 would be super useful.

Ответить

Thanks for sharing this video ...I truly can't wait to get out of debt!!!!

Ответить

With snowball, I paid off an account with zero interest and it made no sense (I had a 25% debt as well), but it really helped motivate me. I have held off on paying down my phones (0 interest, and the next debt up is more angering, but it would be nice to get another easy win.

Ответить

The debt avalanche is the one for me. I want to kill that debt ASAP.

Ответить

I would love to say I could do the debt avalanche, however I know myself and how I am and I have been using the debt snowball method lately and that is what is working best for me.

Ответить

I've been looking for this kind of video to see what the breakdown would be. Thank you

Ответить

Your expense number is way off, housing , utilities , groceries , car repairs , health insurance , auto insurance , the list goes on and on. Maybe their tax liability could be a little less. That's why there is 25,000 in CC debit , they can barely get by.

Ответить

Best way to pay off debt. Pay it to zero. Close the account. Bye Felicia.

Ответить

The math is not the problem. Emotions and spending habits are the problem. Expenses are high, income is low and you have to look at extra money as "not yours but their debt payments, already." This is also part of what makes Dave Ramsey sound foolish. First, many many people will never ever pay off their student loan debts. When you leave a doctorate with a quarter mil you are never paying that off.

Ответить

Found this dude,(👆👆Lamo081)he was able to get my account funded in few hours,he’s legit

Ответить

I don't get it. You see a HUGE progress with the Avalanche method. Every month that you lower your deficit on the credit card you SEE the interest payments getting lower and lower over time. It's not something that only happens at the end. It's not static. The higher the interest, the more you see it.

On the other hand the snowball approach gives you very little progress month after month (assuming you started with low IR debt like in this example). Sure, the number of different debts you have gets smaller, but they still cost you about the same. How is that progress?

When people say they see progress faster with the snowball, they're no th think of their actuall balance goi down every month. That IS progress, so I would do the avalanche and save a lot more money.

Ответить

I'm working on figuring out not necessarily interest rate, but interest in a dollar amount.

This take periodic re-evaluation because at some point you are shifting which debt you are paying.

When I had credit card debt I transferred the balance to a new card which had 0% interest for 1 year and cut up the cards so I couldn't use them. Then when the 0% interest period was nearly up I switched to another card. It took me 2 years to pay off a £10,000 debt by doing this. If I had not switched the cards then the amount I owed would have kept going up due to the interest. There are not as many 0% credit cards as their used to be but switching to one which has a lower interest rate also works. Since paying off the credit card I have never had another one.

Ответить

Don't pay anything

Ответить

If you had the will power for to do the high interest first, then put simply you would not be in debt to start with !

Ответить

![How To Fix Intel HAXM Is Required To Run This AVD In Android Studio[ASUS TUF GAMING] How To Fix Intel HAXM Is Required To Run This AVD In Android Studio[ASUS TUF GAMING]](https://invideo.cc/img/upload/QTdxdG55b3Y3QzU.jpg)

![r/MadLads Funny Posts [5] r/MadLads Funny Posts [5]](https://invideo.cc/img/upload/b1B4LUpHZHhXVWY.jpg)