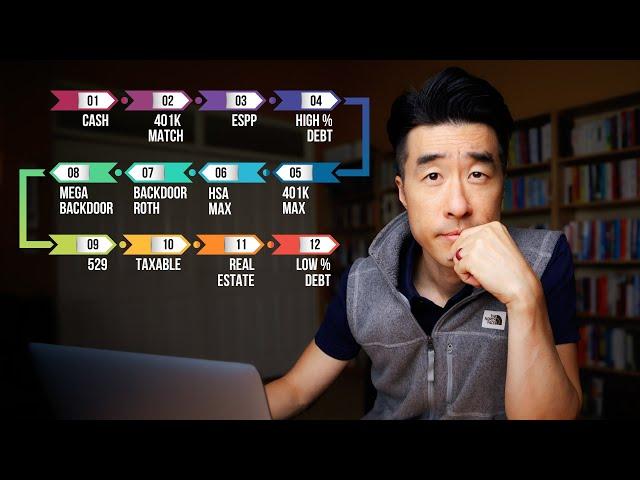

Ideal Order Of Investing For High Income Earners

Комментарии:

May I know for which is better? ETF or Mutual Fund? Too new to this..

Ответить

I anticipate positive growth in the markets for 2024, and I'm considering investing $220k in stocks for my retirement plan due to recent rate cuts. Could you provide guidance on executing this investment safely? Additionally, are there any crucial tips or changes I should be mindful of in the current financial landscape?

Ответить

If you are not a super high-income earner, more like 80-100k annual, would most of this still advice apply except for the backdoor Roth/mega backdoor Roth? Is there something you would do different? Just max the standard Roth contributions?

Ответить

Number one place to invest your money... Bitcoin. This guy is a dinosaur.

Ответить

Brilliant video, subscribing for more!!

Ответить

My spouse and I are adding a variety of stocks/ETF to my present holdings for the long term, We've set aside $250k to start following inflation-indexed bonds and stocks of companies with solid cash flows, I believe it is a good time to capitalize on the market for long-term gains, but it wouldn't hurt to know means of actualizing short term profit.

Ответить

!remindMe in 20 years

Ответить

Where does life insurance fit in this plan?

Ответить

I went from making $30k a year to $145k a year and although I already knew some stuff that were mentioned here, I was able to learn a few new ones such as the triple tax benefit an HSA account has (I didn't know about this). Really good video Tae! Thank you

Ответить

How does this differ for average or normal income earners?

Ответить

I’m considering whether to retain $3 million in single-family rentals, we have $900,000 left on mortgages. What is the possibility of maintaining $70,000 annual income by selling and investing in stocks and bonds?

Ответить

Regarding ESPP, what if my company only give a 5% discount on the stock?

Ответить

I will say... Our HSA is a fantastic benefit. We have had one for like 5 years now, i got it as soon as it was sn option for me. Wow, it is epic.

Ответить

I'm considering investing around $700,000 in stocks as I've learned that savvy investors can still profit during challenging times. Do you have any solid stock market strategies for this year?

Ответить

Do you include 12 months of cash with a mortgage? Thata a lot of cash on hand.

Ответить

You should mention treasury bills during inflation periods. Very good return rates.

Ответить

Any thoughts on where high interest savings accounts fit in to all of this?

Ответить

2024 if filing jointly max allowed salary is 230k to do a Roth Ira.

Ответить

What about whole life insurance?

Ответить

why not mention bonds or bills? or TIPS and this other government vehicle which may have tax advantages when used for education as well. Not to be that guy, ik u cant cover everything, but im just curious if there was a specific reason why you havent mentioned bonds?

Ответить

Wrong advise on VNQ. S&P 500 grew to 319% compared to VNQ 69% (for the life of VNQ starting at 2005).

Ответить

Excellent video!

Please do one explaining the Mega Backdoor IRA 😀

You explain concepts extremely well, so this will be very valuable to us

My ESPP is truly one of my favorite things I have ever had access too. A built in savings plan with automatic 33% returns. Sell when it's inflated and invest into an index, unbeatable. ESPP also helped me save for a down payment on my first house.

Ответить

I think it would be helpful if you gave out examples of what you consider "high income" or " high interest", since these terms are all relative and very general.

Ответить

i believe HSA funds can also be taken out for non medical expenses after retirement age

Ответить

By the time you get to your taxable investments what do you think the ideal index fund/REIT ratio would be if you don't want to operate real estate

Ответить

I would say REITs are a poor choice for property. They can often be poor performing in their value and dividends are not great. Just look at the fund info for the example VGSLX. Funds are not a really comparable option to actual property. But if you’re interested in a dividend fund, I’d instead go with a mix of high quality well managed BDCs.

Ответить

Damn, dude, a lot of useful information. Thanks!

Ответить

Great video! One thing I don't agree with (in terms of order) is choosing to invest in all tax advantaged accounts ahead of Taxable Brokerage account. Tax advantaged accounts have minimum withdrawal age and some of us might want to liquify our investments before hitting 60 (especially those planning to retire early).

Ответить

Q: if you’re using a Roth 401k, do you really get any benefit out of a mega backdoor Roth?

Ответить

What about annuities?

Ответить

If a high income earner needs to pull from a fund to replace his keyboard...

Ответить

wrong, the default 3rd party managed 401k plans are dumb as fk and inefficient. You want to manually manage your own 401k by simply dollar cost averaging into tesla stock.

Ответить

I've heard of index funds and exchange traded funds (ETFs). They provide diversified stock market exposure while spreading risk. I have over $600K in savings; when should I begin investing in the stock market for retirement without taking too many risks?

Ответить

Holding 12 months of expenses in cash is not good financial advice. That is WAY too conservative. 3 months makes a lot more sense, particularly if you have things like equities and bonds that you can sell without penalty to subsidize it (i.e not in a tax advantaged retirement account or something like that).

Ответить

what is the definition of high income? I guess based on different area the amount is different right?

Ответить

There are some parts of this that are incorrect in the order. purely based on the benefits of the vehicle. but other than that, the message is true/correct

Ответить

Thank you for the backdoor Roth IRA information. This is the first year I have this good problem to have.

Ответить

Tae - love the videos. Can you talk about what to do with large amounts of cash? Keep these in our savings still, brokerage, high APY checking?

Ответить

Lots of good info, but missing items and extra detail:

1) Backdoor Roth create compliance issues with other qualified funds in IRAs. More than likely that 401K moves to an IRA at some point.

2) The reason people open taxable brokerage accounts sooner before maxing out tax advantaged accounts is because it’s liquid without early use penalties, as well as you can use margin. A mix of tax-exempt income like muni bonds and growth focused funds is a good place to start for high income earners.

3) 529 is okay, but has its problems with FAFSA reporting and being stuck for education only.

4) Surprised that he put Real Estate so far back on the list. Granted you need stability and liquidity before jumping into real estate. Ideally have a spouse that’s a real estate professional that you can use deprecation to offset earned income too not just passive.

5) REITs are good investments but generate a lot of taxable dividends and are best owned in your tax advantaged accounts.

6) Charitable Remainder Trusts are another way to reduce your current income tax liability, remove assets from estate tax, provide income. Irrevocable so plan it well with a financial planner and an attorney.

7) Cash Value life insurance is a must on this list. It’s much like a Roth, except there is no contribution limit, no income thresholds, no early withdrawal penalties, and it replaces your high income if you die with millions. If you amass wealth you will likely need life insurance in a different way later in a ILIT to help pay estate taxes without your heirs being forced to sell assets, real estate, etc. Design it right, fund it right for a few years, and you’ll be happier with it than yyour bank or brokerage account. Read Becoming your own banker by Nelson Nash and The Power of Zero by David McKnight first though. No IUL, those simply don’t perform as expected in the long run. use a custom designed 5-10 year pay whole life or a VUL.

8) Buying into Limited Partnerships and other private placements (do this much later when you have enough assets and liquidity. These are High risk, super low liquidity, but they can pay off big) also you can use depreciation on your real estate as paper losses to also offset the passive income from your LPs (if you or your spouse aren’t a real estate professional and cant offset earned income)

9) Certain types of Annuities can be really beneficial to protect assets and provide income. Grows tax deferred.

10) Non-Qualified Deferred Comp plans. Has to be set up with your employer. You may be a business owner and thus also the employer paying yourself a w-2 because you’re an s-corp perhaps. Worth looking into to defer income from high income years to low income years. Tax deferred.

11) Get a financial planner. Figure out your goals. Get organized with your current situation in revenue, cash flow, expenses, taxes, assets & liabilities to know what you are working with. All the above items are great, but may not mesh well with your life plans if you don’t plan it out. The last thing you want to do is be forced to wait or pass on something you want to do because all of your money is tied up already because you didn’t think ahead.

12) you don’t invest in this, but insurance. I mentioned life already. But also disability. You don’t want a financial plan house of cards that comes crashing down because your income stops from death or disability. You also need your property and casualty insurance.

Stop trying to get rich quick. Get rich for sure.

Can you do a video like this for low and moderate income earners?

Ответить

As an lnvesting enthusiast, I often wonder how top level investors are able to become millionaires off investing. . I’ve been sitting on over $545K equity from a home sale and I’m not sure where to go from here, is it a good time to buy into stocks or do I wait for another opportunity?.

Ответить

You are missing s0ome high income categories for investment.

Ответить

Hey Tae, love the channel! Thats great your wife works in the NICU, just like mine.

Ответить

🔥🔥🔥

Ответить

I'd recommend maxing out HSA before 401(k)

Ответить

That ESPP advice is great, thank you!

Ответить

It's critical to maintain composure and resist being alarmed by the volatility during the present dip in the crypto markets. This volatility is a normal aspect of the cryptocurrency journey, along with the uncertainty surrounding the approval of Bitcoin ETFs and regular market reactions. Even though major cryptocurrencies have had sell-offs, the long-term outlook is bright. For individuals skilled in analyzing patterns and trends in the industry, this is a unique opportunity. I want to thank Kristine Stones in particular for her great advice and understanding in overcoming these challenges. She is an excellent resource in the cryptocurrency sector due to her proficiency in both traditional and cryptocurrency trading, as well as her dedication to remaining abreast of market developments.

Ответить

What percent interest rate is considered high interest debt?

Ответить