Комментарии:

In IFRS9, is OCI is charged to RE (without recycling) always whenever an F.A. (Financial Asset) gets extinguished? Thus, OCI is not being taxed and Net Earnings per share is lower?

Ответить

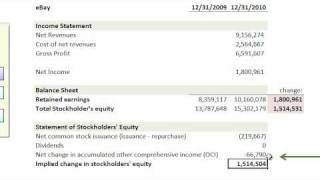

There is a difference of $27 USD (1,514,531 vs. 1,514,504). What could it be? In 2010, the Net Income + Net Common Stock (Issuance-Repurchase)+Net Change in OCI = 1,514,504 only.

Ответить

Okay Im kinda confused. You Got the Implied change in stockholders equity by subtracting the Net common stock issuance and net change in accumulated other comprehensive income from the Net Income. But where does the Total Stock Holders equity come in? What brought the implied change in stock holders equity 27 thousand down from the original total of 1,514,531?

Ответить

This is great. Thanks.

Ответить

Billion?? 😲😨 you're confusing me I know those to be millions 😞

Ответить

Great video. Nice summary of OCI. I am studying for the CPA exam currently and a mnemnoic that we use is PUFER. "PUFE likes to Revalue his income." P-Pension adjustments. U-Unrealized gains/losses (AFS securities), F- Foreign Currency Items, E- Effective Cash Flow Hedges. PUFE belongs on I/S in OCI. R- Revaluation Surplus (IFRS only) is for Retained Earnings. Hope this helps.

Ответить

is that billion or million?

Ответить

This is awesome!!! Thanks!!

Ответить

Could you please tell me where did you find ebay's financial statements?

Ответить

If I only had this when I was in college. Oh well, I can use this information for the CPA exam so better late than never. Thanks so much for this. I am so amazed that people make videos to help others.

Ответить

Thanks a lot David, I have to study this subject for a presentation tomorrow and I was so confused until I saw this video. You saved my life lol I appreciate it.

Ответить

@ThePsyclopz thanks ... yes, definitely i am looking forward to taxes and leases, too! glad you find BT helpful. I am recording FRM foundations today/Wed/Thursday so our *fresh* FRM material starts to publish in two days. Thanks for your support.

Ответить

Thanks david for another great video. Personally, I would like to see you address deferred taxes and leases for the CFA in future. Meanwhile, I eagerly await ur 2011 FRM materials. Been learning a lot from being a customer of BT for about 2 months now. =)

Ответить

![[3.19] Sunblast Self-Chill Turbo Trapper vs A Very Normal Map [3.19] Sunblast Self-Chill Turbo Trapper vs A Very Normal Map](https://invideo.cc/img/upload/ay1XWjc2cFBjd3c.jpg)