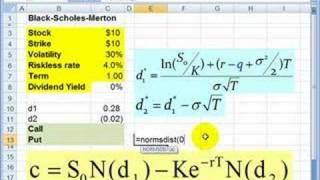

FRM: Using Excel to calculate Black-Scholes-Merton option price

Комментарии:

Do we have to pay for the excel document?

Ответить

Where exactly can I obtain this spreadsheet please?

Ответить

Still usefull thanks

Ответить

thank you so much

Ответить

God bless you sir

Ответить

Thank you very much!

Ответить

@Bionic Turtle I cannot find this spreadsheet :(

Ответить

How to calculate the probability of ITM or OTM for an option?

Ответить

Super simple and easy to follow, thanks!

Ответить

Thanks. how to calculate option greeks using excel

Ответить

Thanks man, better than my school.

Ответить

thanks

Ответить

thanks for that. Can you show how to calculate d1 and d2 in excel please.

Ответить

So helpful! Very educational and easy to follow. Helping me with 3000 level Finance in College.

Ответить

Great resource for Option traders

Ответить

Very useful, thanks

Ответить

yes sir. when you do penny stock trading get good suggestions from professionals is the wise idea. be mature and do this, my father making lots from penny stocks with the help of these professionals. have a try and make the most of them :) -> bit.ly/199aXXo?=qhvydj

Ответить

very gud

Ответить

Gracias!

Ответить

This is exactly what i need for my university course thanks for helping out

Ответить

The file is been removed! Where i can find the xls file? Thnx!!!

Ответить

@bigbabbys yea it is

Ответить

thanks a lot for sharing, bro

Ответить

How you calculate the greek values?

Ответить

In your equation for C, shouldn't S be multiplied by e^-qT to take account of dividends? In this case it works out, because you're discussing a case in which the dividend yield is assumed to be 0 (thus making e^-qT = 1), but since you show the place of q in d1 it seems like it would make sense to represent the place of q in C as well, for consistency's sake. Thanks for the vids, btw. Love 'em.

Ответить

hi just wondering if i want to calculate the number of days , do I take 365 days or 250

Ответить

Thank you so much!!!!

Ответить

@jawadalishe no, one thing is the call option and another is the put option. The call option is the right to buy and specific asset in the future(0.5 years, 6 months for specific price (K)). So, if the spot price(So), is higher than K, you should exercise the call option. The put option is the same, but you should exercise it if K is higher than So. And the volatility is the standar deviation of the asset. The volatility should be per year

Ответить

@lmospina42 so if the call option is high then investor call or put it.. And what does it means volatility...

Ответить

@jawadalishe no it calculate the value of the call or the put. The important thing is thtat they assume that the price move infinte times.

Ответить

@lmospina42 what does this model do (Black Scholes). Does it predict the values of stocks or what.

Ответить

i prefer to use Derivagem from hull

Ответить

You can find link to the XLS in the description field directly below the video. Thanks!

Ответить

Really helpful.. thanks a lot. It confirmed my excel sheet :P T remains constant for different dates of one option right? I mean, the value to use for T at initiation is the same T to use halfway through the life of the option... right? example: a euro call is created which expires in 1 year.. if we wanted to value this option 6 months from now, is the T value to use still 1? Thanks

Ответить

no it doesnt dumbass

Ответить