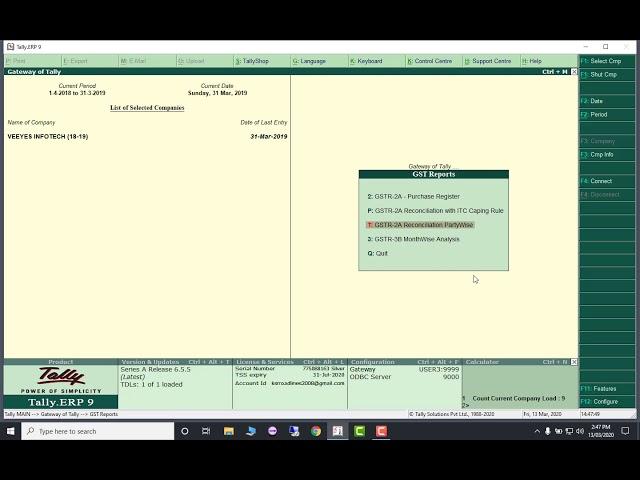

GSTR2 status on your Outstanding Report in Tally.ERP 9

Rs.3600 only

Speak (Mr.vinoth .7200044055.English & Tamil) (Mr.Sharath .8801830567. Hindi & Telugu)

This addon very useful for all Tally.ERP9 users like Tax Practitioners & Auditors

Go to www.veeyesinfotech.com....pay online...give your details...

If you need Bill Please provide Below Details:

-----------------------------------------------------------------------

1.Tally serial no 2.Company Name 3. Gstin No 4.Contact no 5. email id

for any clarification please call to us

---------------------------------------------------------------------------------------------------------------------------

Bank Details:

---------------------

VEEYES INFOTECH

Account No. 50200047956741

IFSC code: HDFC0000166

HDFC Bank, 2nd Line Beach, Chennai-600001

--------------------------------------------------------------------------------------------------------------------------------------------------------------

tally

tally.erp

tally.erp9

tally.erp 9

tally erp9

tally erp 9

Tally

Tally.erp

Tally.erp9

Tally.erp 9

Tally erp9

Tally erp 9

TALLY

TALLY.ERP9

TALLY.ERP 9

TALLY ERP

TALLY ERP9

TALLY ERP 9

tally erp 9 release 4 5 6 4.5.6

tally erp 9 rel 4 5 6 4.5.6

tally erp 9 rel 6.5.4

tally erp 9 rel 6.5.5

GSTR-2 Return Filing with Tally ERP 9 Release 6.2, In Tally ERP 9 Release 6.2, you can do automatic reconciliation of invoices in GSTR-2. Learn How to File GSTR-2 Using Tally.ERP 9 Release 6.2, It is a simple but comprehensive process that allows you to load the JSON file, reconcile all the invoices instantly or one by one, and create a JSON file for upload to the GST portal. Explain all steps to Reconciliation & invoice matching for GSTR-2 in Tally.

GSTR-2 is the monthly GST return to be filed by taxable person registered under GST. GSTR-2 will include the details of all inward supplies made in the given period. In the standard format released by the department, In Tally.ERP 9, GSTR-2 can be viewed in a report format with tax computation details. This report can be changed to table-wise format.

All transactions, whether recorded correctly, incorrectly or inadequately, are captured and categorised in this report. Further, to help you verify the tax details before exporting the returns, the GSTR-2 report in Tally.ERP 9 provides you with options to resolve exceptions in transactions that are not forming part of the returns due to incomplete information or mismatch.

The report also enables you to update the status of each transaction in the return based on the acceptance and reconciliation status of the transaction on GSTN portal using the Status Reconciliation option. It is Full Step by Step Tally GST Tutorial in Hindi. It is a Part of RSCFA Course run by Career Planet. Tally GST Tutorial for Beginners. This Tally ERP 9 Video Tutorial Based on Advance, Professional, expert Tally courses for GST Accounting in Tally.

Speak (Mr.vinoth .7200044055.English & Tamil) (Mr.Sharath .8801830567. Hindi & Telugu)

This addon very useful for all Tally.ERP9 users like Tax Practitioners & Auditors

Go to www.veeyesinfotech.com....pay online...give your details...

If you need Bill Please provide Below Details:

-----------------------------------------------------------------------

1.Tally serial no 2.Company Name 3. Gstin No 4.Contact no 5. email id

for any clarification please call to us

---------------------------------------------------------------------------------------------------------------------------

Bank Details:

---------------------

VEEYES INFOTECH

Account No. 50200047956741

IFSC code: HDFC0000166

HDFC Bank, 2nd Line Beach, Chennai-600001

--------------------------------------------------------------------------------------------------------------------------------------------------------------

tally

tally.erp

tally.erp9

tally.erp 9

tally erp9

tally erp 9

Tally

Tally.erp

Tally.erp9

Tally.erp 9

Tally erp9

Tally erp 9

TALLY

TALLY.ERP9

TALLY.ERP 9

TALLY ERP

TALLY ERP9

TALLY ERP 9

tally erp 9 release 4 5 6 4.5.6

tally erp 9 rel 4 5 6 4.5.6

tally erp 9 rel 6.5.4

tally erp 9 rel 6.5.5

GSTR-2 Return Filing with Tally ERP 9 Release 6.2, In Tally ERP 9 Release 6.2, you can do automatic reconciliation of invoices in GSTR-2. Learn How to File GSTR-2 Using Tally.ERP 9 Release 6.2, It is a simple but comprehensive process that allows you to load the JSON file, reconcile all the invoices instantly or one by one, and create a JSON file for upload to the GST portal. Explain all steps to Reconciliation & invoice matching for GSTR-2 in Tally.

GSTR-2 is the monthly GST return to be filed by taxable person registered under GST. GSTR-2 will include the details of all inward supplies made in the given period. In the standard format released by the department, In Tally.ERP 9, GSTR-2 can be viewed in a report format with tax computation details. This report can be changed to table-wise format.

All transactions, whether recorded correctly, incorrectly or inadequately, are captured and categorised in this report. Further, to help you verify the tax details before exporting the returns, the GSTR-2 report in Tally.ERP 9 provides you with options to resolve exceptions in transactions that are not forming part of the returns due to incomplete information or mismatch.

The report also enables you to update the status of each transaction in the return based on the acceptance and reconciliation status of the transaction on GSTN portal using the Status Reconciliation option. It is Full Step by Step Tally GST Tutorial in Hindi. It is a Part of RSCFA Course run by Career Planet. Tally GST Tutorial for Beginners. This Tally ERP 9 Video Tutorial Based on Advance, Professional, expert Tally courses for GST Accounting in Tally.

Тэги:

#gstr2a_status_on_tally_outstanding_reportКомментарии:

GSTR2 status on your Outstanding Report in Tally.ERP 9

VEEYES INFOTECH Tally Certified Partner

A.M.G K.King Beni Maniaci - Go Hard Like Vladimir Putin (Official Video) #putin

Architects Music Group

HOW TO CHANGE LANGUAGE IN MX PLAYER

SMART RILE

Health Bar Unity Tutorial in 7 Minutes | DevLog 5

BlackCitadel Studios