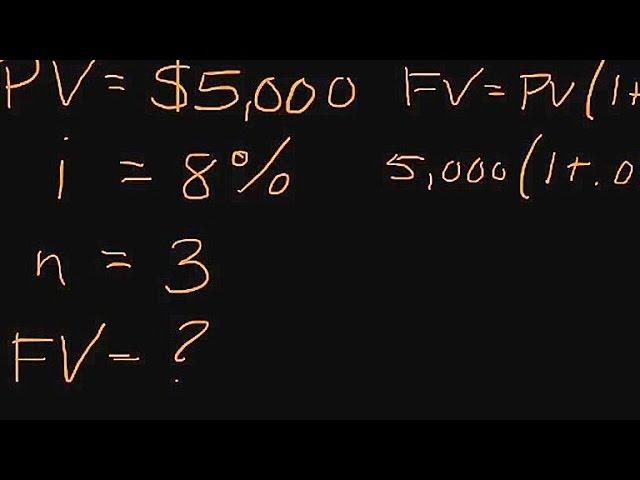

How to Calculate the Future Value of a Lump Sum Investment | Episode 38

Комментарии:

Thanks

Ответить

Thanks for the short detailed video!😊

Ответить

How 1.2597 comes, better you do it manually

Ответить

Great video and information. I basically hate anything that are related to calculation. But im taking my degree now and i need to take financial management class. This video really helped me a lot.

Ответить

Thank you.

Ответить

How about if the PV is 1 dollar?

Ответить

Hi, I plugged in these numbers into excel with the FV calculations and I got $6,351.19. Not sute why there is a difference...

Ответить

Bro for 3 year fV 1.36048896.

Ответить

who else here listens to da baby

Ответить

why you always do it with years TT_TT , can you explain how to do it with days? please..

Ответить

Monthly interest: 100$

Yearly interest: 0.05

Number of year: 5

FV=?

8%=0.08?or 0.8

Ответить

FYI interest rate is usually denoted as r

Ответить

great but I couldn't get the right calculation for the (1+i )over the next can you tell me how to do that I have a professional calculator

Ответить

what if you have everything but the interest rate what do i do?

Ответить

How do solve for i?

Ответить

Not to my knowledge. You'd almost have to treat the problem like two separate problems. The first thing you need to know is how frequently does interest compound. Depending upon the level of detail expected, you may even develop a amortization schedule, but you would need to know the loan maturity date for that. After doing this you can determine the remaining balance of the loan after three years of paying $300 towards the loan. Hope this helps.

Ответить

One more quick question is there a formula for a question like this.. A couple borrow $1000 to furnish their new home. They have to pay interest of 18% on this amount If they repay $300 at the end of each year, how much do they owe at the end of the third year of the loan? is there a formula to work out the third year of the loan amout? Thanks

Ответить

Thanks for the Quick reply.. Not very familiar with the formula, but will learn and try it out.. Thanks once again for your help

Ответить

Unfortunately I only have a financial calculator so I can't complete the calculations. However, with interest compounding daily it would be approximately 6.7 years. So your response should be somewhere around that figure. Good luck!

Ответить

Compounding continuously works a little differently since it is being earned constantly as opposed to monthly, quarterly, or annually. I'm assuming you're being taught the PERT formula (like the shampoo), which is A = Pe^rt. P represents your principle, A represents your future value, r represents your interest rate in decimal form, and t represents the number of years. You would solve for t since you're trying to find the number of years. You'll need to use logarithms to undo the exponent.

Ответить

Hi Great Videos.. Thanks so much.. wonder if you could help with a question eg. If $500 is invested at 7% compounded continuously, how long would it take for the value of the investment to reach $800 thanks how would this be calculated.. thanks

Ответить

Great video!

Ответить