Комментарии:

I have a question if there is a swap bank then is bid-ask spread quoted against LIBOR?

Ответить

Good video

Ответить

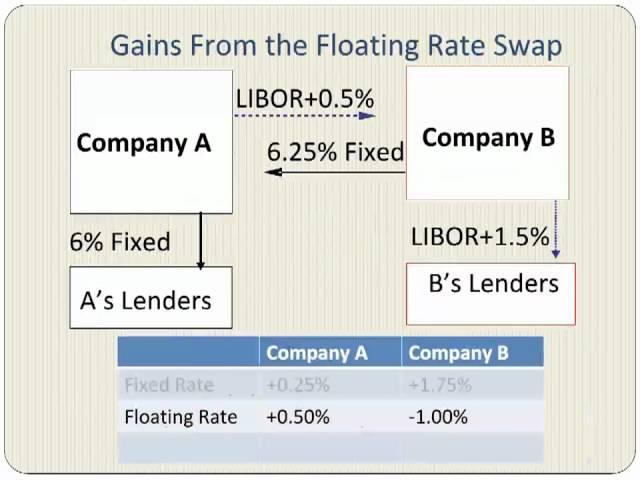

I am bit confused who u got Libor+0.5% and 6.25 % fixed... Kinldy help

Ответить

10s in and my understanding of swaps moved from 1% - 95% = THANK YOU!!

Ответить

Consider a 6 month OIS

Notional Price = INR 200

Fixed Rate = 7.5%

Floating Rate = NSE Overnight MIBOR

Under the structure of the swap, the Fixed Rate is nominal rate,

MIBOR is compounded daily (on holidays the previous MIBOR is taken)

Consider 182 days in the period of SWAP, 365 days in a year

MIBOR remains constant for the entire period at 6.90%

What is the amt to be exchanged at the end?

Answer is INR 0.479 (Can you show the calculation for it)

The part about LIBOR changing impacting the transaction is wrong. Neither company cares if LIBOR moves. Company A still is paying less than LIBOR+0.25 effectively, which is less than what it was quoted while Company B pays 7.25 effective which is less than what is quoted.

There is a default risk, yes, and as LIBOR goes up, company A may be at higher default risk. But LIBOR moving won’t force company A to take a loss.

So for those asking about the 6.25%. Both parties look at which rate they can borrow at the cheapest. In this case A has an absolute advantage over B in terms of borrowing rates (A can borrow at 6% fixed vs 8% and LIBOR vs LIBOR + 3%). B however has a comparative advantage over A in floating rate and will therefore borrow from the bank at the rate of LIBOR +3%. Meanwhile A will borrow 6% fixed from the bank. The QSD is 1.5%, which if split evenly is 0.75%. We then subtract 0.75 from the rates from both of the banks quoted floating and fixed rates of the loans that they DIDN'T take out.

So for A it is LIBOR +1- 0,75% (QSD) = LIBOR + 0.25%

B is 8% - 0.75% = 7.25%

He isnt going to use indian sentences midway right ? I got so annoyed by CFA/ACCA help videos where the guy teaching was on the verge of making soemthing clear then switches to indian, then english then indian..

Ответить

Good 👍

Ответить

Thank you !

Ответить

Confused yes

Ответить

Brilliantly explained.....so much more simpler than my text

Ответить

how to calculate this 6.25% and LIBOR+0.5

Ответить

Observation - How is it win-win situation for both:

A has managed to make fixed (6%) to floating at lower % (Libor + 0.5) instead of (Libor +1) that it would have paid outside market. So, 0.5 gain from floating market & 0.25 gain from B.

B has managed to make floating (Libor + 1.5%) into fixed (6.25+1) 7.25% instead of 8% that it would have paid outside market. B is directly getting 0.75 gain on fixed now.

great video ! thanks !

Ответить

Thanks for this wonderful explanation. I do really appreciate your effort. However, I think the solution you provided is not accurate. In my calculation the Company A should pay LIBOR +0.25% and Company B should pay a fixed rate of 7.25%. Both parties are better of with 0.75%

Ответить

A bit confused... Comp A has the obligation to pay 6% ($60.000) fixed to its lender for the loan and LIBOR+0.5% ($55.000) to Comp B on Swap agreement? What's the deal here then?

It goes far beyond the roof:) Am I missing smth here?)

Great video - however doesnt make it easier for me to answer the following Question

if you are able to assist:

- Metro fund is a buyer of floating rate assets of 3 years maturity, with a minimum return of Libor +8bp

-City corp has launched a 3 year bond which pays 9.25% semi annually and is currently trading at par

-if 3 year swaps are quoted as 9.15%-9/20%

-should metro fund buy the bond?

much obliged if you are able to help answer this.

For general understanding if we say B pays 6.25% and LIBOR + 1.5% and A pays 6% and LIBOR + 0.75% (instead of LIBOR + 0.5%) that can justify 0.75% equal arbitrage sharing. Thus B totals 7 % and A totals LIBOR + 0.5%.

Ответить

thanks a lot

Ответить

what is the risk premium that make company b has comparative advantage

Ответить

Thanks a lot

Ответить

Oh thanks so much. Really didn't know how to do it without the swap dealer involved.

Can you sure us how find the net of receipts from a linear function with this same example?

Thank you very much. It can help me a lot

Ответить

how can i get copy of this powerpoint

Ответить

Thank you very much for explaining the topic is a simple and clear manner

Ответить

Good video, well explained, thank you :)

Ответить

Urgent. I still confuse about the 6.25% fixed rate and Libor + 0.5%. How do we get that ?

Ответить

thank you so much. Ive a clear picture now .

Ответить

Really thank you a lot!

Ответить

This helped me a lot to understand Interest rates swaps. Thank your for this

Ответить

That could happen when the two companies have the same credit rating. For example, if both companies have AAA credit rating then comparative advantage may not exist. In that case, the company that is interested in an interest rate swap, would have to find another company that has a lower credit rating.

Ответить

May i ask wt happen if no one has comparative advantage which mean different between fixed and floating are 0

Ответить

Company B pays a premium of 2% on the fixed rate over company A, but only 0.5% premium at the floating rate. The difference in premiums is the comparative advantage. In other words, if A borrows at the fixed rate, the combined benefit to both companies would be +2%. However, if A borrows at the fixed rate, B must borrow at the floating rate to make the swap deal possible. When B borrows at the floating rate, there is a combined loss to the two of 0.5%. The net result is +2% - 0.5% = 1.5%.

Ответить

Can someone please explain how is that there is a comparitive advantage of 1.5% - shouldn't this be 2.5 % - Please explain

Ответить

Thank you very very much for this clarification!

Ответить

thank you so much. very well explained. i came here totally having totally no clue what my notes is trying to explain but now i everything makes sense.

Ответить

Thanks for a very well done introductory explanation.

Ответить

I am still very confused.

Ответить

Great stuff. Thanks.

Ответить

Thank you so much. That was so helpful.

Ответить

Thanks for this , it is nice one.

Ответить

You my friend should get a peace prize.. awesome!! thank you !!

Ответить

thank you for your effort very helpful

Ответить

wow. I went from not understanding how the f#$@ interest rate swaps works to "bingo!" thank you! You the best!

Ответить

In this example, the fixed rate of 6.25% is negotiated between the two parties. They could have negotiated another rate, but this is what they both agreed upon.

Ответить