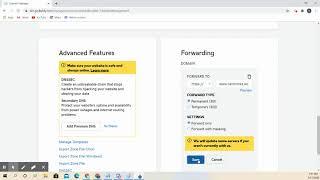

GSTN Official Guide on GST Practitioner's accepting/rejecting engagement requests made by Taxpayers

Комментарии:

I registered for GST Practitioner, and after 1 year it showing pending for approval please anyone help me with this issue

Ответить

I Have the GST Practitioner ID and Passward but how to add Party in this

Ответить

Thank u sir. It was very helpful.

Ответить

sir , i have enrolled on 25/09/2018 but still in my membership type it shows NA. what can i do now

please reply......................

any return filing for gst practitioner

Ответить

Thank you.

Ответить

आप ये मेल हिन्दी में क्यों नहीं भेजते हो इगलिस हमें समझ में नहीं आती हैं जीएसटी की सारी सुचना हिन्दी में भी मिलती रहे तो हमारा महिने का 2000 बस जायेगा

Ответить

I have applied for GST practicener in the month of August 2017 but still not received any response could you please let me know further details

Ответить

There is a difficulty in filling GSTR 1 as we are feeding GSTIN of local dealer , even though it is showing IGST and from whom i have purchased, they are facing difficulty in filling there GSTR1

Ответить

Kindly made video on change of email id and mobile number of authorised signatory. Currently system is not changing after even ARN number. When we change lawyer or accountant we depend for EVC OTP on them . 95%cases number remains of lawyer. Kindly provide addhar based mobile OTP generation facilty to file GST return.

Ответить