Комментарии:

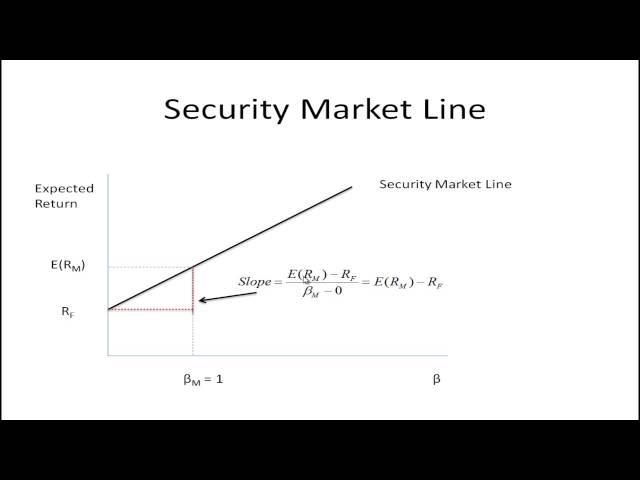

Thanks for the simplistic explanation.

Ответить

Thank you! Transparent clear!

Ответить

Fucking glorious, quality work.

Ответить

Nice video! I understood SML!

Ответить

great video

very helpful

thank you

Such a excellent video- you explain the security market line so well...Thank you!!

Ответить

Why wouldn't you want to buy an undervalued asset/portfolio? Your return is higher than expected for the given amount of risk, wouldn't this make it more attractive to investors? Any help/explanation would be appreciated - Confused university student

Ответить

clear and to the point.big help, thank you

Ответить

Gem of example and explanation of what is often a complex and unnecessary mystery in finance classes! Bravo!!

Ответить

really well explained! thank you!

Ответить

Best explanation ever

Ответить

thanks for a great guide ..

Ответить

I thought Beta was a slope; is that for the CAPM formula? Or is the CAPM formula the same as the SML formula. Thanks in advance.

Ответить

Excellent video, explaining SML.

Ответить

What about the shifts of the SML?

Ответить

Excellent video

Ответить

If an asset is priced above the SML, and thus undervalued, it should be bought? and If it is priced below the SML, and thus overvalued, it should be sold? Right?

Ответить

thanks a lot

Ответить

Thanks alot,much appreciation.

Ответить

This video is extremely helpful. Excellent explanation!

Ответить

thank you for the great lectureSML pass on the Tbill and S&P500 when we draw it on the graph since Tbill's beta is 0 and S&P500's beta is 1? or we have to choose the line passing on many portfolio most on the scattered graph?

Ответить

Why does prices and returns move in opposite directions? I understand that if an asset's expected return is above the SML, it is undervalued. But, investors will buy up this asset and the price will increase and the expected return will then decrease; thus bringing the asset's return to the level of the security market line.

Why does the expected return decrease though? After spending some time thinking about it, I came up with the following: Expected Return = Dividend Yield + Capital Gains yield. If the price increases, the dividend yield will decrease because the bottom of the fraction gets larger; thus decreasing the yield. However, the capital gains yield will also increase because you are receiving capital gains because the price went up. Therefore, the capital gains nullifies the the decreased yield. The return then does not actually decrease. So my thinking does not make sense.

Can anyone help?

Very good explanation ! Could you make an another clip about estimating the beta faktor?

Thanks ! Greetings from Germany

are we comparing the expected rate of return calculated under capm Vs actual return to determine whether the security is under priced or over priced. some defined it as difference between estimate returns and expected return under capm

Ответить

If the beta is missing and the only given are E(Ri) & Var(Ri) how will get it.

Ответить

Thank you so much for such an insightful video.

Ответить

Hi Ronald, I have a question for this. Is the beta a result from regression or you calculate it based on the covariance-variance formula? Thank you.

Ответить

You are amazing! Thank you.

Ответить

Fantastic presentation

Ответить

Fantastic! Thank you!

Ответить

This video helps me a lot thank you Ronald!

Ответить

Excellent explanation of SML! Thank you!

Ответить

Very very very helpful!!! Thank you so much!!!

Ответить

No clarity voice and under ursu tag is covered the graph

Ответить

You are amazing! I loved this tutorial! it was exactly what I wanted to learn. Not many explained the stock value using SML properly!!!

Ответить

Thanks for an incredibly well explained video!

Ответить

Thank you sir

Ответить

Fantastic explanation by u. Other are creating the hell outof this complex topic. I will recommend only your videos to my cfa pursuing friend's. 😅👍👍☺

Ответить

Tesla: Hold my beer

Ответить

Thanks for the precise and concise video.

Ответить

I is a beautiful sharing. I finally got it

Ответить

thank you so much sir!

Ответить

Really really amazing work, thank you

Ответить

I appreciate u.i have learned a lot

Ответить

What's means that the slope of SML is negative?

Ответить

Sir stocks that are undervalued giving higher return relative to the risk i’m gonna take, so my question is if i m getting higher return while taking a lower level of risk isn’t is good for me? Then why this particular security is considered to be undervalued & why i should not invest in it?

Ответить

![[ DANCE IN PUBLIC/SOUL TRAIN ver. ] BTS (방탄소년단) - DYNAMITE Dance cover by RISIN' from France [ DANCE IN PUBLIC/SOUL TRAIN ver. ] BTS (방탄소년단) - DYNAMITE Dance cover by RISIN' from France](https://invideo.cc/img/upload/UUZoaG1vbVR1TGs.jpg)

![[영어듣기 중급] 3시간 연속듣기 연속재생 Asking politely 외 ㅣ영어회화 팟캐스트ㅣ영어말하기 듣기 연습ㅣ생활영어ㅣ원어민이 가르쳐 주는 영어회화 [영어듣기 중급] 3시간 연속듣기 연속재생 Asking politely 외 ㅣ영어회화 팟캐스트ㅣ영어말하기 듣기 연습ㅣ생활영어ㅣ원어민이 가르쳐 주는 영어회화](https://invideo.cc/img/upload/WWg0azM4WWNSUzA.jpg)